With startups in the country securing JPY 335.4 billion (USD 2.5 billion) in the first half of 2023—a drop-off from the JPY 416 billion (USD 3.2 billion) raised in H1 2022—the tide appears to be shifting in the Japanese startup market.

While their global counterparts grappled with the effects of VC winter in 2022, startups in Japan defied the trend by attracting more funding than ever before. However, as 2023 unfolds, it appears that Japan is experiencing the belated impact of this freeze.

“Japan Startup Funding” is a report detailing investment trends involving Japanese startups that is independently researched and published by INITIAL, a leading platform for startup information in Japan. This is an English version of the preliminary report prepared as a summary in advance of the release of INITIAL’s full mid-term “Japan Startup Funding” report for the first half of 2023 (full report available in Japanese only).

*Please note that the conversion from JPY to USD throughout this report is provided for reference and is based on average mid-market exchange rates (2022: 131.43 JPY/USD; 2023: 134.85 JPY/USD).

CONTENTS

- Overall Funding in Decline

- More Deals, Smaller Amounts

- Valuations of Series D and Later Stage Startups Hit the Hardest

- Bear Market Behind Japan’s Startup Woes

- Duo of R&D-Focused Startups Raised Over JPY 10 Billion Each

- General Business Corporations and Financial Institutions Make Presence Known

- Initial Market Cap Rebounding, Even as Number of IPOs Fall

- Slight Uptick in Number of M&A Deals

- Seven New Funds Attracted Over JPY 10 Billion

- Navigating the Currents of Japan’s Startup Landscape: What Can VCs Do?

- すべて表示する

Overall Funding in Decline

After setting a ten-year high with JPY 945.9 billion (USD 7.2 billion) in total investments in 2022, Japanese startups attracted about 35% of this figure in the first half of 2023. While this data is purely observational, even when taking into account deals that have yet to be disclosed, total startup funding in Japan is likely to end up in the range of JPY 350–380 billion (USD 2.6–2.8 billion) for H1 2023—less than half that of the previous year.

More Deals, Smaller Amounts

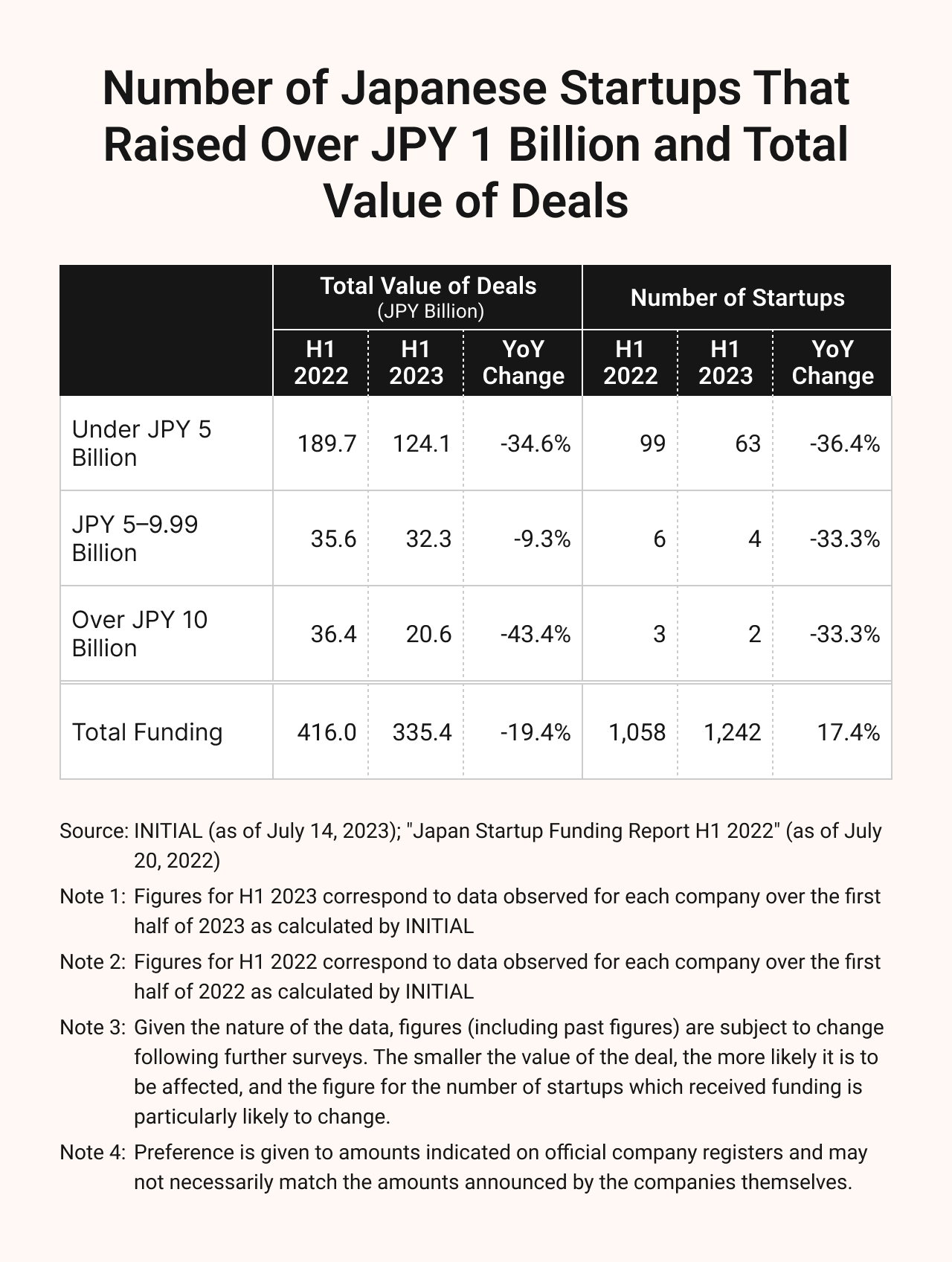

Of course, this is not to say that fundraising itself is losing steam in Japan. In fact, the number of startups receiving funding in H1 2023 actually rose by 17% YoY from 1,058 to 1,242.

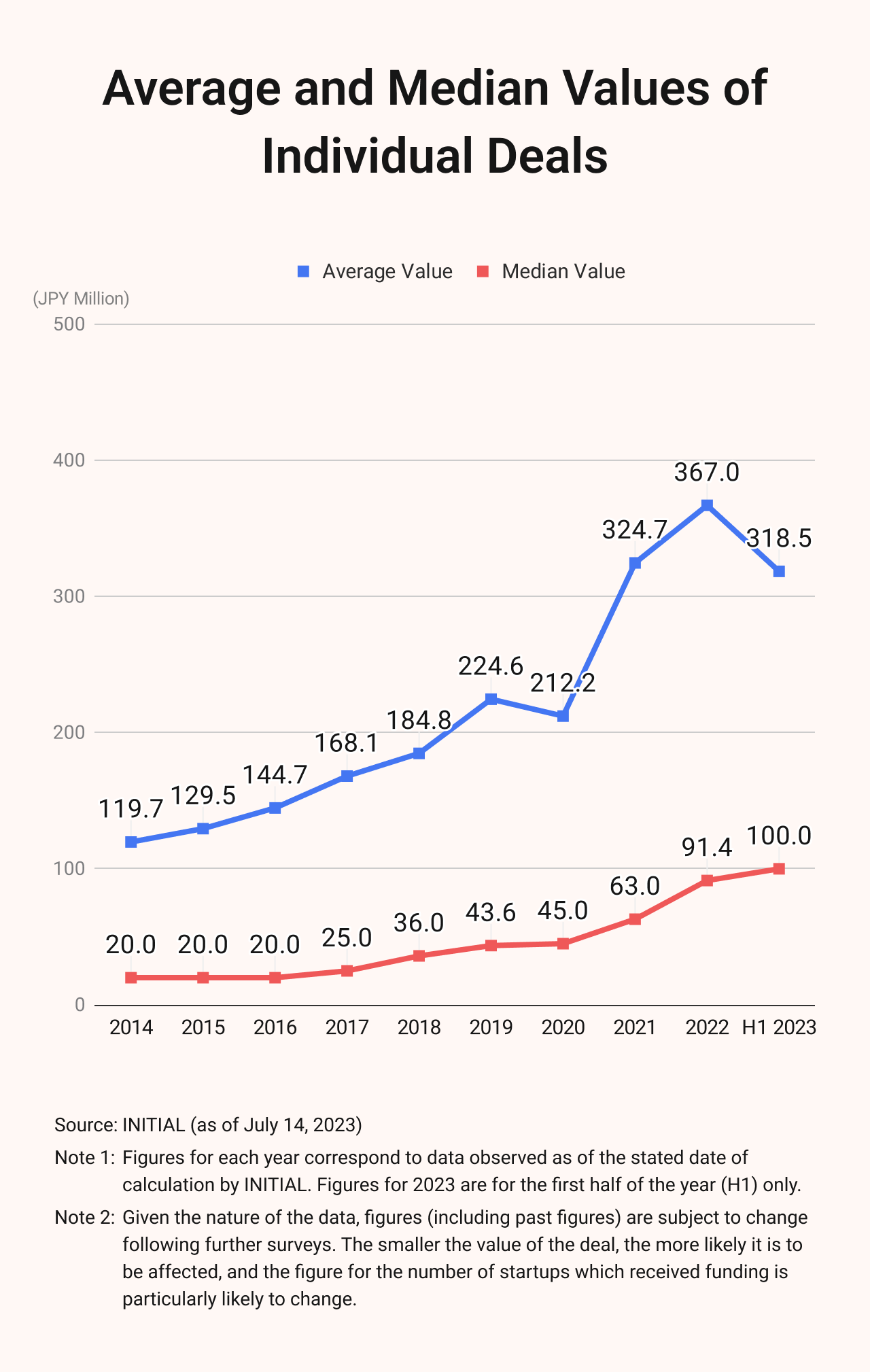

At the same time, the average value of individual deals, which had been growing annually, declined over the previous year—a major contributing factor to the overall decrease in startup funding observed in H1 2023.

