2021 was yet another record-breaking year for Japanese startups, with the highest amount of funding raised in the market’s history and a few mega-deals reaching a scale previously unseen in Japan’s startup ecosystem. Total funding is ultimately projected to come close to JPY 1 trillion (USD 9.11 billion), almost 50% higher than the figure recorded in 2020.

While unprecedented monetary easing in the US has undoubtedly supported this growth, boosting the appeal of Japanese startups in the eyes of foreign investors and creating a more favourable exit environment, the adoption of increasingly innovative capital policies by startups for IPOs was also a factor.

In this summary report, we leverage data from INITIAL to shine a light on some of the major funding trends that shaped Japan’s startup scene in 2021.This year's report also includes an interview with Tohru Akaura and Shinzo Nakano, co-chairmen of the Japan Venture Capital Association (JVCA), in which we discuss startup funding trends in 2021 and their thoughts on what the future holds. The JVCA is an organization dedicated to supporting the establishment, growth, and further development of promising startup companies in Japan.

“Japan Startup Funding” is a report detailing funding trends among Japanese startups that is independently researched and released by INITIAL, one of Japan’s leading startup information platforms. This is an edited English version of the preliminary report prepared as a summary in advance of the release of INITIAL’s full “Japan Startup Funding” for 2021 (full report currently available in Japanese only).

