In the first half of 2025, total funding raised by startups in Japan reached JPY 339.9 billion (excluding debt), showing a flat growth with 4% increase year-on-year. While investors maintain their selective stance, companies with proven track records are securing capital.

The number of newly formed funds exceeded the year-on-year (YoY) numbers, whereas the total capital raised declined. A stagnant IPO market that has made it difficult for managers to showcase performance, the environment surrounding the deals is becoming increasingly polarized between funds that can secure capital and those who are struggling to do so.

With the government’s five-year plan to develop startups reaching the halfway mark, early signs of shifts in the startup environment are emerging.

This article summarizes the key points of a “Japan Startup Finance in First Half of 2025” report by Speeda that compiles funding trends of startups in Japan.

CONTENTS

- Overview of Deals

- Top 20 Most-Funded Japanese Startups: Lengthening And Growing Complexity of Large-Scale Deals

- Direct Investments by Business Corporations Increasing in Large-scale Deals

- Trends of Startup Funds Formed: Polarization Progressing Due to Stagnant IPOs

- Stagnant IPOs

- Aggressive Large-scale Companies, Expanding Startup M&A

- Transitioning Market

Overview of Deals

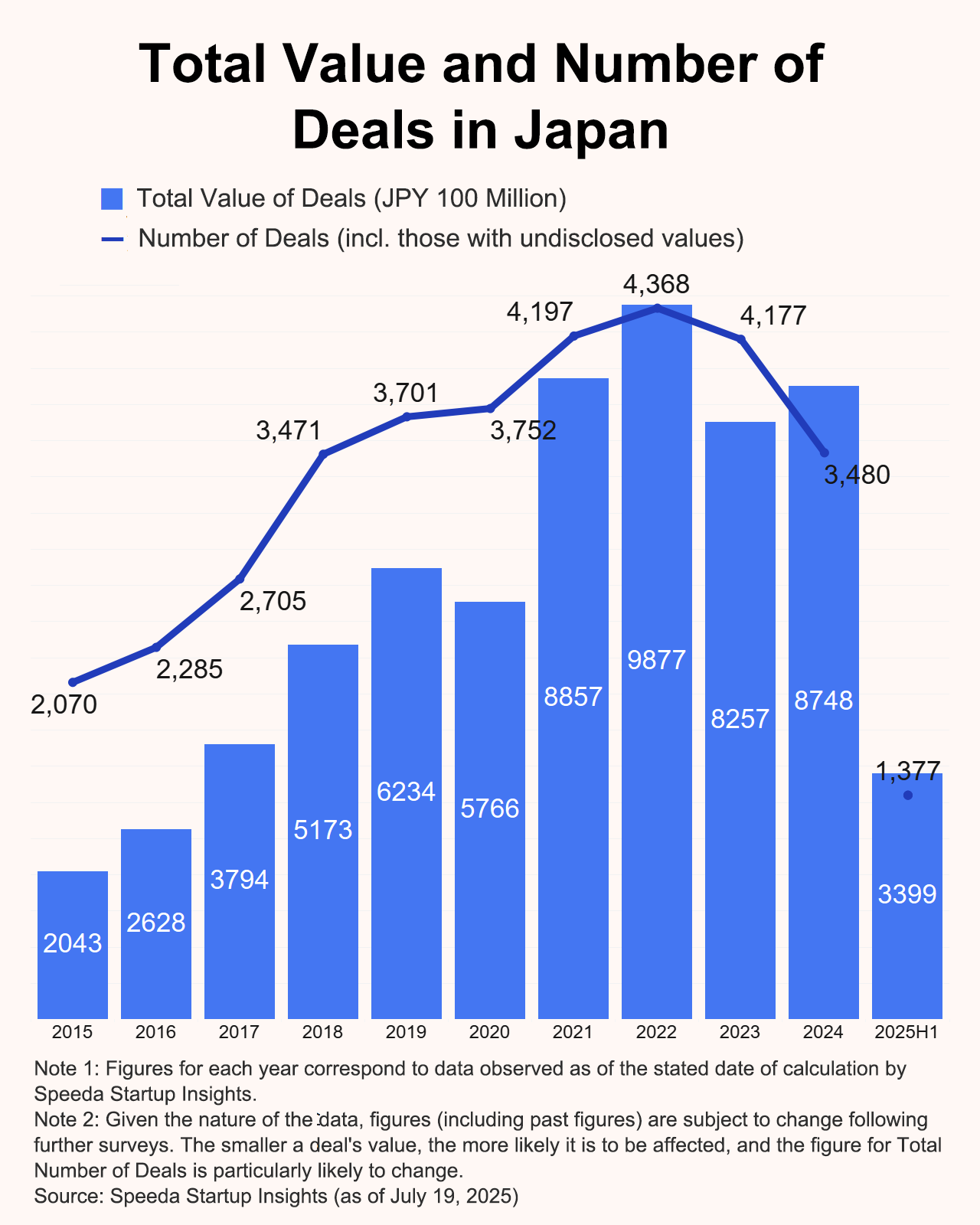

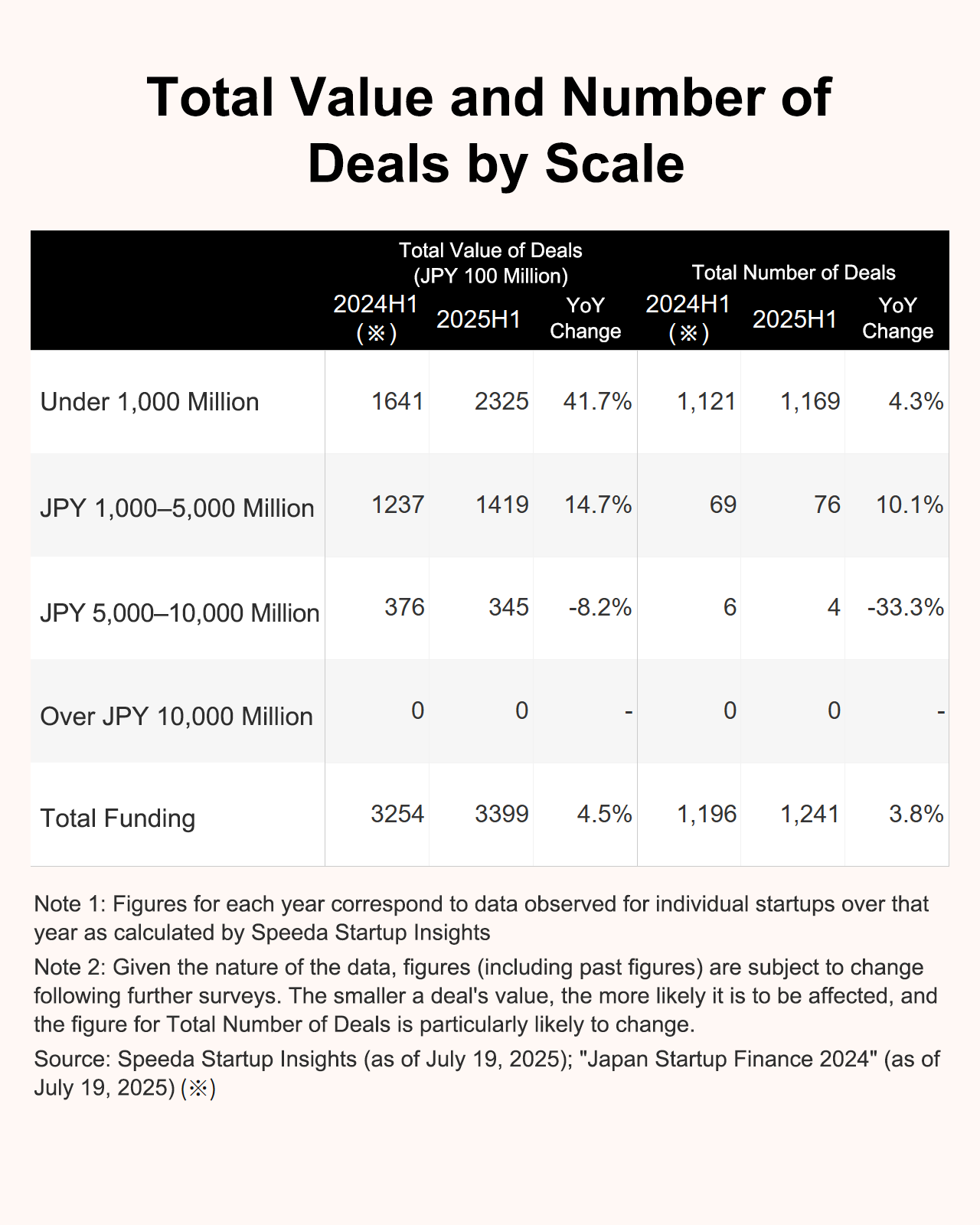

In the first half of 2025, total funding raised by startups in Japan reached JPY 339.9 billion (excluding debt), showing a flat growth with 4% increase from JPY 325.3 billion year-on-year. The number of companies that raised funds was 1,377, which was roughly the same level as the 1,411 companies year-on-year.

The trends of the total value and the number of deals by scale indicate that the deals under JPY 5 billion increased YoY, suggesting a shift toward smaller funding rounds. As a result, the median funding amount raised per company fell from JPY 83.6 million YoY to JPY 67.9 million in the first half of 2025.