Narrowing the scope to larger rounds of JPY 1 billion or more, the decline in the total value of deals was most prominent among startups raising under JPY 5 billion This group, which accounted for the majority of all such rounds, also saw the largest drop in total number.

Valuations of Series D and Later Stage Startups Hit the Hardest

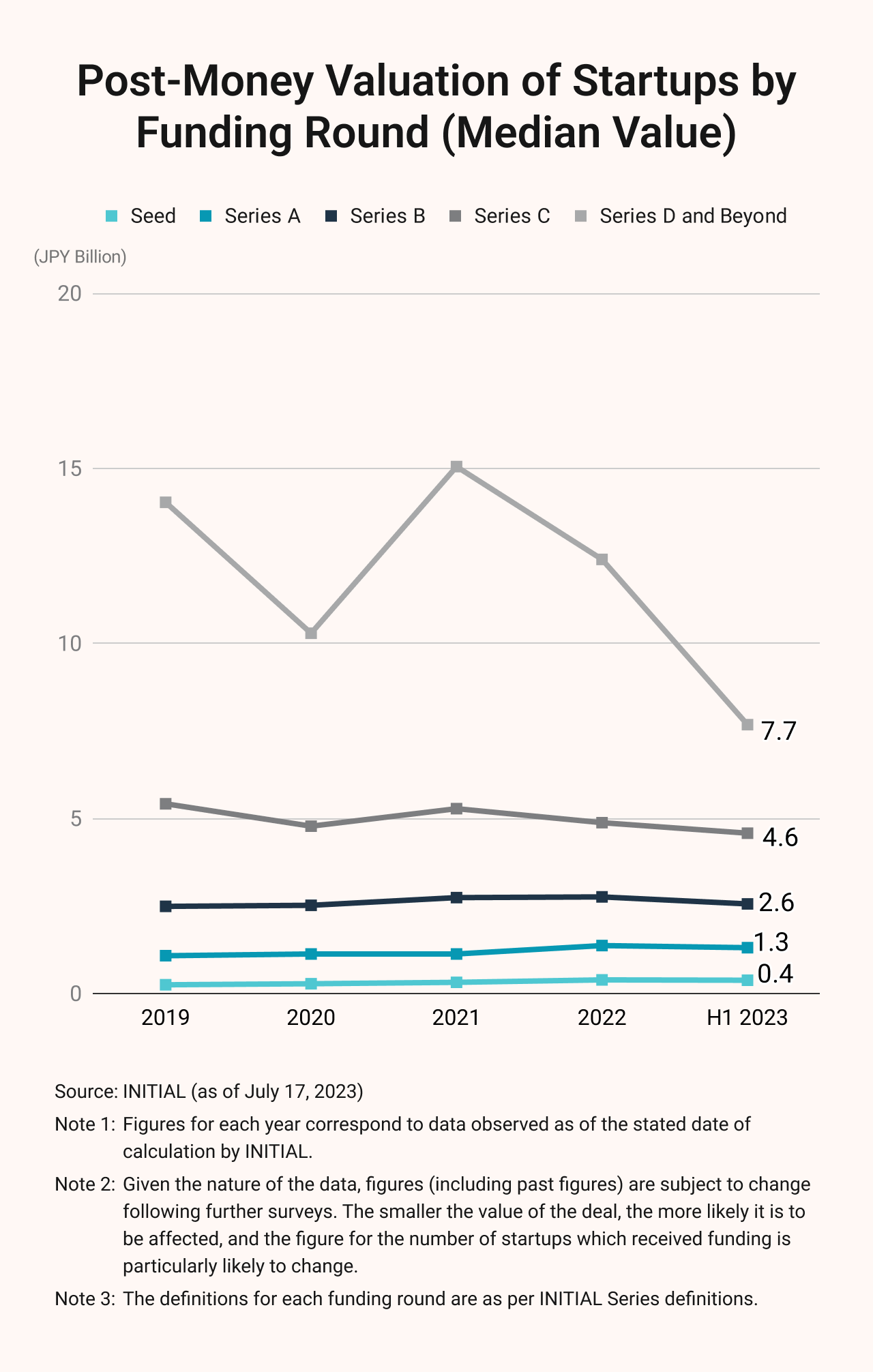

A similar trend was observed when looking at the total value of deals by funding round, with amounts falling across the board compared to 2022 levels. Companies seeking funds in Series D rounds and beyond, meanwhile, struggled the most in terms of both total capital raised and post-money valuation, with the latter falling by 38% YoY.

INITIAL funding rounds are defined here (currently available in Japanese only)

Bear Market Behind Japan’s Startup Woes

Falling market prices have led investors to scale back their investments in Japan.

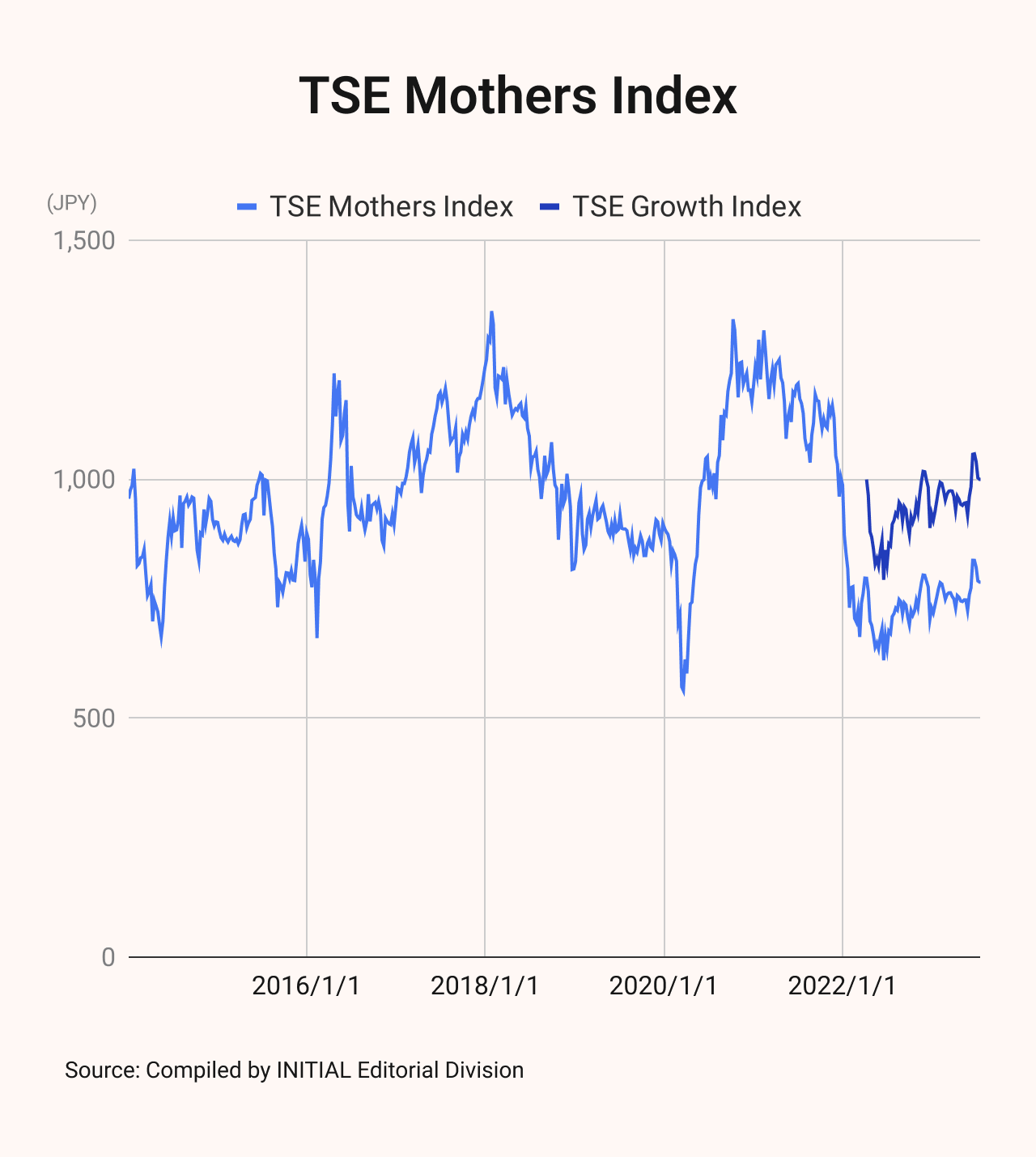

The Mothers Index of the Tokyo Stock Exchange (TSE) traded at an exceptionally high level from around September 2020, peaking in H1 2021 before declining sharply at the end of 2021. In the span of a single year following that peak, the Growth Index declined by more than 30% in value in H1 2022 (note: the TSE Growth Index is currently trading at a level 20% below the H1 2021 peak of the TSE Mothers Index).

At the same time, the amount of capital raised by startups peaked in the first half of 2022, which seems to indicate that the public market is impacting the startup market with a lag of around six months to a year.

Including the time taken by investors to decide on and execute an investment, INITIAL estimates the average duration of a startup fundraising cycle to be around 15–18 months. This means that the timing for the next round of fundraising for those startups that last sought capital in around 2021—when markets were trading high—would likely have coincided with H1 2023.

Along with this drop in market prices, price earnings ratio (PER) has also begun to overtake price-to-sales ratio (PSR) as the predominant metric for calculating a startup’s valuation. The further along a startup is in its development, the closer a potential exit is for a likely investor and the greater the emphasis is on PER, which is why companies seeking capital in Series D rounds and beyond have been especially impacted by the bear market.

According to Atsushi Fujii, partner at Japan’s largest privately established VC fund JAFCO Group, “It makes more sense to look at profit growth [PER] since the profit a company generates is what ultimately accrues to its shareholders. When investment funds flood the market (e.g., through monetary easing), the focus tends to shift to sales [PSR] as the leading metric for identifying promising investments, but history shows that such periods happen rather irregularly.”