Overview

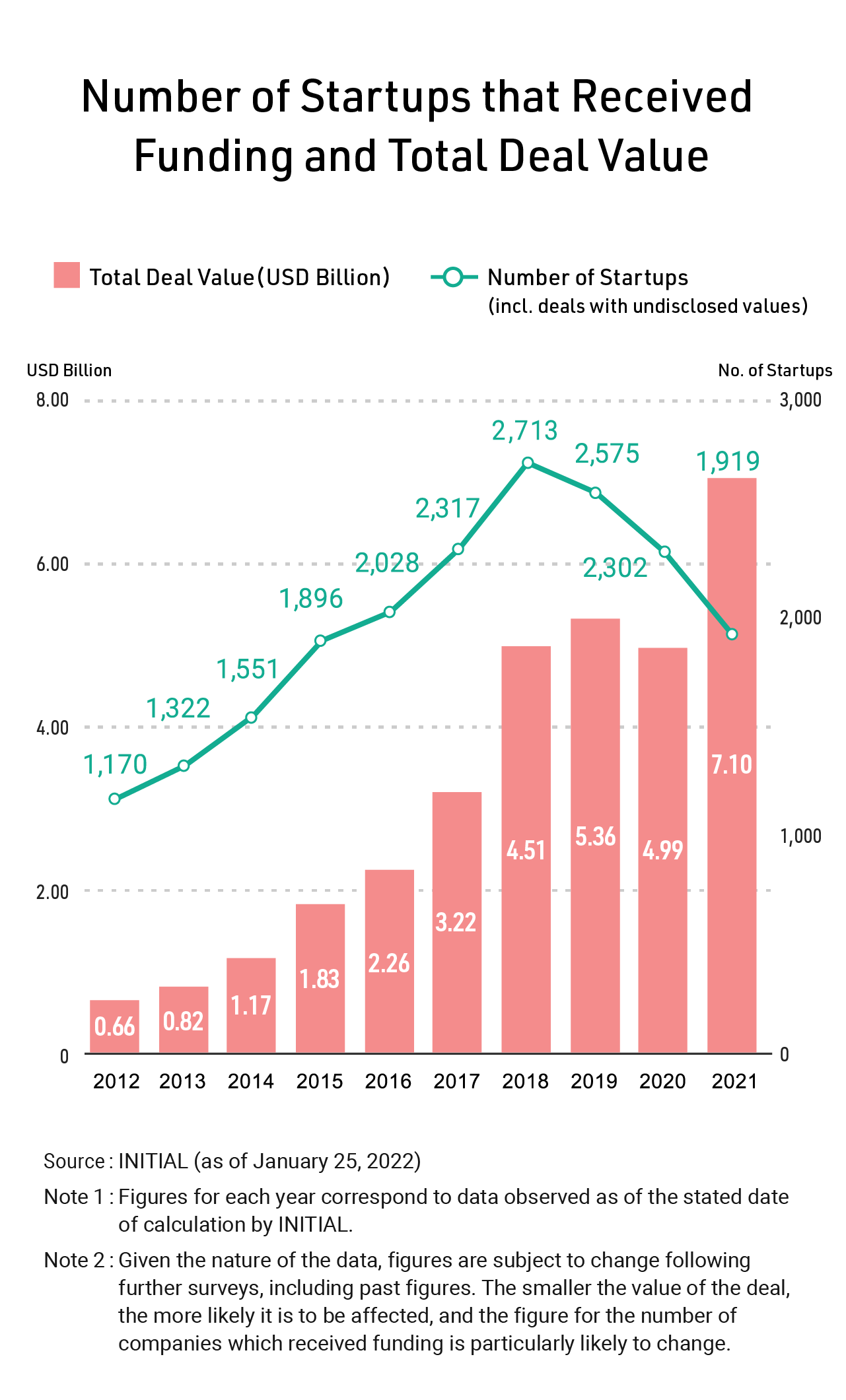

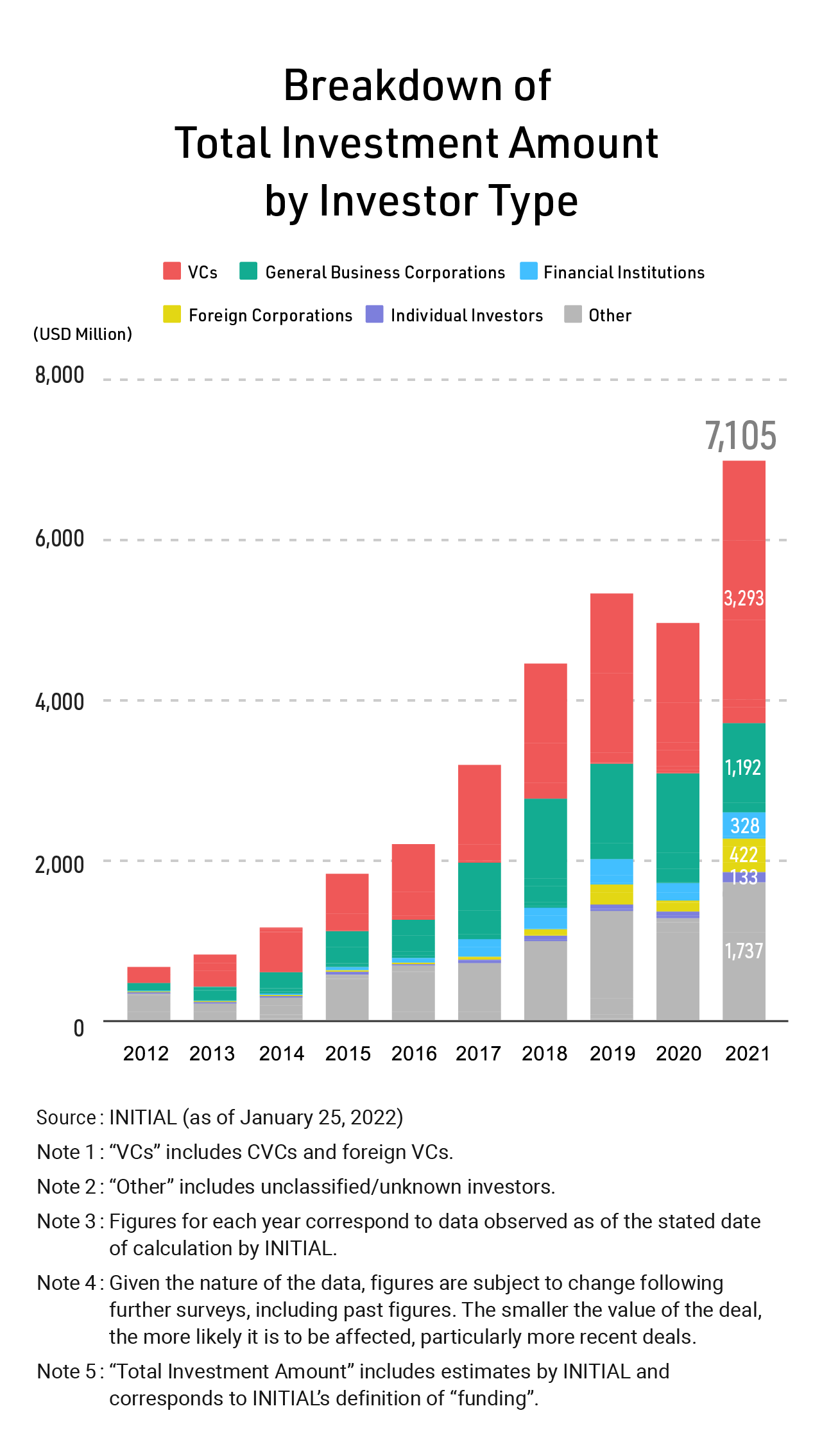

The amount of funding raised by Japanese startups (observable data as of January 25, 2022) jumped by 46% YoY in 2021 to around JPY 780.1 billion (USD 7.10 billion). Please note that the conversion from JPY to USD throughout this report is based on the average mid-market exchange rate for each corresponding year.

This figure is projected to reach at least JPY 850 billion (USD 7.74 billion) once further data is disclosed (data is composed of public information, which can result in a partial time lag between the actual funding event and its detection) and is well on its way to reaching the JPY 1 trillion milestone.

In contrast to deal value, the number of deals in Japan did not increase in 2021, indicating that the deal value per startup is growing.

While large funding rounds by companies such as news app provider SmartNews and taxi hailing app provider Mobility Technologies have certainly boosted the total amount of funding, this growth has also been supported by an overall increase in the median deal value.

The median deal value in 2021 stood at around JPY 110 million (USD 1.01 million). As can be seen in the below graph, median deal values have been rising across the board in recent years.

The growth in deal value is more pronounced for mid- and later-stage startups (those in existence for three years or more), with the median deal value for companies in existence for 10 or more years standing at JPY 300 million (USD 2.75 million).

Nevertheless, recently established seed and early-stage startups have also seen a notable rise in their median deal values since 2018.