This trend is consistent with the first half of 2024. However, since large-scale deals were largely clustered in the second half of 2024, an increase in large-scale deal is also anticipated in the second half of 2025.

Top 20 Most-Funded Japanese Startups: Lengthening And Growing Complexity of Large-Scale Deals

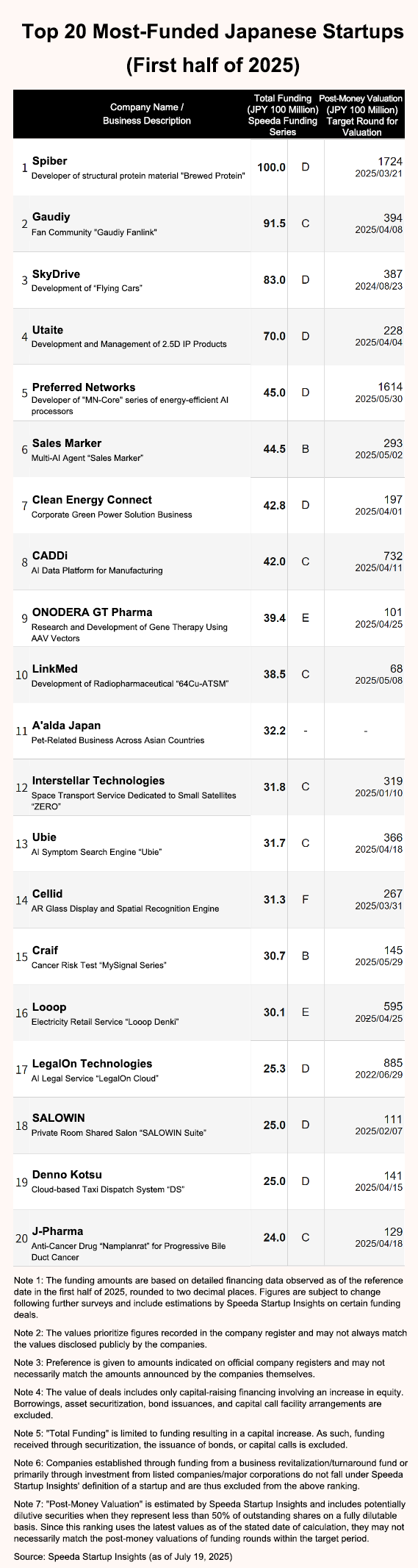

Based on publicly available information, half among the top 20 most funded startups have engaged in rounds for valuation such as pre-series or extensions, indicating a trend toward lengthier and more complex fundraising processes. Moreover, given the limited number of VCs capable of making large-scale investments, most companies commonly raise funds from business corporations and corporate venture capital (CVC) firms.

Spiber, a developer of structural protein materials and the company with the largest number of deals, carried out a unique capital transaction. According to the copy of register and financial disclosures, Cool Japan Fund Inc., a public-private fund, sold its JPY 9.999 billion investment in common shares back to Spiber at the original price. Spiber then reissued the same amount in Class A preferred shares to the fund. Practically, this was a reorganization of the capital structure without any new inflow of funds.

These Class A preferred shares allow the holder to have priority in recovering the amount invested in the event of liquidation, thereby reducing the downside risk for the fund, likely because of the fact that Spiber will be facing repayment of JPY 36.2 billion in debt within the next year. COVID-19 delayed operations at the Thailand plant, while depreciation of the yen and rising inflation slowed the U.S. plant, pushing back the company’s mass production schedule and disrupting its repayment plan. Spiber is currently in discussions about additional financing or refinancing, while trying to improve profitability and strengthen its management structure, and diversify its revenue sources by exploring applications beyond the apparel sector.