Minoru Imano (Managing Partner at leading independent VC firm Globis Capital Partners), meanwhile, advises investors to view current conditions in a more neutral light rather than as a depression of the market, opining that this market trend is likely to persist into H2 2023 and beyond, as many startups are working to transition to structures that actually turn a profit.

Even in a bear market, a company that is profitable can boost its valuation and engage in equity financing. Those that can’t, however, are forced to either hold out until markets rebound or raise funds in a down round at a valuation lower than in their previous round of funding.

Companies that fail to secure the desired amount of equity may also opt to engage in debt financing, a practice that has become increasingly common since around 2022 as more and more startups choose to go that route.

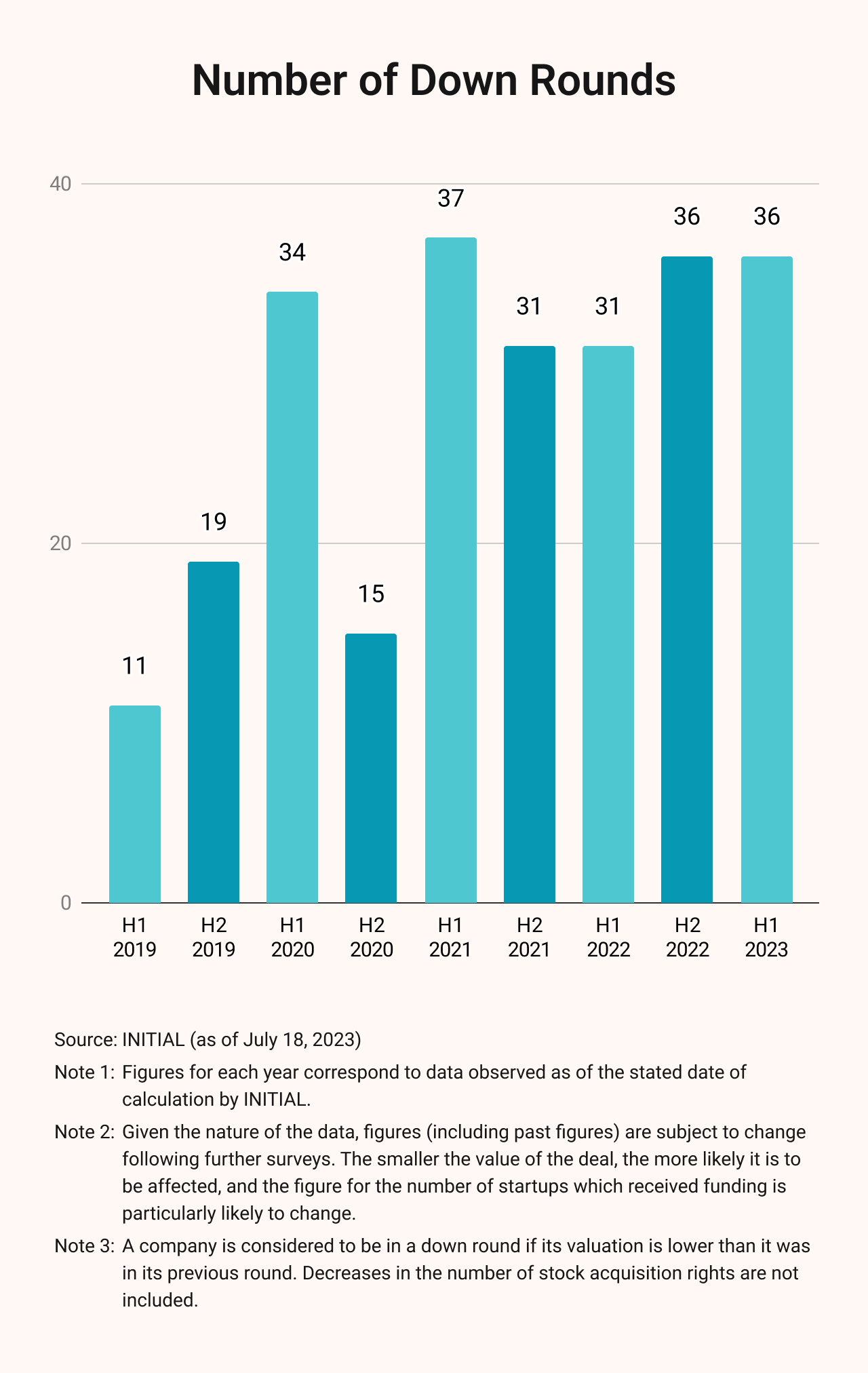

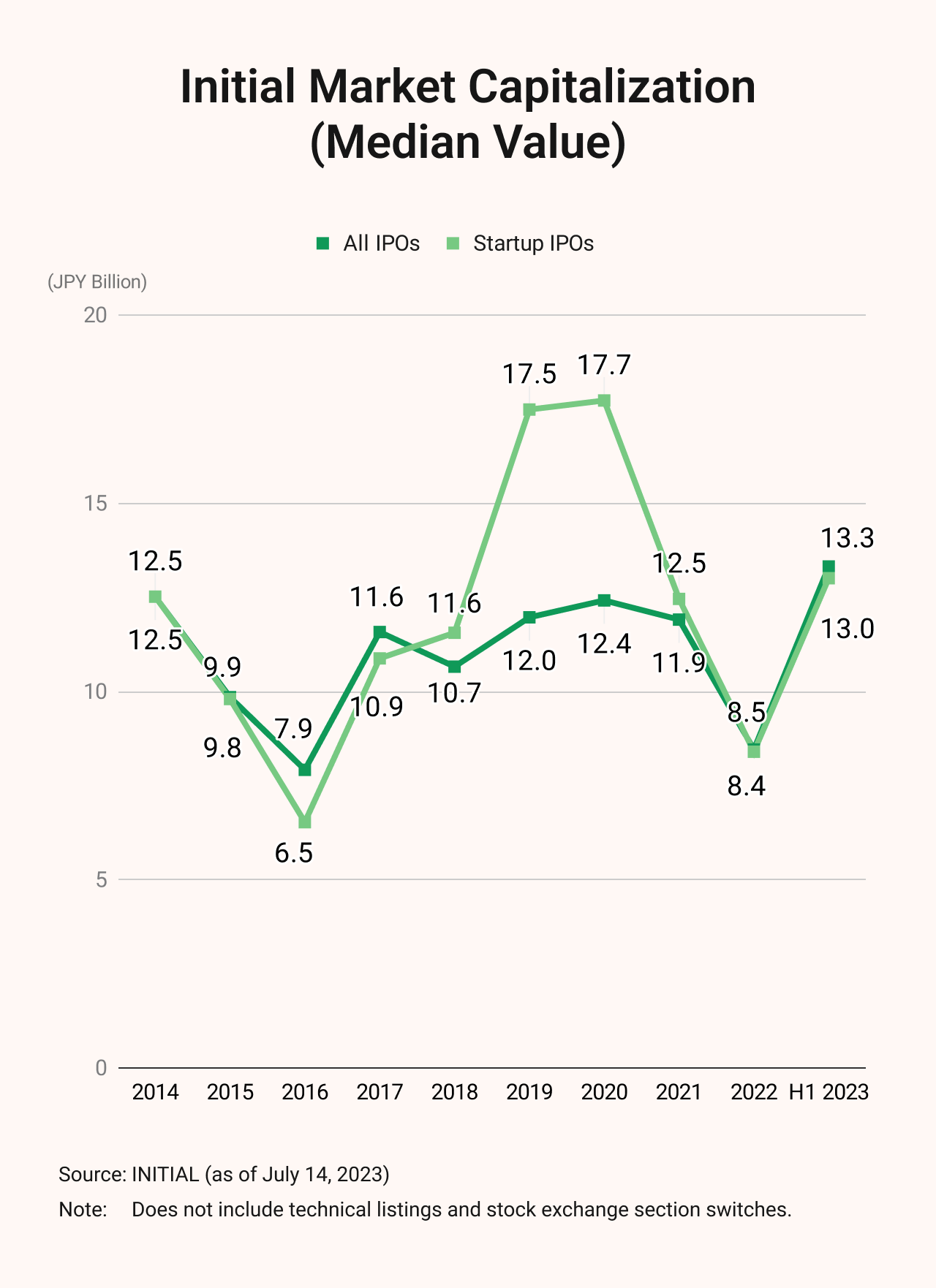

H1 2023 also saw a rise in the number of down rounds compared to the first half of the previous year. While there were plenty of down-round IPOs in 2022, and the median market capitalization fell below JPY 10 billion for the first time in six years, the overall trend in down rounds and other factors in the private market did not see a marked change YoY.

Perhaps more symbolic than the increase in the number of down rounds observed in the first half of 2023, however, was the change in the composition of those rounds. While startups in Series A funding rounds have traditionally comprised the largest share, most of the down rounds in H1 2023 were recorded by startups in Series B funding rounds. This was followed by Series C, Series D, and even later-stage startups (for which down rounds are generally uncommon)—all of which accounted for a larger number of down rounds than Series A startups.