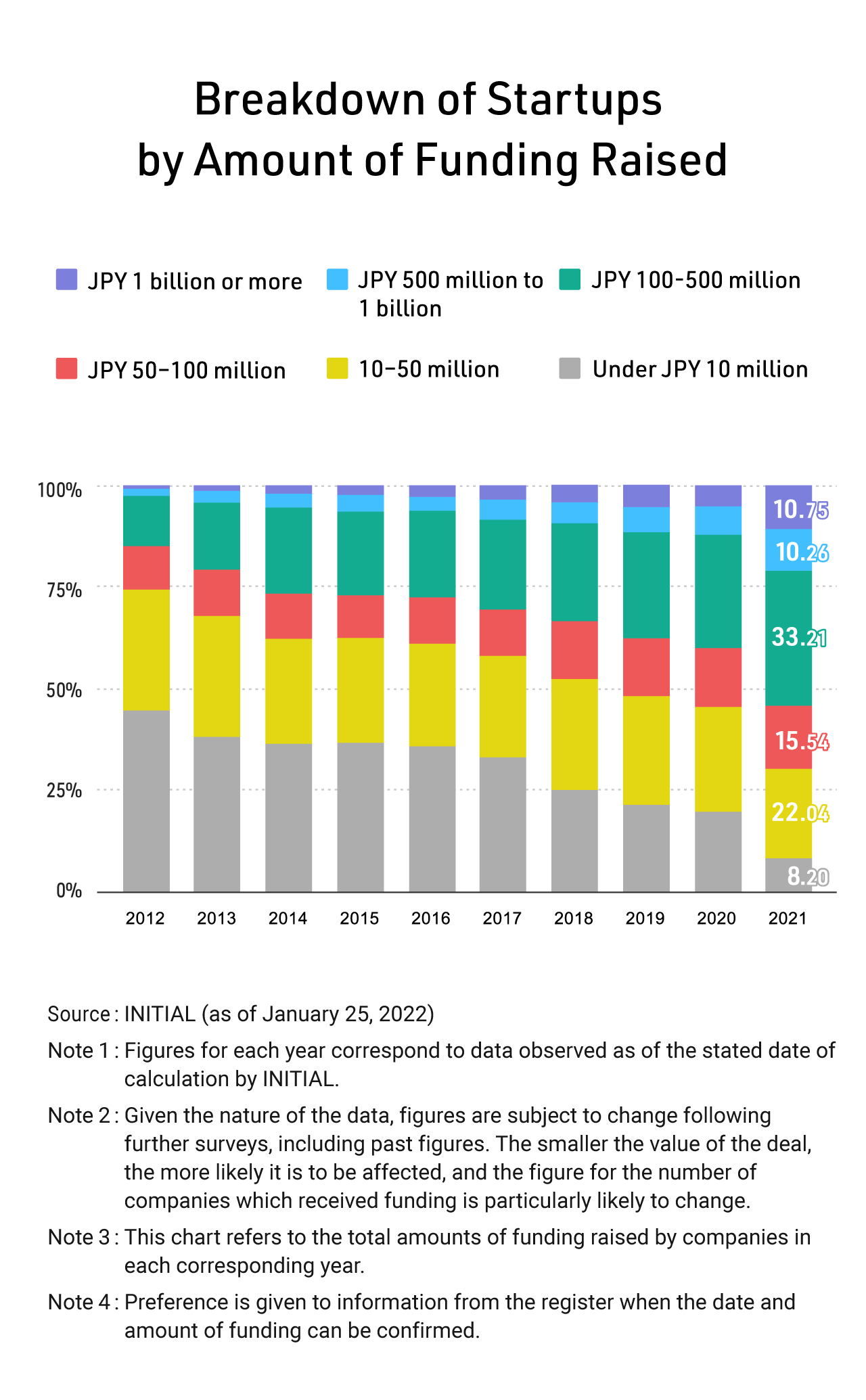

Also, the share of startups that raised more than JPY 100 million (USD 0.91 million) exceeded 50% for the first time in 2021, with large rounds of more than JPY 1 billion (USD 9.11 million) accounting for more than 10%. In contrast, the share of small rounds of less than JPY 50 million (USD 0.46 million) declined further.