Although the number of such cases is limited, there are still instances of startups raising funds from overseas investors. Utaite, a developer of 2.5D IP, secured funding from Tencent and SBVA (formerly SoftBank Ventures Asia). This latest round of valuation is expected to accelerate the company’s M&A strategy.

CADDi secured funding as a lead investor with Atomico, a leading European venture capital firm. Originally CADDi was a parts ordering platform but shifted its operation to an AI data platform for the manufacturing sector in 2024. It now offers applications including a “Data Utilization Cloud” and an “AI Quotation Cloud.”

Atomico assessed a potential for the strong business growth and global expansion following this pivot and invested in a Japanese startup for the first time in 10 years since SmartNews in 2015. Further, Japan Investment Corporation (JIC), a Japanese sovereign wealth fund invested USD 50 million (about JPY 7.4 billion) in Atomico’s fund in 2024, showing hopes for more investment in Japan.

Kakehashi, which offers cloud-based electronic medical records and medication guidance tools, announced in June that it made deals of about JPY 14 billion (including loans), led by Goldman Sachs. Since the funds weren’t confirmed received in the first half, they are not included in the ranking.

Direct Investments by Business Corporations Increasing in Large-scale Deals

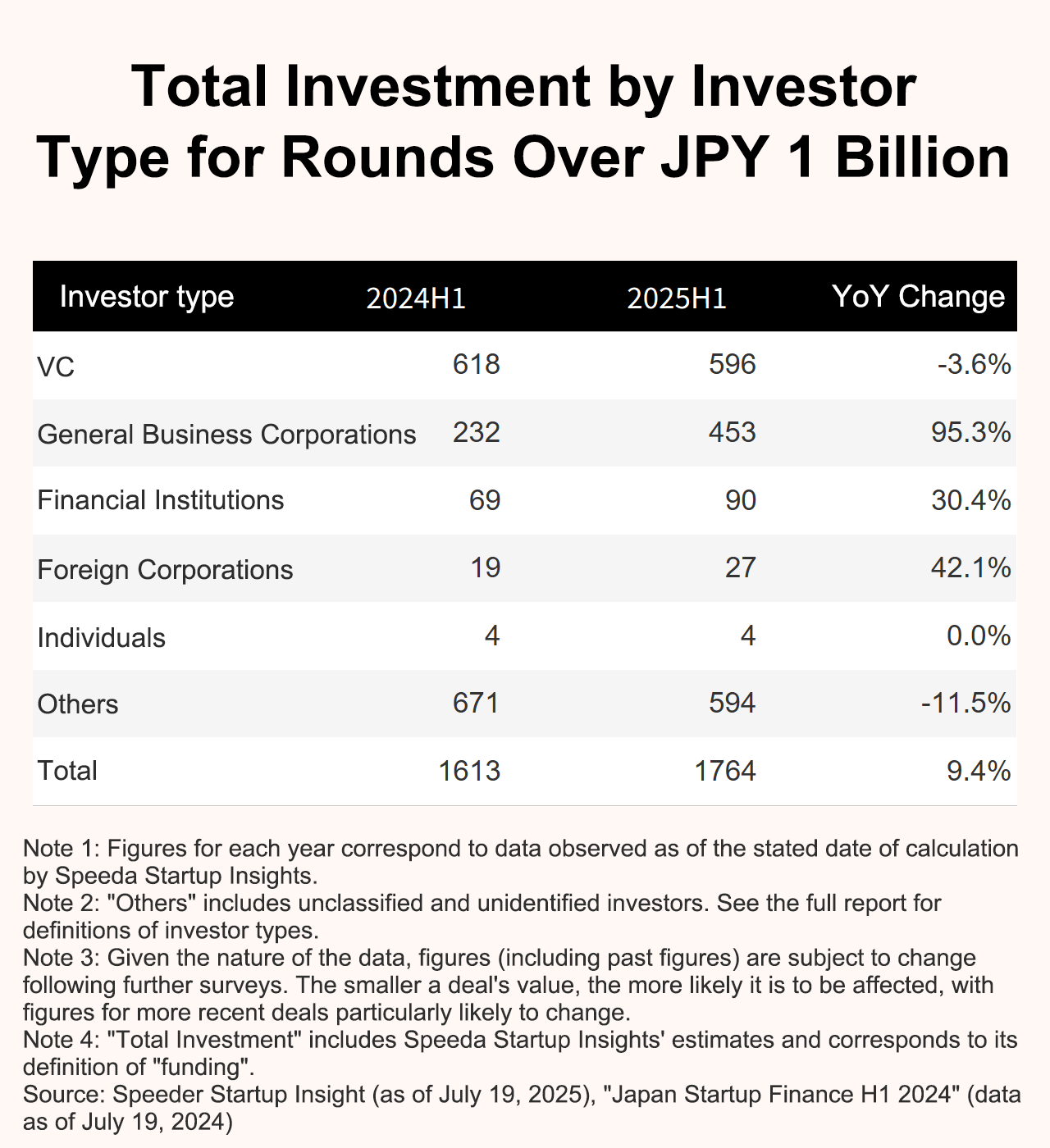

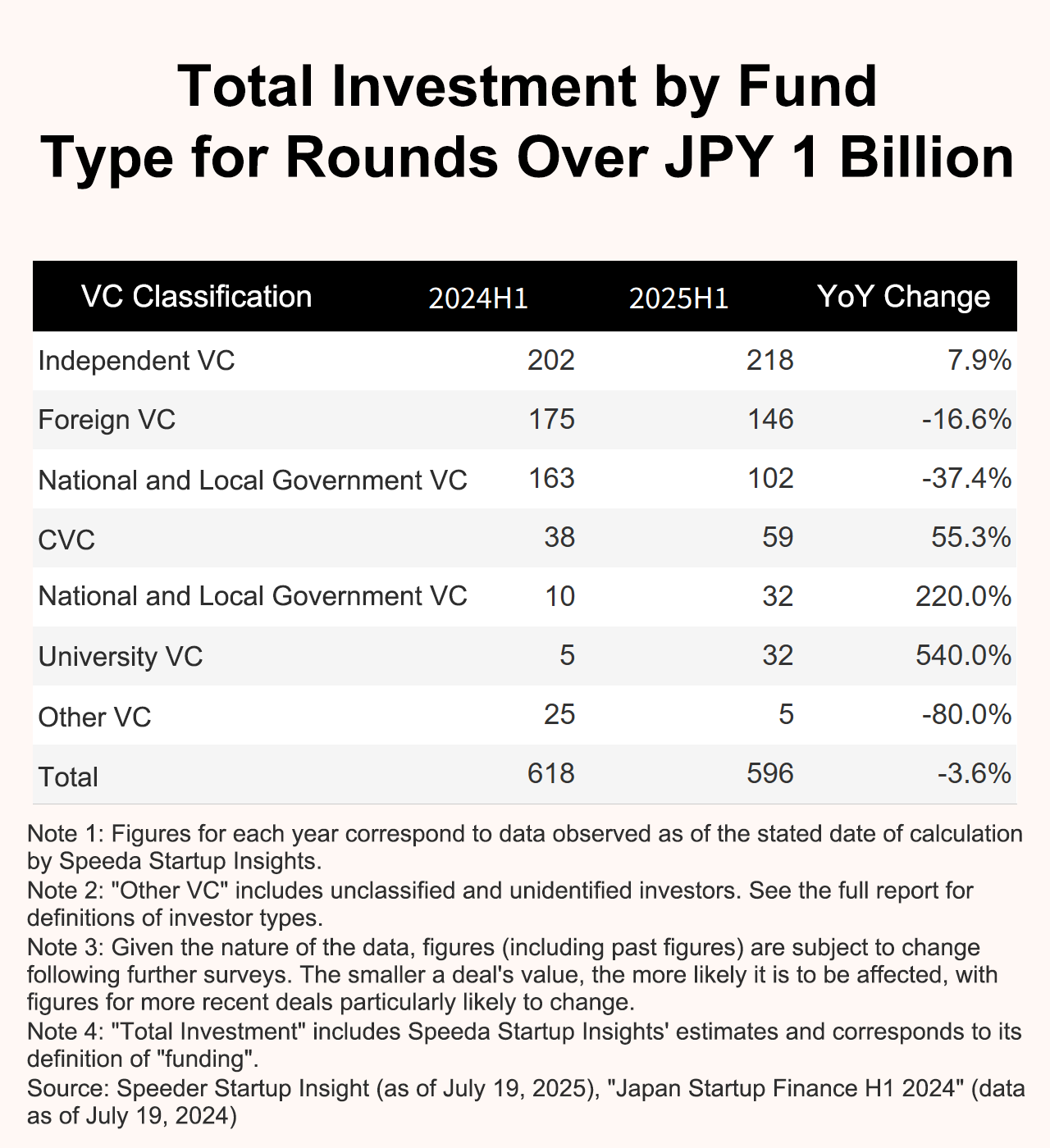

For the deals over JPY 1 billion, the total amount was similar to the first half of 2024, but there was a clear change on the investment side. Direct investments by corporations nearly doubled year-on-year.

Venture capital (VC) investments show a clear shift in terms of their composition. Investments by overseas and financial-sector VCs decreased, while corporate VCs (CVCs), university-linked VCs, and sovereign funds made up the difference. This matches the profile of the top 20 most funded deals.

Trends of Startup Funds Formed: Polarization Progressing Due to Stagnant IPOs

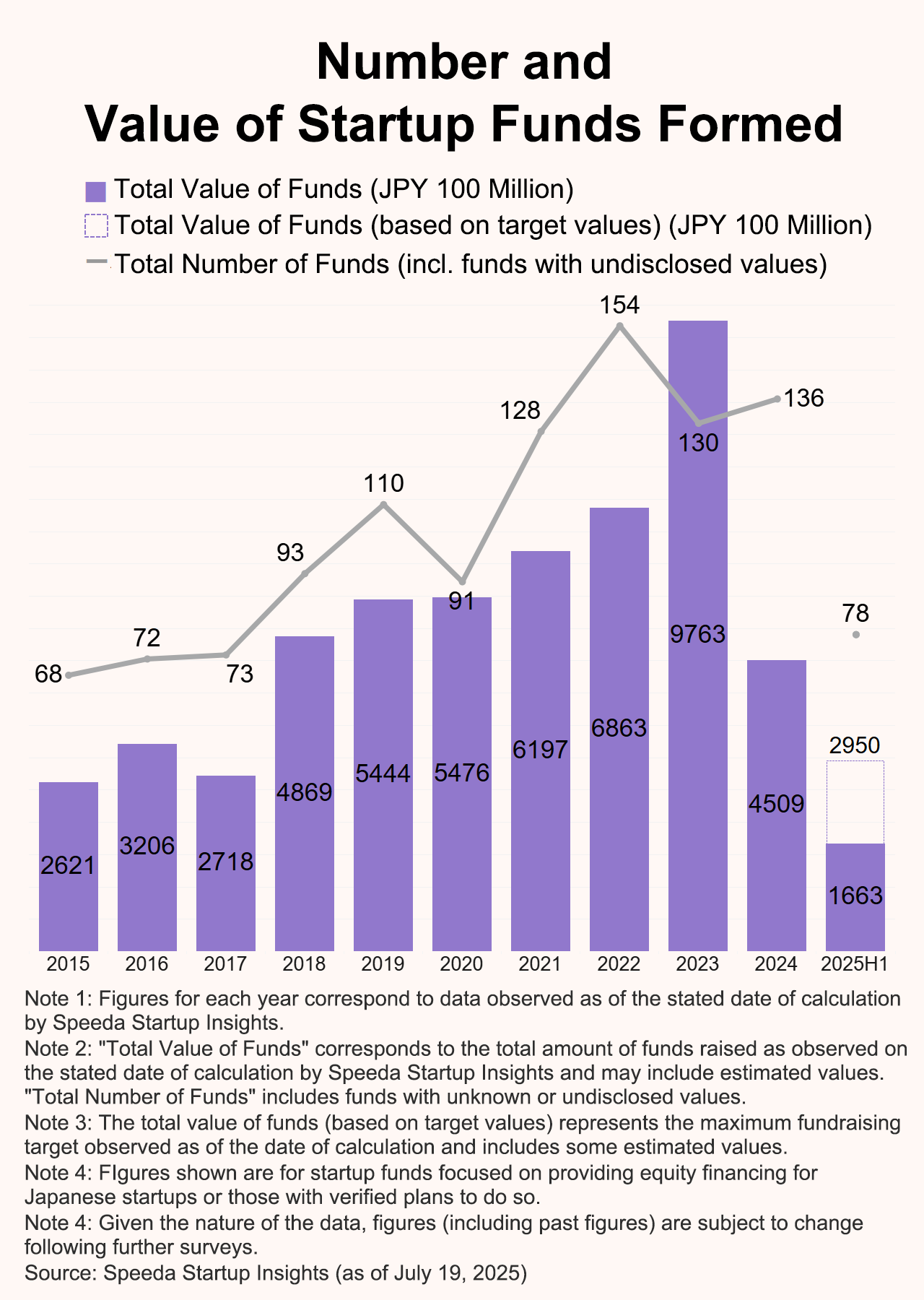

78 funds were established in the first half of 2025, 27 more than the same period in 2024. However, total fund closings dropped by about 30% year-on-year to JPY 166.3 billion.