Duo of R&D-Focused Startups Raised Over JPY 10 Billion Each

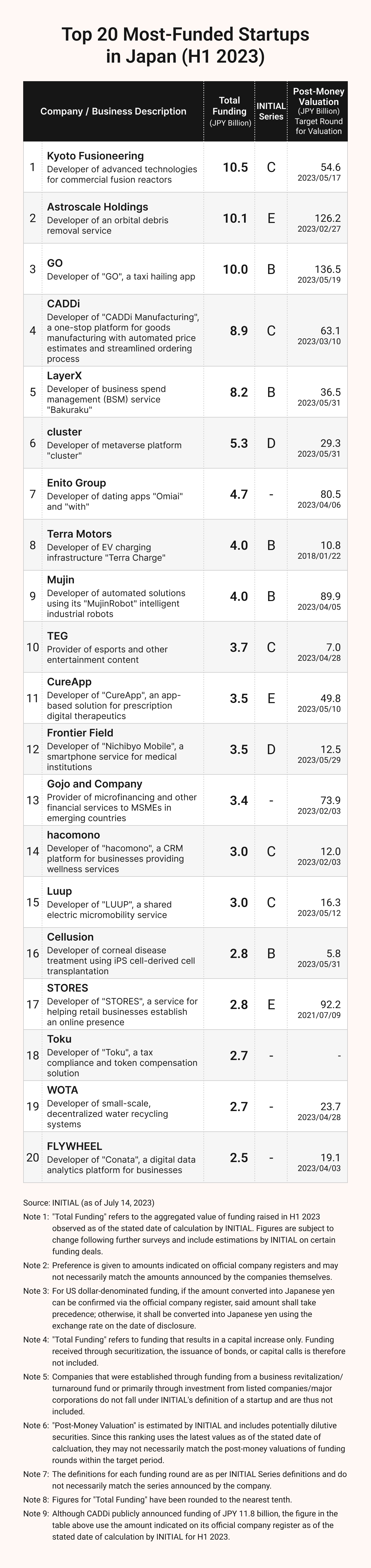

In H1 2023, the top spots on the ranking of the top twenty most-funded startups were occupied by two companies engaged in R&D activities, both of which managed to attract over JPY 10 billion in funding. The first, Kyoto Fusioneering, is a developer of advanced technologies for commercial fusion reactors, while the latter, Astroscale Holdings, is working to develop a service for removing orbital debris (i.e., any human-made object in orbit around the Earth that no longer serves a useful function).

While CADDi (fourth place) and Telexistence (just outside the ranking) each announced funding rounds of over JPY 10 billion in July (JPY 11.8 billion for the former, roughly JPY 23 billion for the latter), the above ranking uses the amounts indicated on each company’s official register as of the stated date of calculation by INITIAL.

In third place, GO (formerly Mobility Technologies) received an injection of around JPY 10 billion from Goldman Sachs. However, because INITIAL could only verify funding of JPY 9.99 billion (after rounding) on the company’s official register, it was excluded from the number of Japanese startups that raised JPY 10 billion or more in funding.

Compared to H1 2022 rankings, H1 2023 saw a drop-off in the number of startups that raised capital in the range of JPY 3–5 billion. Looking at the twentieth-ranked companies in the first halves of 2022 and 2023, CureApp managed to raise JPY 3.5 billion in H1 2022, while FLYWHEEL only attracted JPY 2.5 billion in H1 2023. In fact, the five companies ranking from sixteenth through twentieth on the most-funded Japanese startups of H1 2023 all received investments in the range of JPY 2 billion.

Options for debt financing—which is excluded from the above ranking focused on equity financing—are also on the rise, with six companies in the top 20 raising additional capital via such means.

General Business Corporations and Financial Institutions Make Presence Known

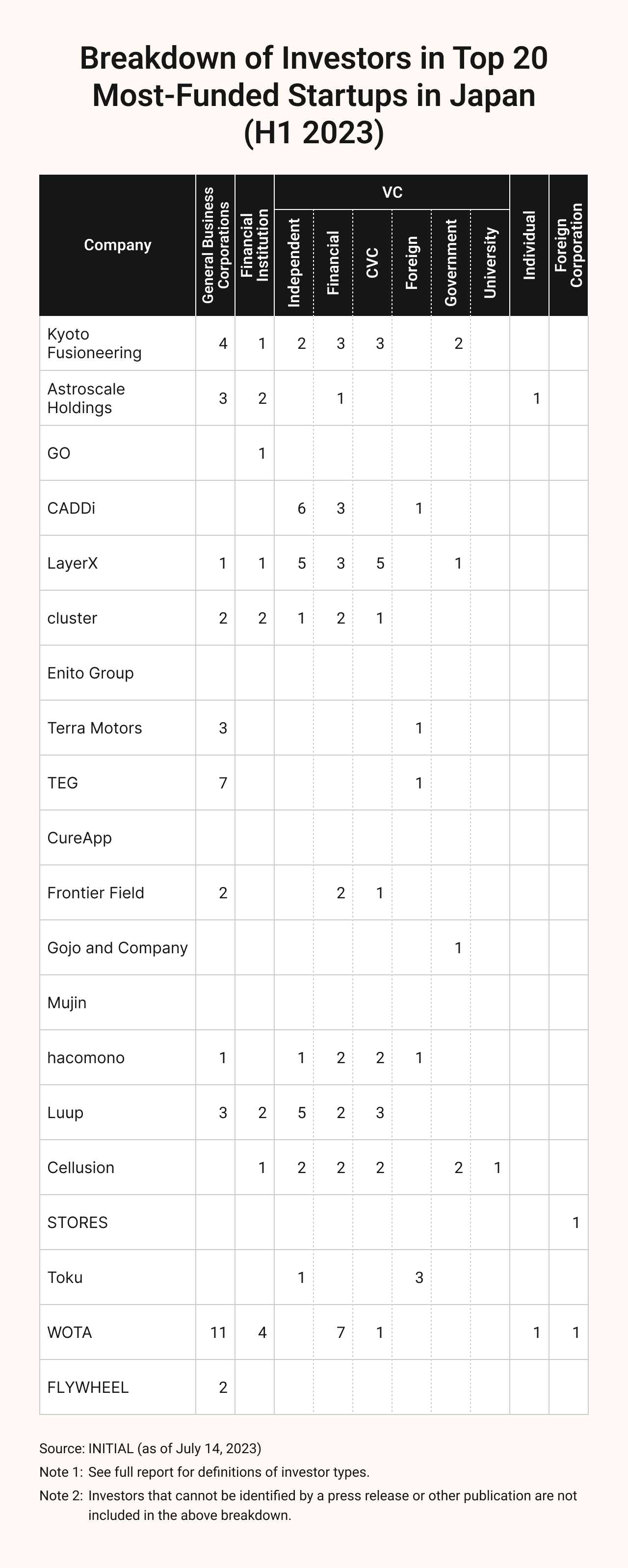

Looking at the types of investors making moves in H1 2023, general business corporations and financial institutions were particularly active.

Financial institutions adopted a proactive stance regarding investments in H1 2023, including in the form of loans and other financing. General business corporations, meanwhile, were well represented by Mitsubishi Corporation, which invested in the top two most-funded startups, and several general trading companies that participated in major funding rounds.

JAFCO Group partner Atsushi Fujii believes this to be the result of the open innovation initiatives launched by such general business corporations in the 2000s gradually taking root and evolving (i.e., into full-on equity investments).