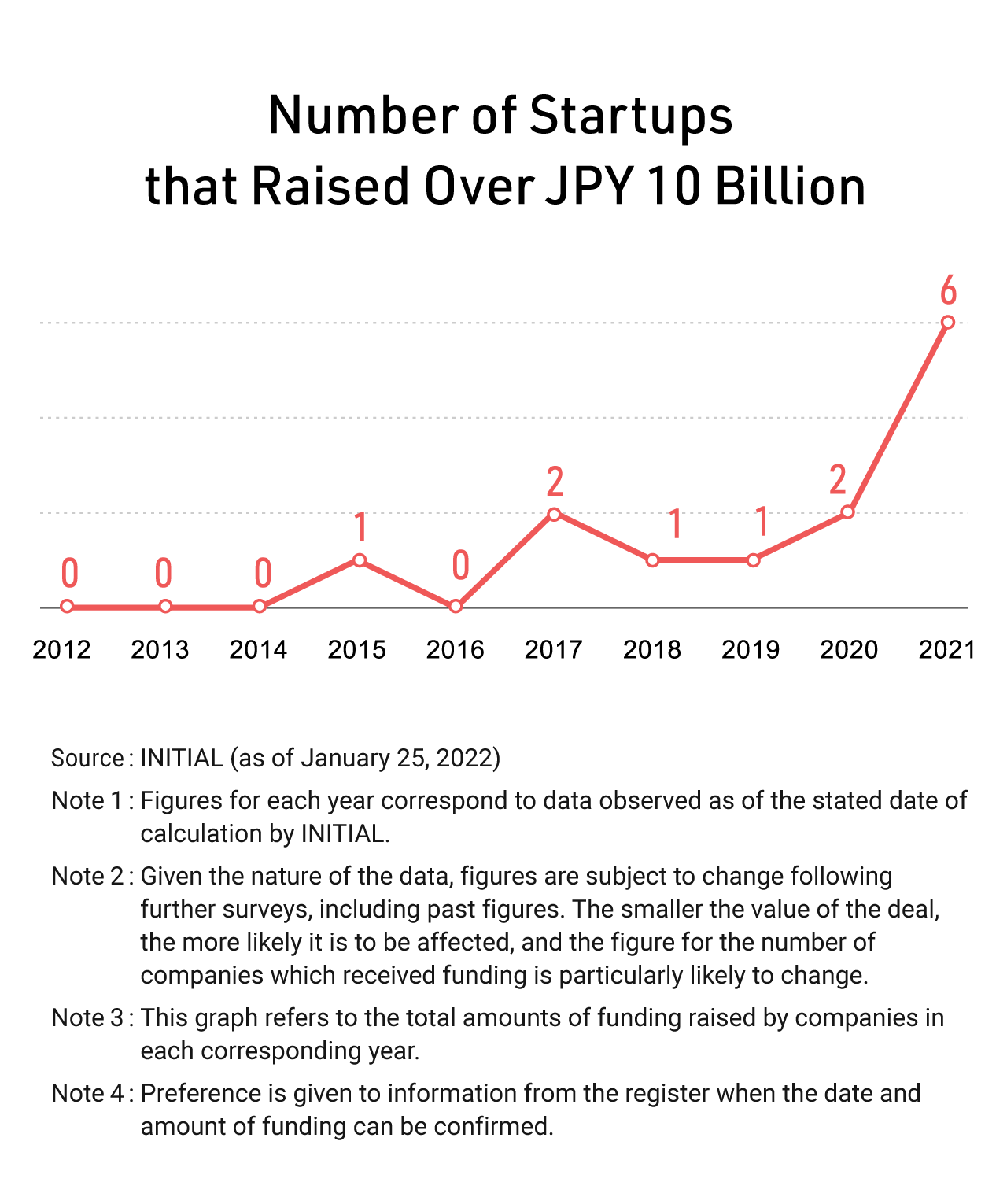

2021 saw a record high number of 6 startups raise over JPY 10 billion (USD 89.13 million).

In terms of value, companies that raised large scale amounts of JPY 1 billion or more accounted for around 66% of the JPY 780.1 billion raised in 2021, while those that raised smaller but still substantial amounts of JPY 100 million or more accounted for 96%.