Independent VCs are setting up several new funds, aiming for over JPY 100 billion in total. Notable examples include fund UTEC 6 (JPY 47–50 billion) and new JPY 30 billion growth-stage fund by Incubate Fund in partnership with Tokyo Metropolitan Government.

A standout example is ALPHA, which is an independent early-stage VC. They have already raised JPY 10 billion for their first fund and expect to reach JPY 15–20 billion. First-time funds often struggle to get institutional investors, yet ALPHA succeeded thanks to the founders’ 40+ successful exits and support from the government’s “Emerging Manager’s Program (EMP)” launched in 2023.

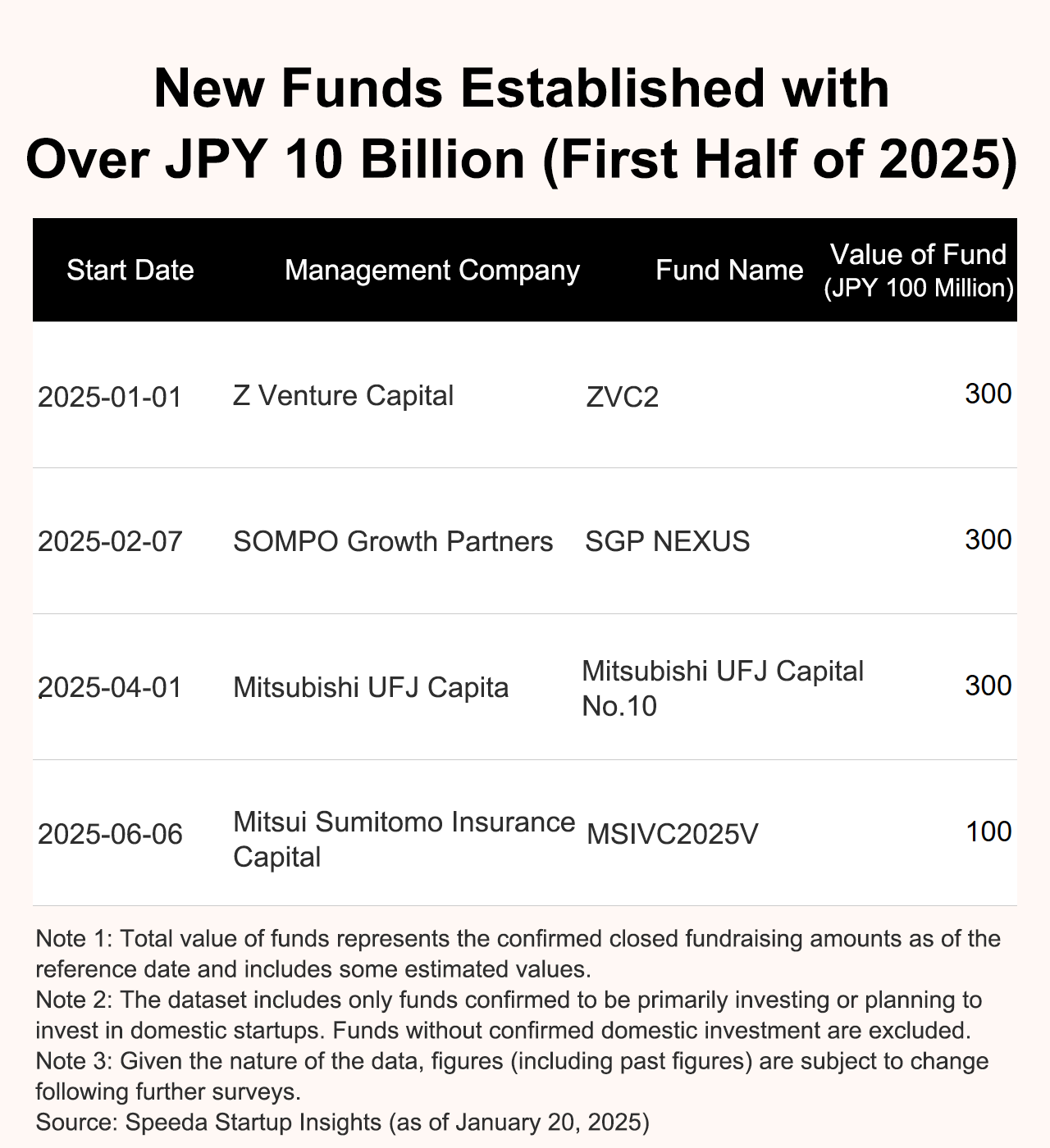

Four large funds over JPY 10 billion had closed by mid-2025. That is six fewer than the previous year.

Z Venture Capital has launched a new JPY 30 billion CVC fund, the same size as its first fund. It will actively invest in LINE Yahoo’s focus areas—media, commerce, fintech, and AI—as well as deep tech fields like space technology and robotics. The firm invests across all stages, with bases in Japan, South Korea, and the United States.

SBI Investment’s JPY 100 billion fund and AN Venture Partners’ JPY 20 billion fund recently announced their final close. However, since both were established in 2023, they are counted in that year’s total.

With IPOs prolonged stagnation, the upward trend in new fund launches seen in 2024 has reversed. In early 2025, funds are generally smaller, showing that conditions are still challenging. More funds are also choosing not to disclose their total size when announced.

The U.S. is facing a similarly tough VC fundraising environment. In the first half of 2025, total fundraising was USD 26.6 billion, down 33.7% from a year earlier and the lowest level in the past decade.