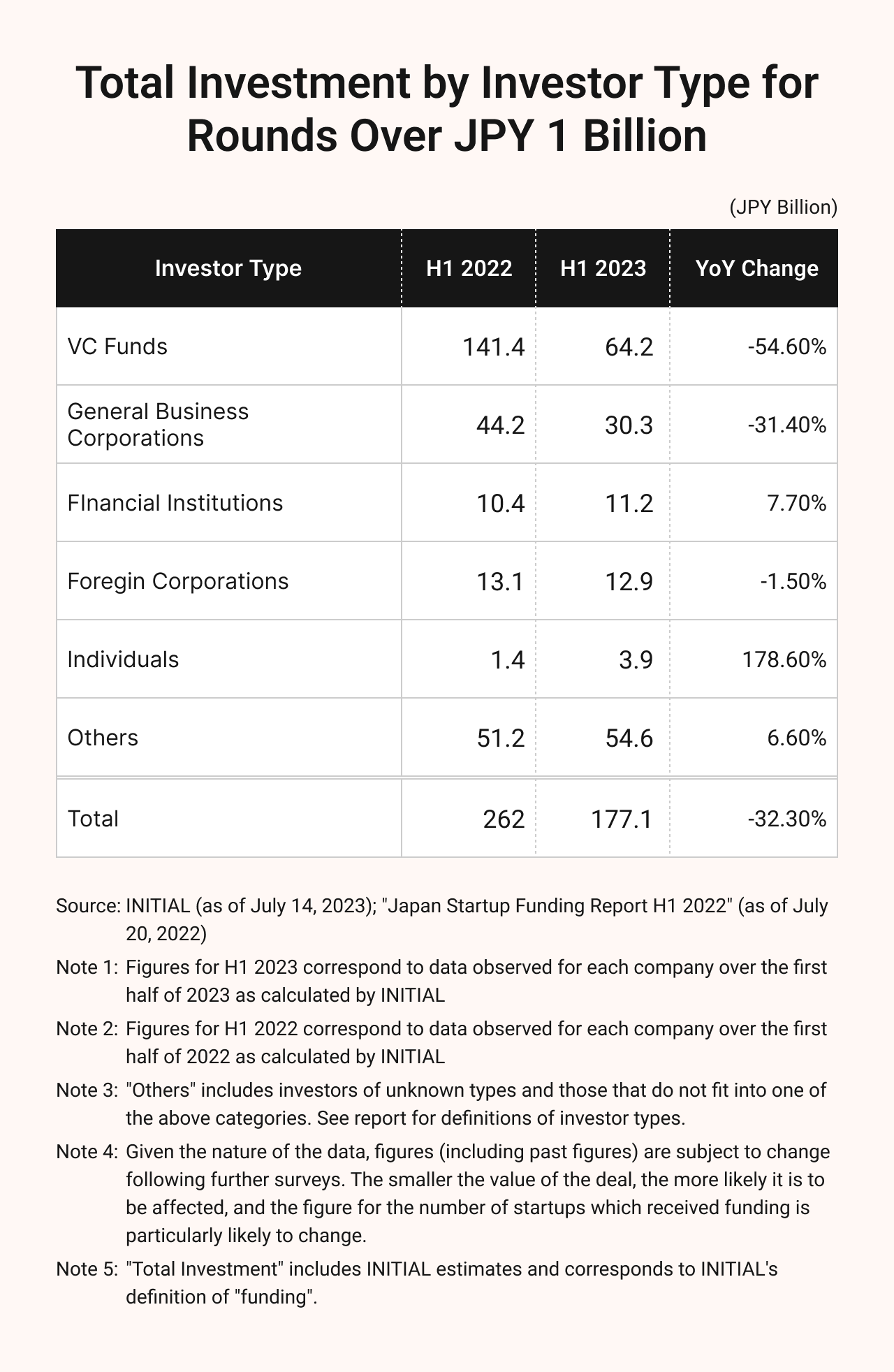

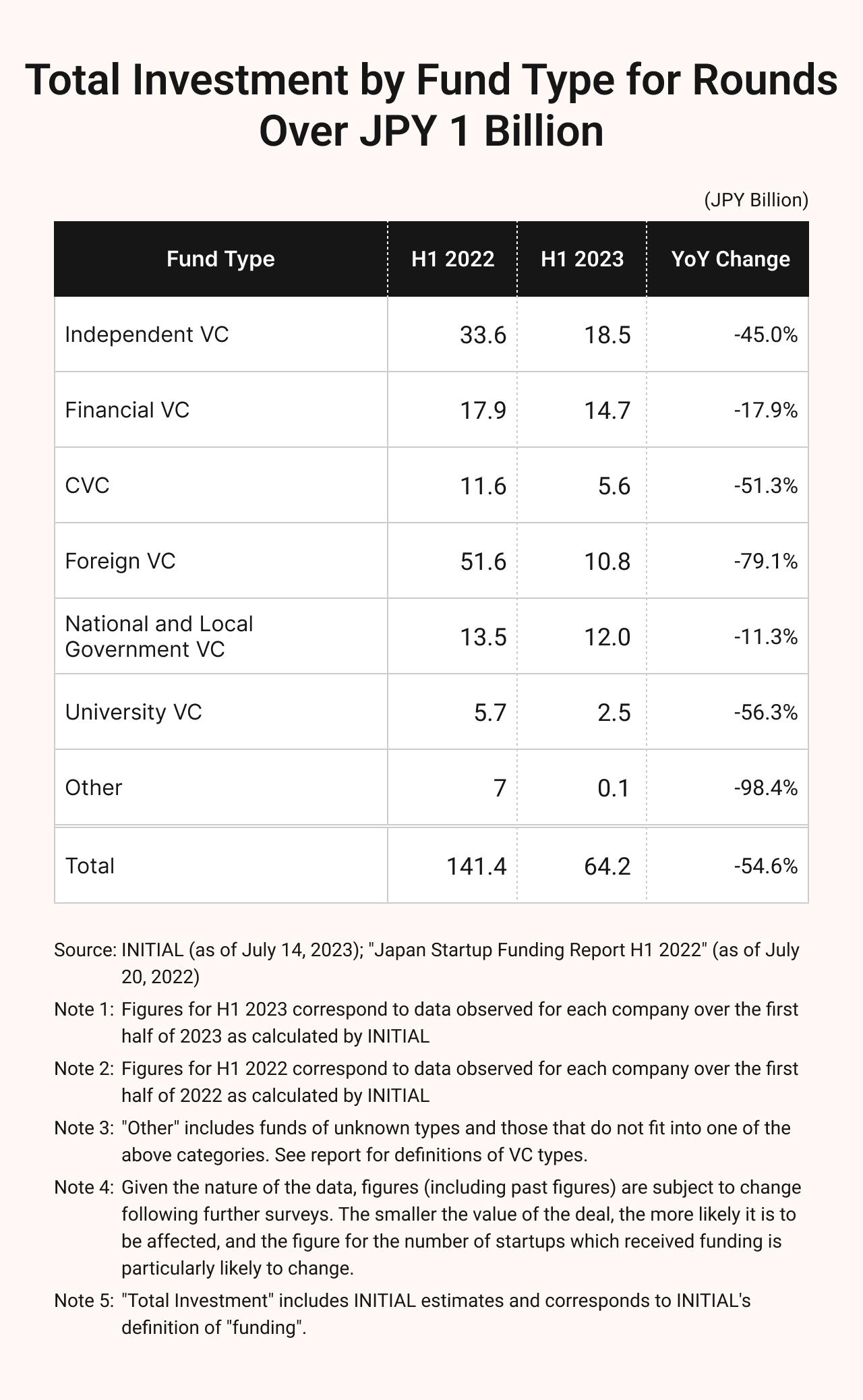

H1 2023 saw significantly fewer large rounds featuring a combination of independent VCs and multiple foreign investors—something which had been commonplace in past years. In fact, total VC investment was down 30% over H1 2022, which undoubtedly had a resounding impact on the overall amount of investment seen in the Japanese startup landscape.

This drop-off in the amount of VC funding was significant, even when looking at deals of more than JPY 1 billion in total value alone. By fund type, foreign VCs—the largest contributors in H1 2022—saw the most significant decline in total investment.

Meanwhile, CVC investment is declining as direct investment from general business corporations stands out, particularly in the ranking of the top twenty most-funded startups in Japan. But, why? Globis Capital Partners’ Imano explains that investors are placing greater emphasis on strategic factors (rather than on simple financial returns), and we are therefore seeing more direct investments from companies themselves, rather than through CVCs, in hopes of gaining a synergistic boost.

Although the amount of investment from foreign VCs in the country has fallen, foreign institutional investors continue to maintain a high degree of interest in Japanese startups. This is something on which both Fujii and Imano agree, with each reporting numerous inquiries from such investors.