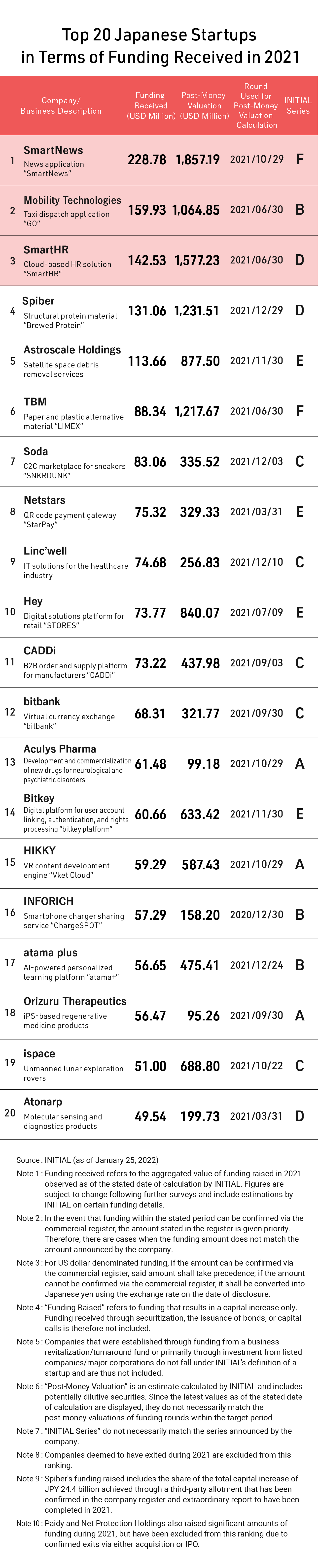

SmartNews raised the largest amount of funding of any startup in 2021, becoming the eighth Japanese startup to reach a Series F funding round, as per INITIAL’s definition of a round (see below).

INITIAL has statistically analyzed funding rounds carried out since 2016 in order to create uniform definitions for each round. Based on this analysis, the definition for advancing from a Series A funding round to a Series B funding round (the same definition applies for all subsequent rounds as well) is that there must have been an increase of at least 20% from a company’s post-money valuation following the previous round to its pre-money valuation for the current round. INITIAL definitions can be found here (currently available in Japanese only).

Astroscale Holdings and ispace, both of which operate in the space industry, announced major funding rounds from October 2021 onwards, while healthcare software provider Linc'well and Aculys Pharma, the Softbank Vision Fund’s first investment in a Japanese company, raised nearly JPY 7 billion (USD 63.75 million) in their Series A rounds.

In fact, three companies in their Series A rounds (including Aculys Pharma) made the top 20, indicating that investors are investing large amounts of capital at increasingly early stages of a startup’s development.

In terms of post-funding valuation, there are 10 Japanese unicorns (startup with a valuation of over JPY 100 billion) as of the writing of this report. Existing unicorns move on to exit, and new ones emerge in their stead—this cycle repeats itself, and the number of unicorns in the country has remained consistent at around 10 in recent years. In the near future, both Astroscale Holdings and payments startup Hey are also likely to become unicorns following their next funding rounds.

While the below image ranks only the top 10 most valuable startups, a broader look at the top 20 shows that virtual reality (VR) startup HIKKY ranks in 16th place at JPY 64.5 billion (USD 587.43 million). This is an exceptionally high valuation for a company that has only completed a Series A funding round.