Stagnant IPOs

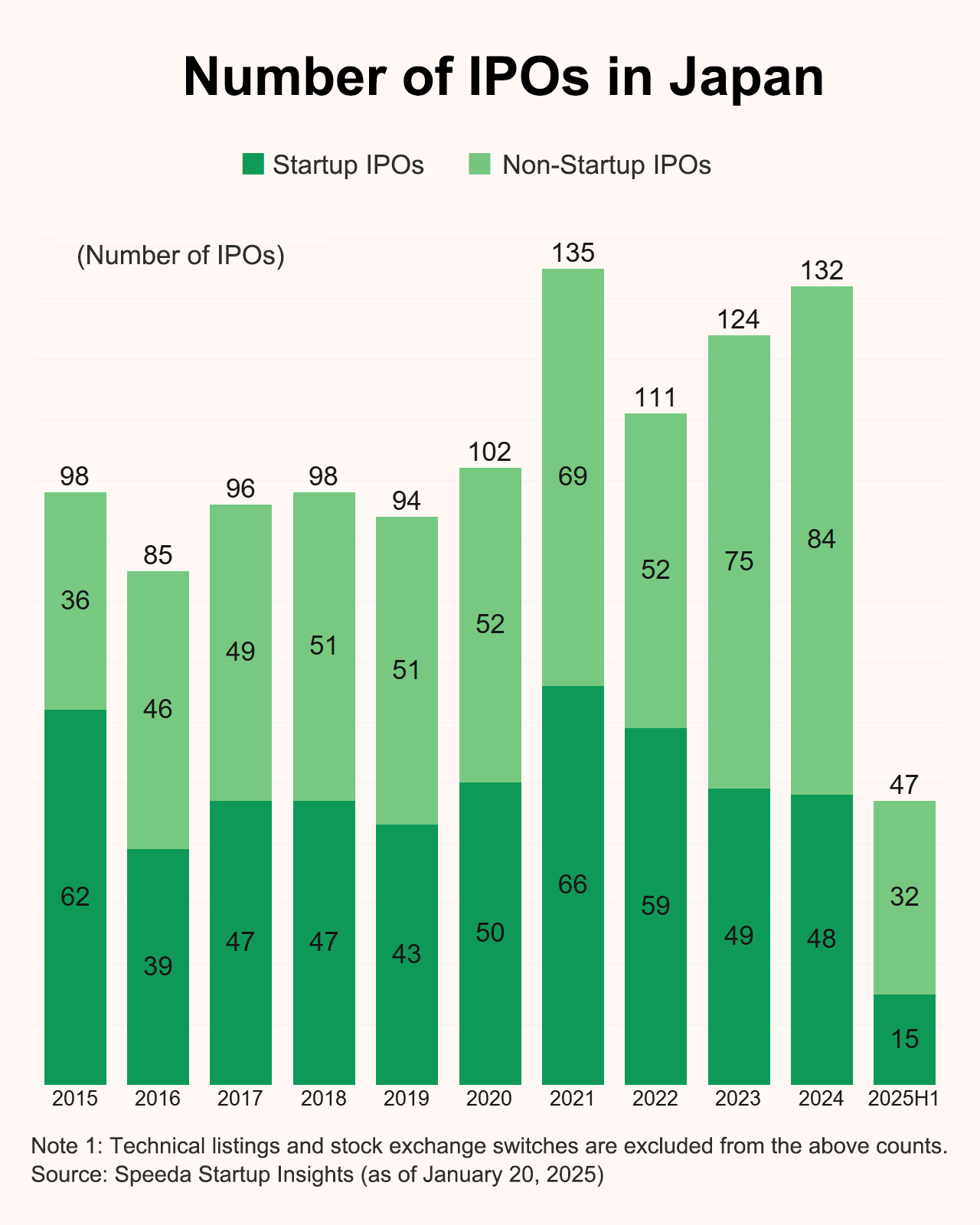

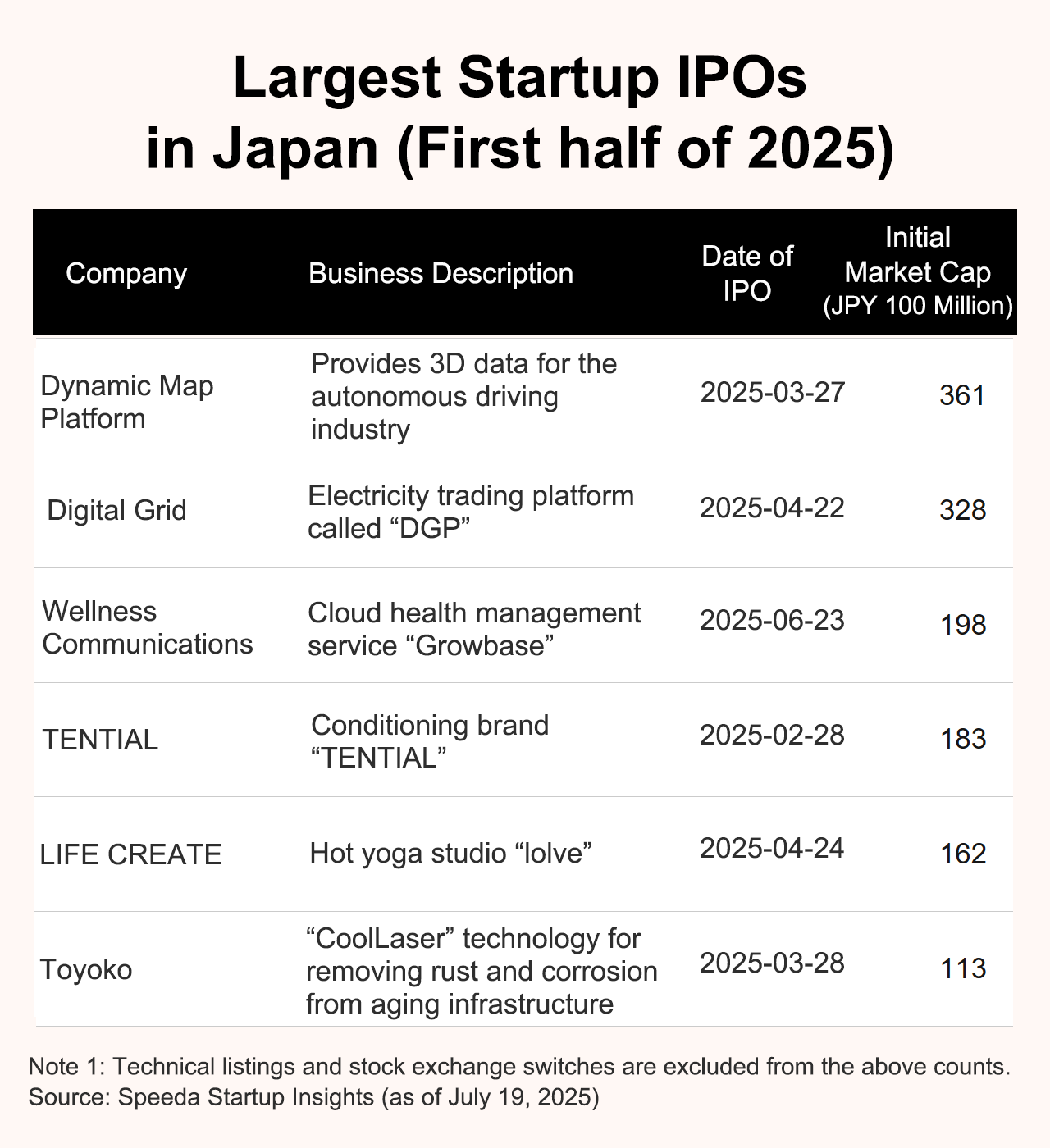

In the first half of 2025, there were 47 IPOs in total, including 15 from startups. Among the startups, 12 went public on the Tokyo Growth market, and three on the Tokyo Pro Market. This is 13 fewer IPOs overall and 7 fewer startup IPOs compared to the same period last year.