Initial Market Cap Rebounding, Even as Number of IPOs Fall

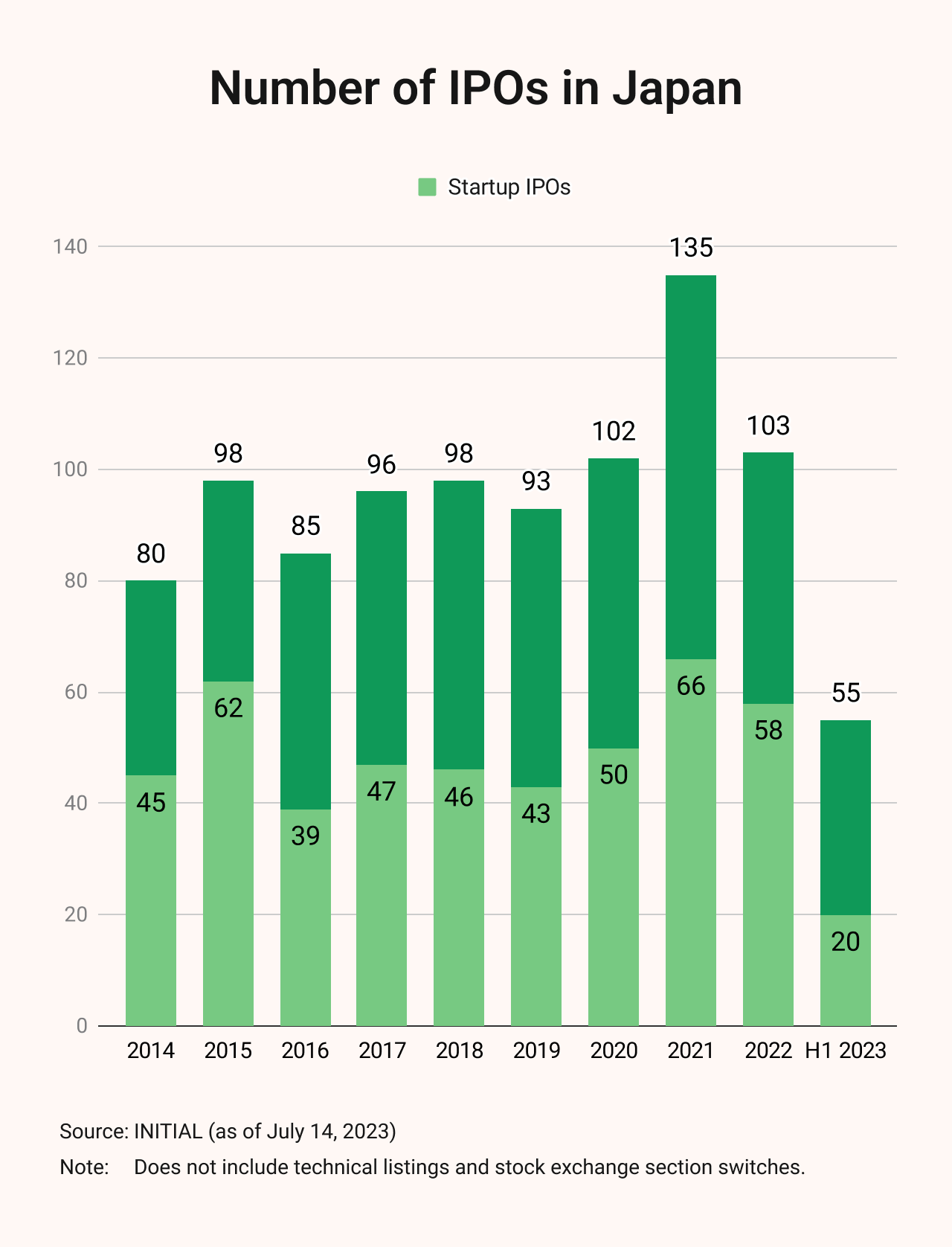

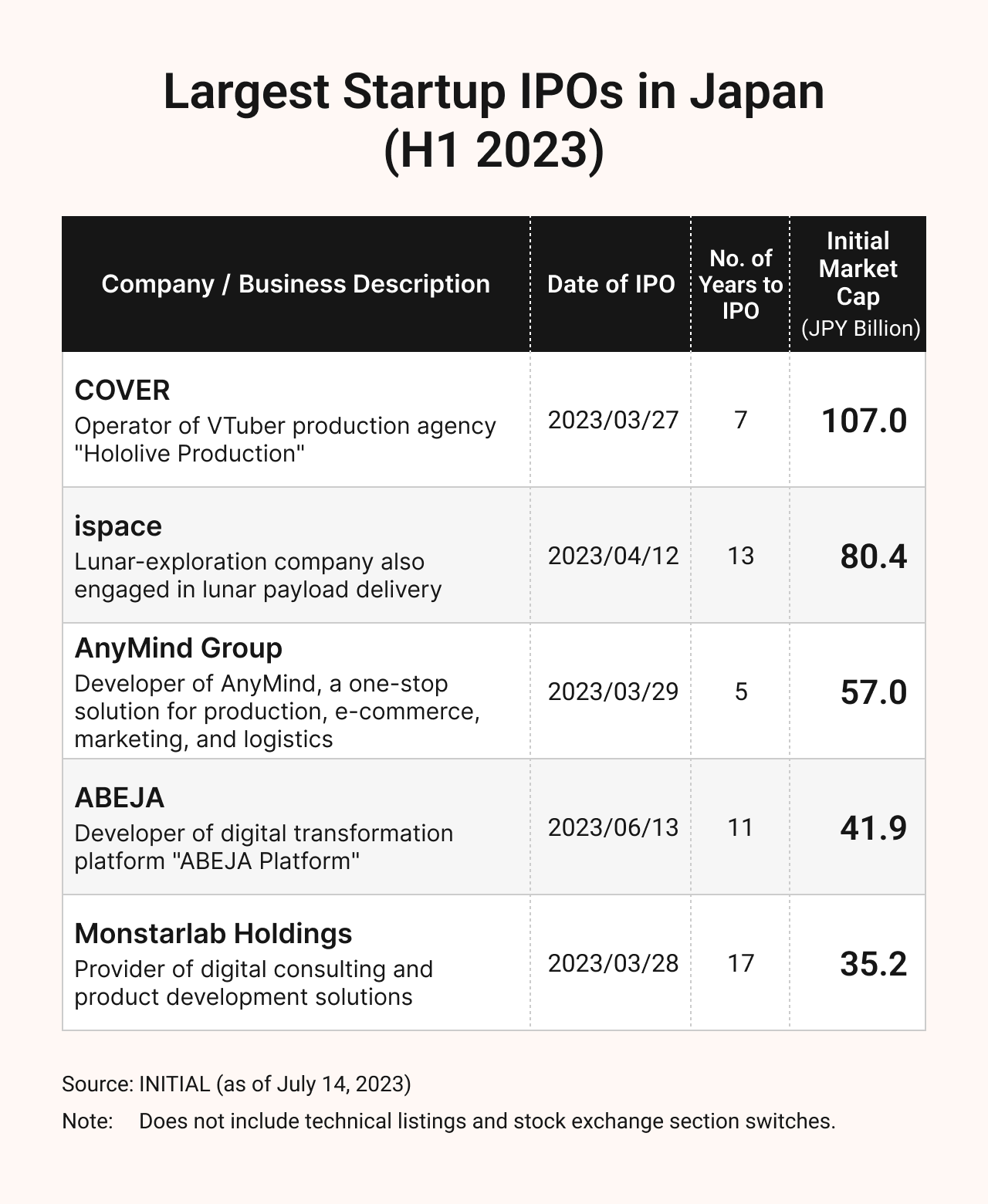

In H1 2023, the total number of startup IPOs dropped in Japan as we saw signs of some companies forgoing the chance at a public offering. In fact, only twenty (36.4%) of the 55 IPOs in the country in H1 2023 featured a startup.

Nonetheless, the median market capitalization at the time of IPO actually appears to be recovering, standing at JPY 13 billion (USD 96.4 million) in H1 2023 after falling below the JPY 10 billion line for the first time in six years to JPY 8.5 billion (USD 64.7 million) in 2022. This figure marked an increase over similar values for both 2021 and 2022.

Of all the Japanese startups that went public for the first time in H1 2023, the only one to top an initial market cap of JPY 100 billion was COVER. While the median number of years to IPO for newly listed startups stood at nine, three of the five companies with the largest initial market caps in H1 2023 waited longer to go public.

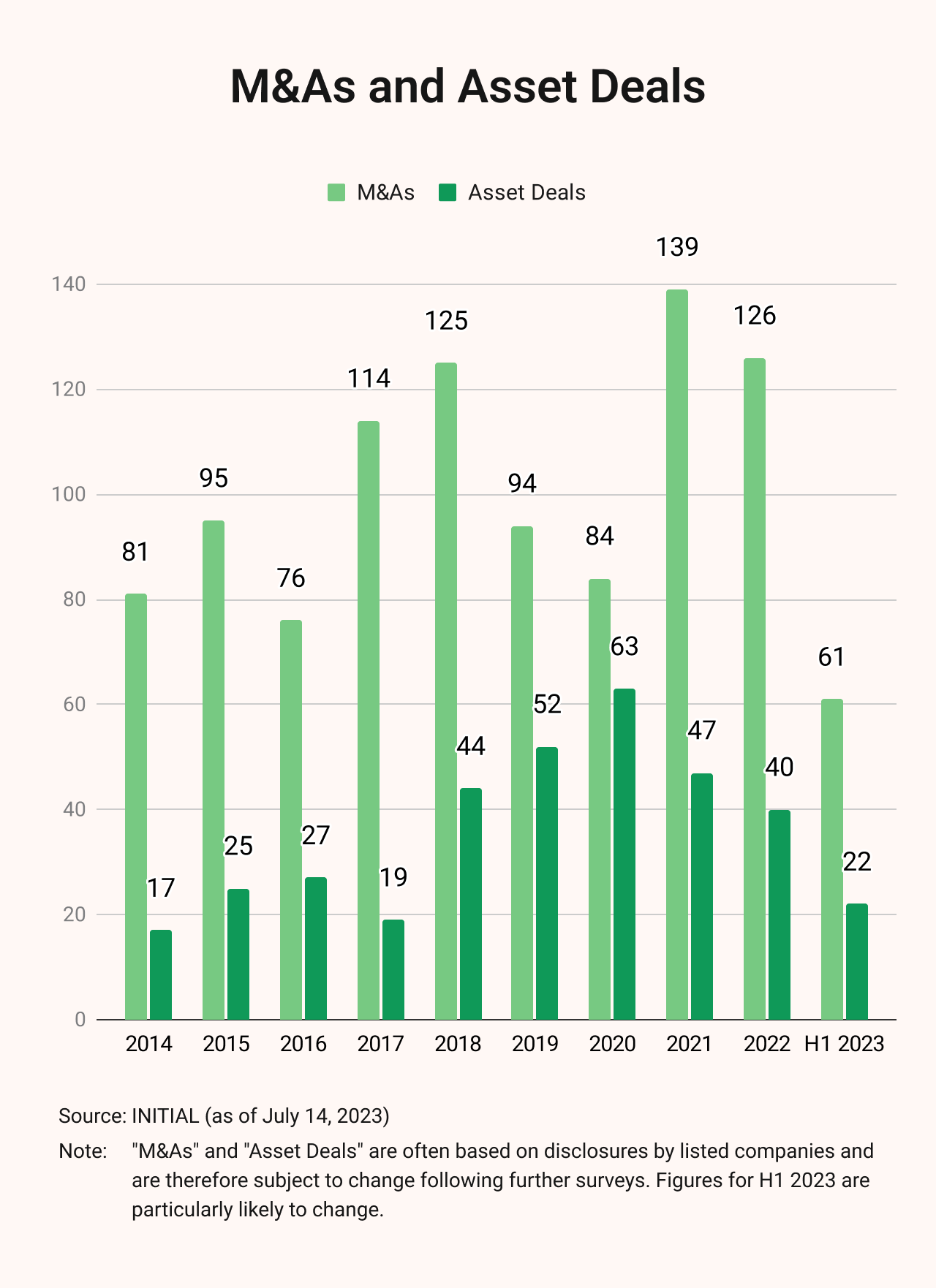

Slight Uptick in Number of M&A Deals

Startups in Japan saw a marginal YoY increase in the number of M&A and asset deals—other common exit strategies for startup investors—in the first half of 2023, with the former reaching a total of 61 deals and the latter reaching a total of 22 deals (for reference, these figures stood at 59 and 18 deals, respectively, in H1 2022).