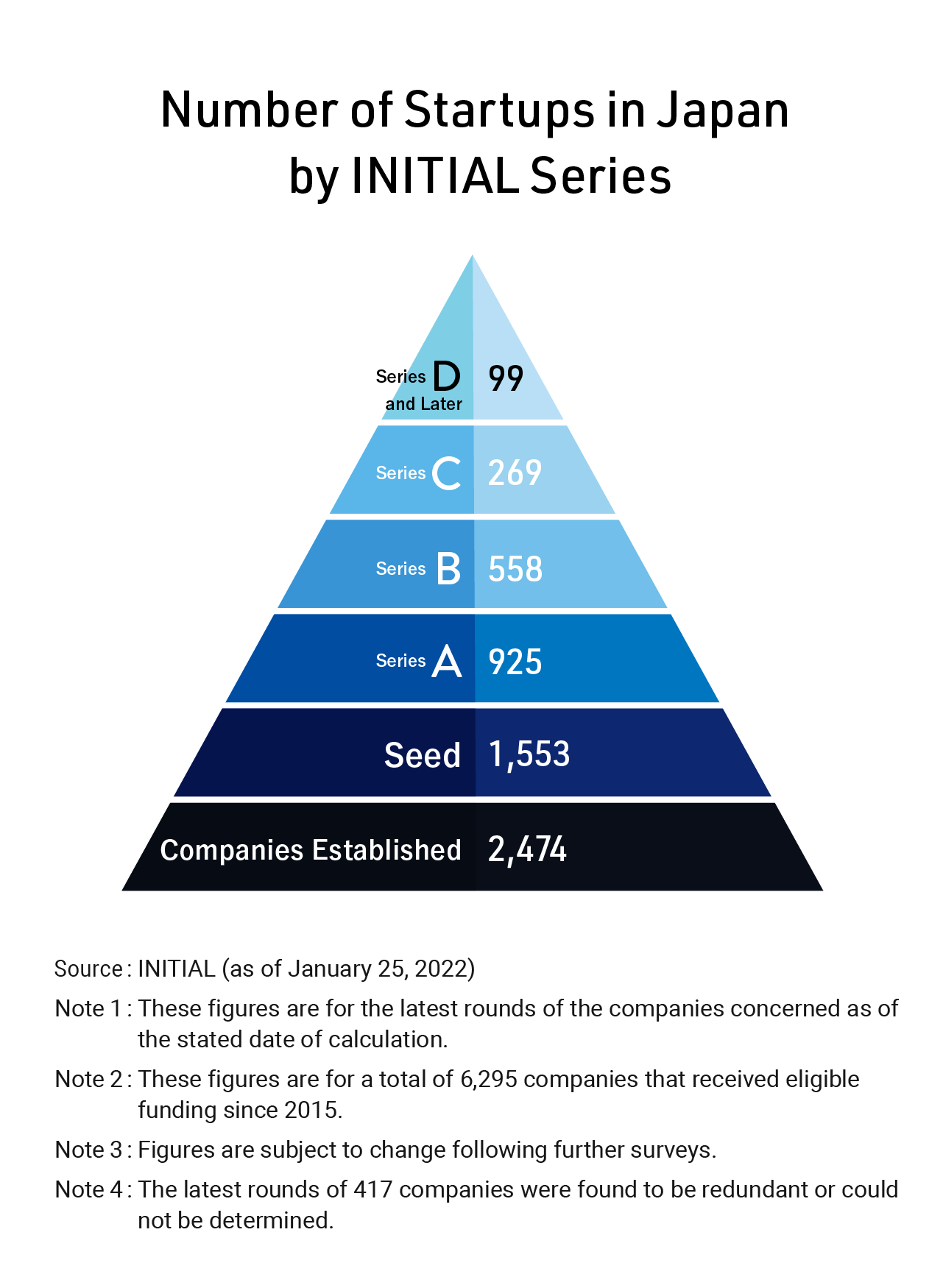

As of writing, there were a total of 6,295 startups in Japan.

Of these, 925 (29.4%) were Series A, while 99 (1.6%) were Series D or later. Looking back at figures in February 2021, a total of 69 startups (1.5%) were Series D or later, revealing that both the number and overall share of startups in this bracket have increased.

Series D or later rounds are often used to attract long-term foreign investors to a startup before it goes public. The growing number of Series D rounds or later in the country therefore may suggest an increasing influx of foreign capital into Japanese startups. One interesting fact highlighted by these figures is that, while it was common for startups to exit through IPOs prior to a Series D round in the past, they are now able to attract significant amounts of investments without turning to the public market.

In contrast, it should also be noted that the shares of startups in their Series A and Series B rounds have shrunk.

The Sectors

This section takes a look at the sectors driving the overall growth of the Japanese startup ecosystem.