Despite the decrease in IPO numbers, signs of recovery are seen in initial market value. The median market capitalization at IPO rose to JPY 11.3 billion, a 27% increase compared to 2024.

Startup IPOs have been decreasing since 2021 due to the slump in the Tokyo Growth market. The continued IPOs suggest that high-quality startups are earning market recognition.

Conversely, the decline in IPO numbers indicates cautious stance by the investors, suggesting that the environment for startup listings remains challenging.

Reviewing the key IPOs in the first half of 2025, all 11 companies listed on the Growth market—excluding Dynamic Map Platform—had reached profitability by their latest fiscal period or at the time of their listing application. It is also notable that many of these companies had business corporations among their major shareholders.

Dynamic Map Platform, a developer of high-precision 3D data for autonomous driving, recorded the highest initial market capitalization. In the fiscal year ending March 2024, 57% of its revenue was derived from the U.S. automaker General Motors. It stands as the sole company to have proceeded with an IPO following a significant down-round in its final private funding. The timing of the IPO is believed to be influenced by the planned cessation of operations of its largest shareholder, INCJ (formerly Japan Investment Corporation), at the end of March 2025.

PicoCELA, originating from Kyushu University, was listed on the U.S. Nasdaq market in January with the goal of supporting future global expansion. The company has secured investments from Shimizu Corporation, Sojitz Corporation, and Japan Post Capital, and offers solutions for constructing large-scale Wi-Fi environments.