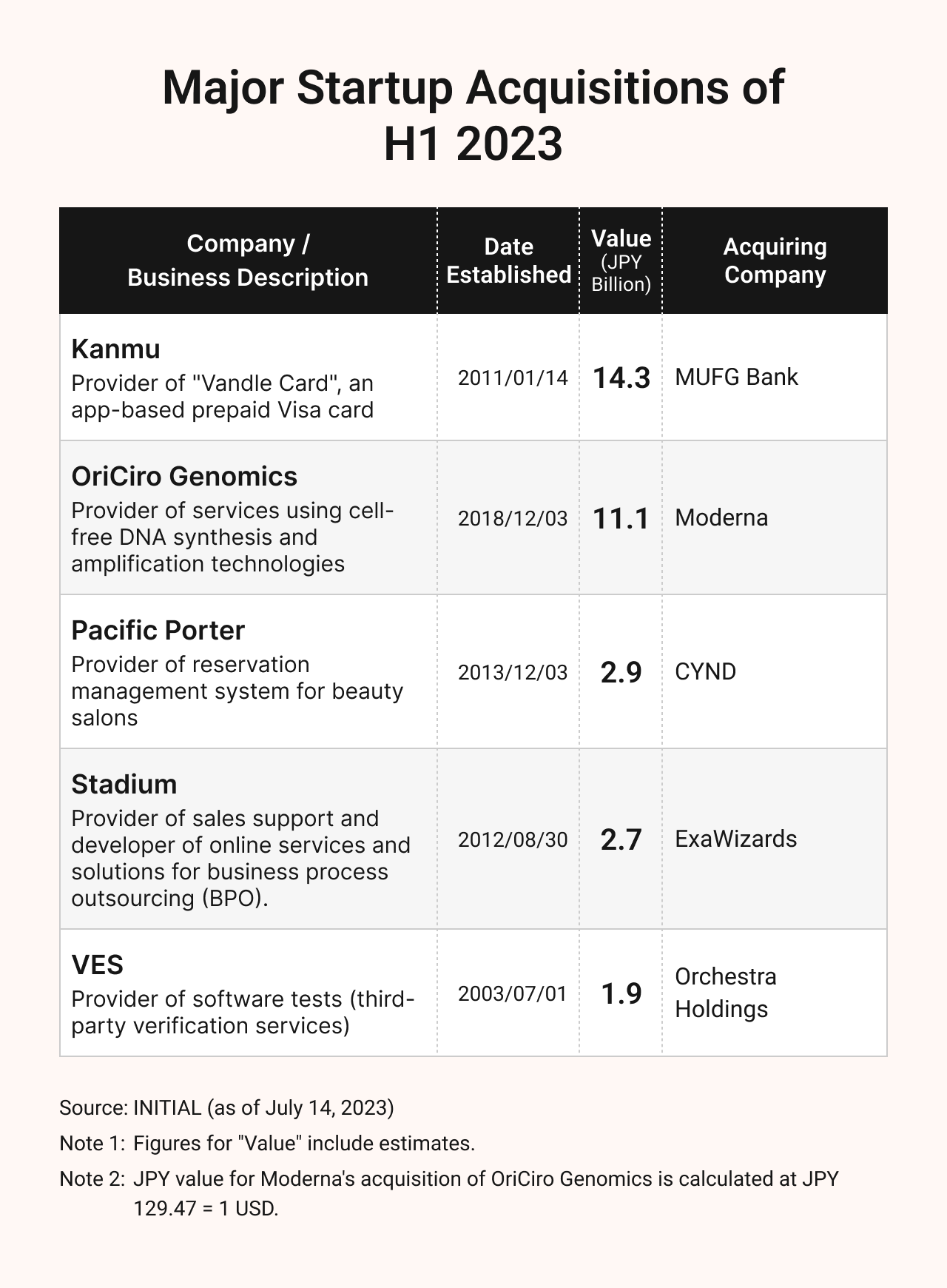

In terms of overall deal value, MUFG Bank’s acquisition of Kanmu and the acquisition of OriCiro Genomics by US-based Moderna were the only two to top JPY 10 billion.

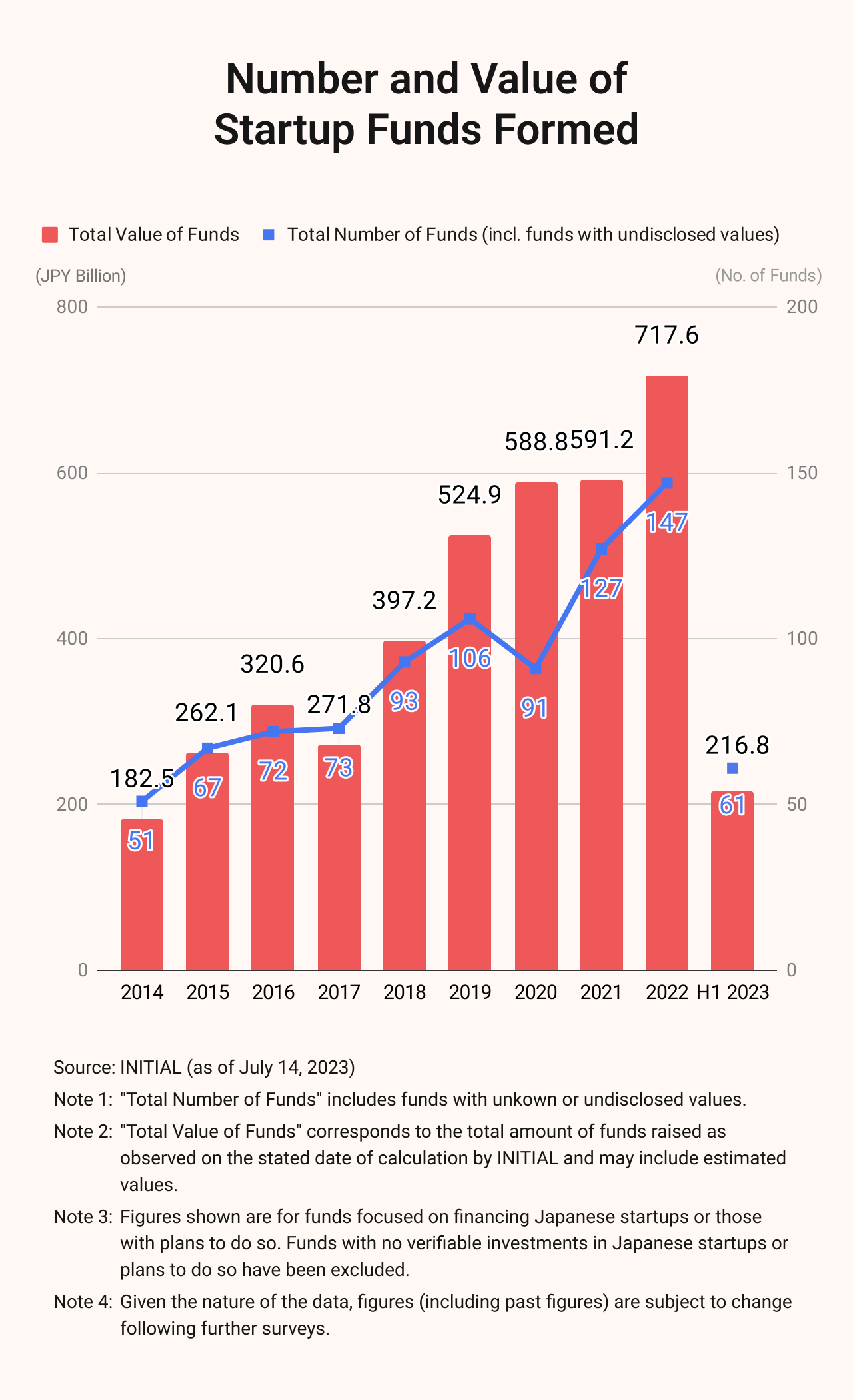

Seven New Funds Attracted Over JPY 10 Billion

Overall investment in Japanese startups has fallen, but there have been no signs of a slowdown in the formation of startup funds in the country.

In fact, 61 new startup funds were formed in the first half of 2023, with the total combined value of all verifiable capital raised amounting to JPY 216.8 billion (USD 1.61 billion). If things continue at this rate, this figure will likely end up in the upper JPY 500 billion (USD 3.71 billion) range, putting it on par with ordinary years.

Although startup funds raised a higher combined total of more than JPY 700 billion (USD 5.33 billion) in 2022, much of this was accounted for by the Japanese government-backed JIC Venture Growth Fund No. 2 (valued at JPY 200 billion). A YoY comparison in terms of the total number of deals (49) and the total combined value of all verifiable capital raised (JPY 185.6 billion), meanwhile, reveals that these figures are currently trending at higher levels in H1 2023.

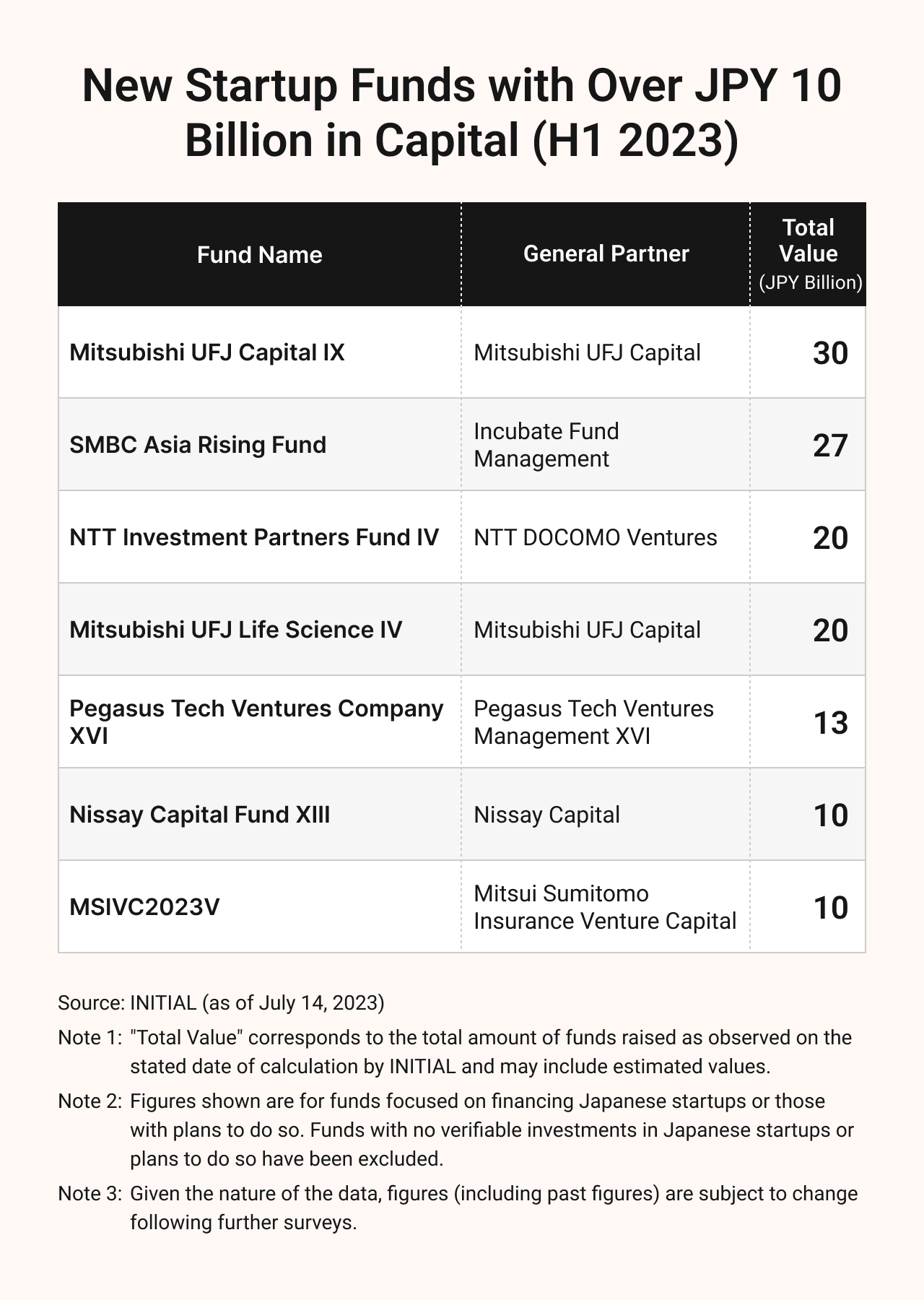

The Japanese startup ecosystem also saw the formation of seven new startup funds with JPY 10 billion or more in capital in H1 2023. Of these, funds backed by financial institutions were particularly prominent, comprising the majority.

Meanwhile, Japan finally appears to be feeling the effects of last year’s market cooldown in terms of the amount of capital being raised in the private market, with startups in the country raising less in the first half of 2023. Investors should keep an eye on developments in the TSE Growth Market going forward, as startups are likely to find themselves in a challenging climate in the future, given the current price at which the market is trading, unlike when the market was trading high.

However, there are also positive takeaways from our analysis. There will likely be a gradual increase in new funding from H2 2023 for startups whose last funding round took place in 2022 or later. Assuming that share prices are at least somewhat tied to prices on the public market, these companies should not appear overvalued, and investors will be more likely to see them as potential investment targets.

The “Startup Development Five-Year Plan” announced in November 2022 by the Kishida administration is also in full swing, which could potentially provide a tailwind for boosting growth.

Now that the tide is turning and Japan’s private market has entered a new phase, startups in the country will need to learn to adapt if they wish to succeed.

In Conversation with the JVCA

Navigating the Currents of Japan’s Startup Landscape: What Can VCs Do?

As part of this year’s mid-term Japan Startup Funding Report, INITIAL sat down with Tomotaka Goji and Soichi Tajima—newly appointed co-chairmen of the Japan Venture Capital Association (JVCA) as of July 14th—to discuss startup funding trends in Japan in H1 2023, as well as their thoughts on what lies ahead. Two of the leading names in Japan’s VC domain, Goji and Tajima provide us with their assessment of the current startup landscape.

Tomotaka Goji: JVCA Co-Chairman

Goji is co-founder, Managing Partner, CEO and President of The University of Tokyo Edge Capital Partners (UTEC) fund. Since founding UTEC in April 2004, Goji has raised and managed five funds totaling roughly JPY 85 billion, overseen team building, and guided the investments, development, and exits of UTEC portfolio companies, 20 of which have gone public and another 20 of which have achieved some other form of substantial exits, mainly in the form of M&As.

Soichi Tajima: JVCA Co-Chairman

Tajima is CEO and General Partner of Genesia Ventures and a graduate of the School of Engineering at Osaka University. During his eight-year tenure at Sumitomo Mitsui Banking Corporation, he was involved in a variety of forms of debt financing. He joined CyberAgent in January 2005 where, after launching a variety of financial services, he led the effort to expand investment areas at the company’s subsidiary, CyberAgent Ventures (now CyberAgent Capital), achieving numerous IPOs and buyouts in the process and being appointed as CEO in August 2010. In August 2016, he founded Genesia Ventures. In July 2023, he assumed his current position as co-chairman of the JVCA.

What do you make of the YoY drop seen in total funding for Japanese startups in H1 2023, and more specifically, of how little later-stage startups have been able to raise?

Goji: Well, I think a lot of it has to do with the cautious stance Series D and pre-IPO investors have taken. The fact that foreign VCs have largely disappeared also bears this out. Investment in the former TSE Mothers Index had been booming, and stock prices were strong through 2021.

With the onset of the Ukrainian crisis, however, conditions in the market began to deteriorate. In 2022, we saw several down-round IPOs where companies found themselves valued at an amount lower than in their previous round of funding. Of course, the valuations of unlisted companies are a lagging indicator compared to stock prices on the public market, and it appears that the delayed impact of conditions in the public market began to manifest in the unlisted market sometime between late 2022 and early 2023.

Since startups generally raise larger amounts of capital with each consecutive series progression, a decline in later-stage investments has a resounding effect on overall funding in the startup landscape. However, I do not believe the future is bleak for startups in Japan. In fact, with initial market capitalizations recovering in the first half of 2023, I anticipate that it won’t be long before we begin to see investors changing their stance on unlisted investments.

Tajima: I think the situation really depends on which business domain you’re looking at. But even when comparing companies in the same domain, it’s important to look at overlapping trends. So, for example, the SaaS domain in general is a solid choice for investment, but that doesn’t mean that all SaaS companies are a safe bet. Right now, sustainability-focused SaaS providers working on decarbonization, Clean Tech, and other similar solutions are the ones ripe for investment.

The data shows that general business corporations were very active investors in H1 2023, yet it’s generally thought that they would shy away from investing in poorer climates because investing is not their primary business. Do you think this is a sign that things have changed?

Tajima: I’m afraid I can’t offer precise figures on this, but intuition tells me that CVCs have become a stable source of funding and are beginning to take root in the Japanese startup ecosystem.

The fourth or fifth year after a company starts to make investments tends to be the turning point. These companies may face impairment losses, leadership changes, or otherwise encounter obstacles that make them shy away from investments. And yet, many CVCs have successfully overcome these challenges, leading me to believe that, for large corporations, startup investment has become a significant aspect of business management.

Behind this change is a shift in thinking—CVCs are no longer just “a trend”, but rather a means of achieving the bigger goal of open innovation. This mindset materializes in the form of continued investments despite less-than-favorable conditions, which is certainly encouraging to see.

We saw a YoY drop in the number of startup IPOs in Japan, but the median market capitalization was way up. What do you make of this, and is it something we should expect to stick around?

Tajima: One of the reasons we’re seeing fewer startup IPOs is because of timing. More and more companies are aiming to go public only after they’ve reached or neared profitability.

Goji: Another reason behind this decline is that IPOs are a lagging index. It takes around 18 months from the time a company starts prepping for an IPO to the time it actually goes public. In other words, there is a time lag—any upturn only becomes evident in concrete figures later.

Now, if we take the Nikkei Stock Average and the TSE Growth Market and compare their current conditions with those of a year ago, the Nikkei is currently on an uptrend, while the TSE Growth market is trading at around 30% lower.

Having said that, though, the median market capitalization for all IPOs in the first half of 2023 is rising, and that’s a good sign. How much things end up improving will depend largely on how high the median market cap rises, and it’s likely the tides will turn again when the TSE Growth Market rebounds to around mid-2021 levels, before the downturn.

There seem to be a lot of new startup funds being formed. Have you noticed any changes in the LP investors involved or their approaches?

Goji: On a macro level, we haven’t seen much of a change in the trend. Our membership has grown, and it currently stands at 348 members, with minimal departures. This is just a personal feeling of mine, but I think that we’re also beginning to see an increase in the flow of funds from foreign institutional investors to Japanese VCs.

One major issue that must be overcome to facilitate this is that many domestic VCs are not up to global standards in terms of how VC funds are valued and how information is disclosed, both key factors when conducting due diligence on LPs. Assessing the fair value of VC funds is something that has been largely solved globally but still hasn’t been solved here in Japan. The JVCA has recognized this as an issue and has been working to improve the situation for more than eight years.

Tajima: While the overall formation of funds has been trending in a positive direction, on a more micro level, all new VC funds struggle to get up and running—except those formed by VCs with clearly established track records, of course. For example, it’s often said that funds focused on seed investment tend to be especially prone to these struggles since the longer times required to achieve an exit means more time required to establish that all-important track record.

What are some things you’re keeping an eye on heading into the second half of 2023?

Goji: Well, from the standpoint of our role as a supporter of startups in Japan, we’ll be keeping an eye on the government’s promotion of public procurement from startup companies. This past spring, 100 startups were selected and promoted by the Ministry of Economy, Trade and Industry [with its publishing of a catalog entitled “100 Startups with a Track Record of Government Collaboration”] based on a survey of VCs and their track records of collaborating with government bodies. For these companies, this should provide a major boost in terms of revenue growth.

The JVCA has also set its own target of increasing the total market capitalization of startups—both listed and unlisted—to around JPY 100 trillion by 2027 when the government’s Startup Development Five-Year Plan is set to end.

As of now, the combined total of all company valuations in Japan’s startup ecosystem is estimated at around JPY 20–30 trillion. Going forward, it’s important to increase this figure further by leveraging companies listed on the Prime and Growth markets of the TSE, as well as Japan’s unicorns and other unlisted and acquired companies.

In order to do this, the JVCA will work to (1) expand the pool of investment capital in the country, (2) stimulate the flow of funds, and (3) continue broadening the Japanese startup ecosystem. For this to be successful, however, it will also require a change in how VCs themselves behave: specifically, they will need to raise more capital for investment.

For that to happen, though, we need a solution to the current dilemma. That is, a cycle in which low exit valuations hinder investor returns and those limited returns bring down the average value of individual deals. Increasing the amount of funding, including by boosting the amount of investment from CVCs and promoting more M&As, should encourage a greater circulation of funds. As I mentioned earlier, I also think it will be important to properly disseminate the kind of information that institutional investors are looking for—not just in Japan but overseas as well.

Personally, I don’t find myself fully on board with the current state of VC involvement after a startup’s listing. Let’s put it this way: to get closer to the end goal, shouldn’t VCs in Japan continue to support startups, like how VCs in the US work with startups even after they’ve gone public?

Those issues aside, as the newly appointed chairmen of the JVCA, we are ready and determined to pursue big goals for the industry.

About the JVCA

The Japan Venture Capital Association (JVCA) is an organization focused on the venture capital (VC) industry that provides support and other services to assist in the founding, growth, and development of promising startups not yet listed on any stock exchanges. Since its founding in November 2002, it has worked to promote deeper cooperation within Japan’s VC industry and solidify its own role in fostering successful startup companies. Its regular membership—which includes VC and CVC firms—currently comprises 266 members, with total membership climbing to 348 members when also accounting for supporting members.

Interviews and Text by Atsuko Mori

Editing by Masumi Ohsaki

Banner Design by Ryo Sugino

Image Design by Naomi Hirota

English Version by Cody Branscum, Eliza Lim