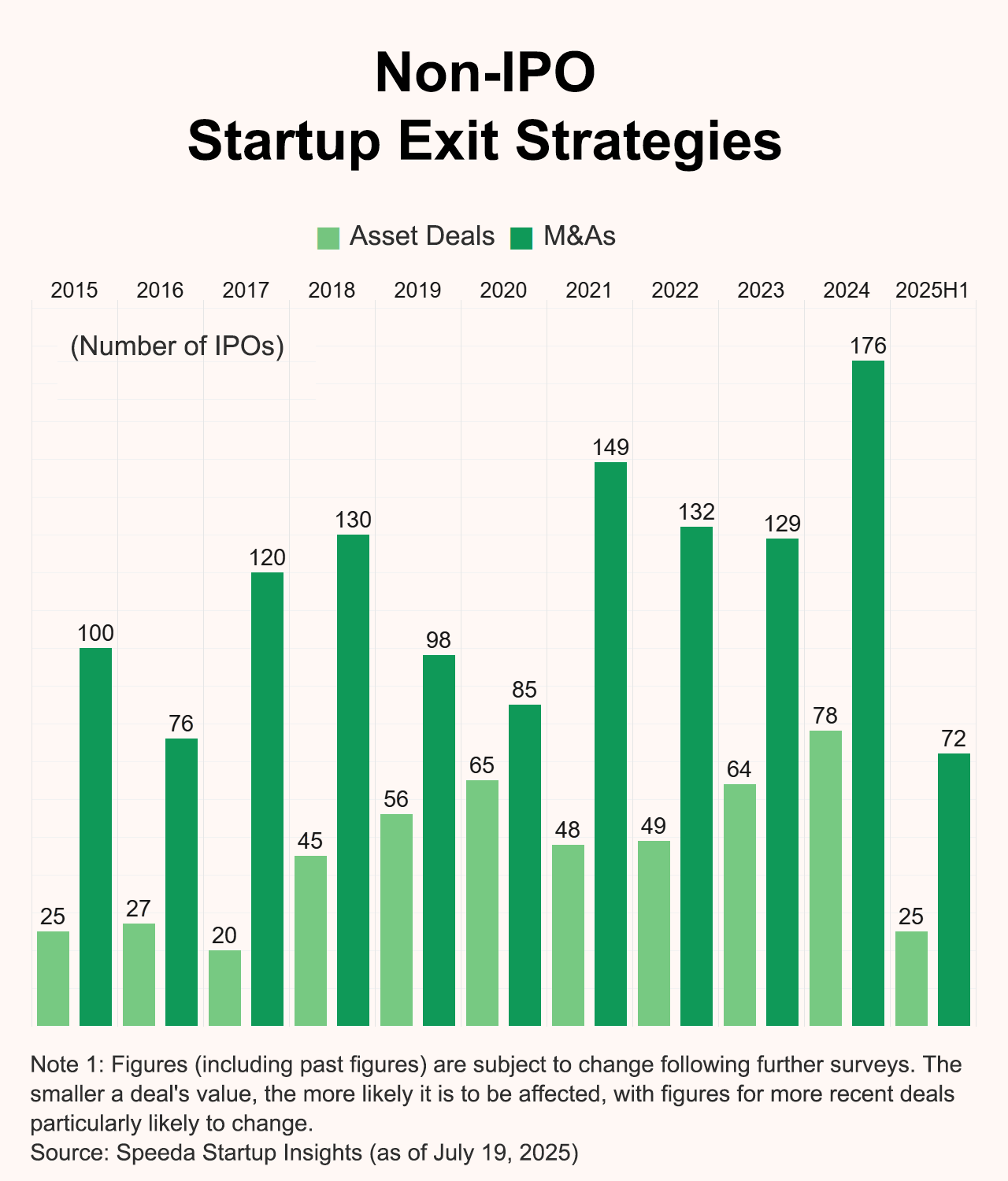

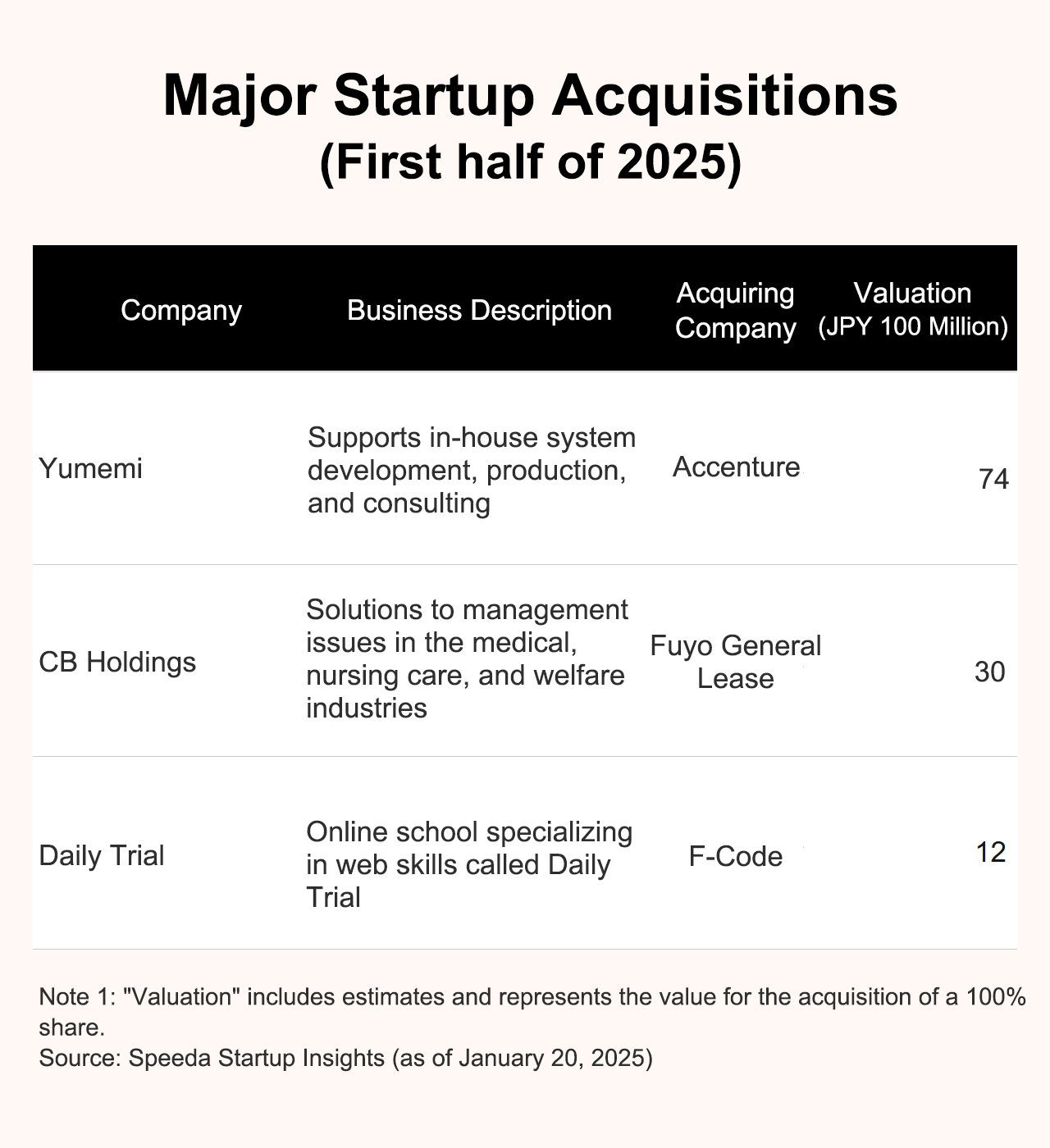

Aggressive Large-scale Companies, Expanding Startup M&A

As of the date of calculation, 25 business transfers and 72 acquisitions or subsidiary integrations were recorded. The number of acquisitions is approaching the record high set in 2024, which represented the highest since 2014. Among the acquisitions, Yumemi was the only one valued above JPY 5 billion.

Yumemi, which became a consolidated subsidiary of Ceres after it acquired a 49.8% stake in 2018, was acquired by Accenture. The goal of this acquisition is to help clients accelerate company-wide transformation in the era of generative AI by supporting the development of digital services from start to finish.

While a final agreement is pending, significant developments are underway.

Moneytree, an asset management service that has raised funds from overseas institutional investors, has signed a basic agreement for the full acquisition of its shares by Mitsubishi UFJ Bank and WealthNavi. According to Nikkei, the acquisition is expected to exceed JPY 10 billion.

In rare cases, startups have acquired business units from major corporations.

Asuene, a provider of CO2 emissions management services, has acquired the "Sustana" business from Sumitomo Mitsui Banking Corporation. Furthermore, it is enhancing the strategic capital and business partnership established with Sumitomo Mitsui Financial Group in June 2024. Going forward, Asune intends to utilize Sumitomo Mitsui Bank’s broad sales network to promote and distribute its services to companies both within Japan and abroad.

In the first half of 2025, Japanese companies completed about JPY 31 trillion in domestic and international M&A deals—3.6 times more than the previous year. With large firms adopting aggressive strategies, the second half’s startup M&A activity will be closely watched.

Transitioning Market

In the first half of 2025, the Tokyo Stock Exchange announced a proposal to revise the criteria for listing maintenance for Growth Market, which drew significant attention within the industry. Under the new rules effective from 2030, the requirement will be significantly raised from a market capitalization of JPY 4 billion after 10 years of listing to JPY 10 billion after just five years.

As a result of this change, it is estimated that approximately 68% (422 of 615) of companies listed on the Growth Market as of March 31, 2025, may not satisfy the revised criteria. This has accelerated the tendency to prioritize mergers and acquisitions as a preferred exit strategy. The implications extend to venture capital investment policies and fund structuring, rendering the evolution of the exit market a matter of significant concern.

Also, the influence of large language models (LLMs) cannot be overlooked. Although SaaS continues to be the primary investment focus in Japan, the increasing competition between LLMs and existing sectors is driving some companies to pivot their business models. BellFace’s recent divestiture of its flagship online sales meeting system to concentrate on the AI-driven "bellSalesAI" exemplifies this emerging trend.

Further, the tariffs imposed on Japan during the Trump administration, currently set at 25% calls for certain amount of caution. Since most Japanese startups focus on software development and domestic sales, the direct short-term impact is limited. However, these tariffs could indirectly affect business corporations involved as customers, investors, exit partners, and limited partners, which may have wider effects on the ecosystem. In addition, changes in exchange rates and market instability caused by tariff policies should be carefully watched, as they might influence foreign investors’ attitudes.

As the Japanese startup ecosystem embarks on this pivotal phase of change, its ability to adeptly navigate emerging challenges and opportunities will be key to driving sustainable growth and innovation in the years ahead.

Text:Ryo Hirakawa、Editing:Atsuko Mori、Design:Nanami Kawasaki、Illustrations:NUT DAO