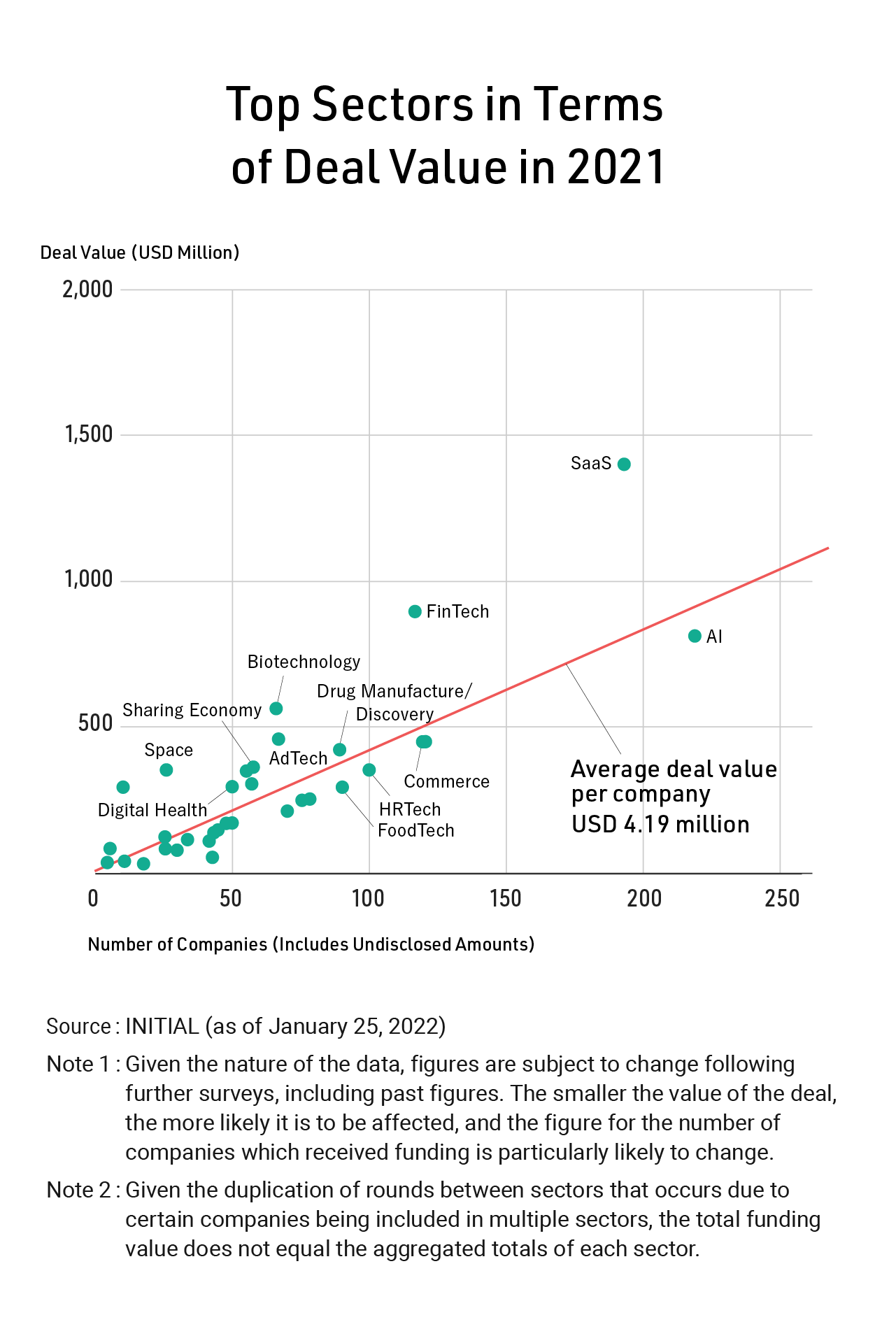

The SaaS sector raised the largest amount of funding in 2021 by some margin at more than JPY 150 billion (USD 1.37 billion), followed by FinTech and AI.

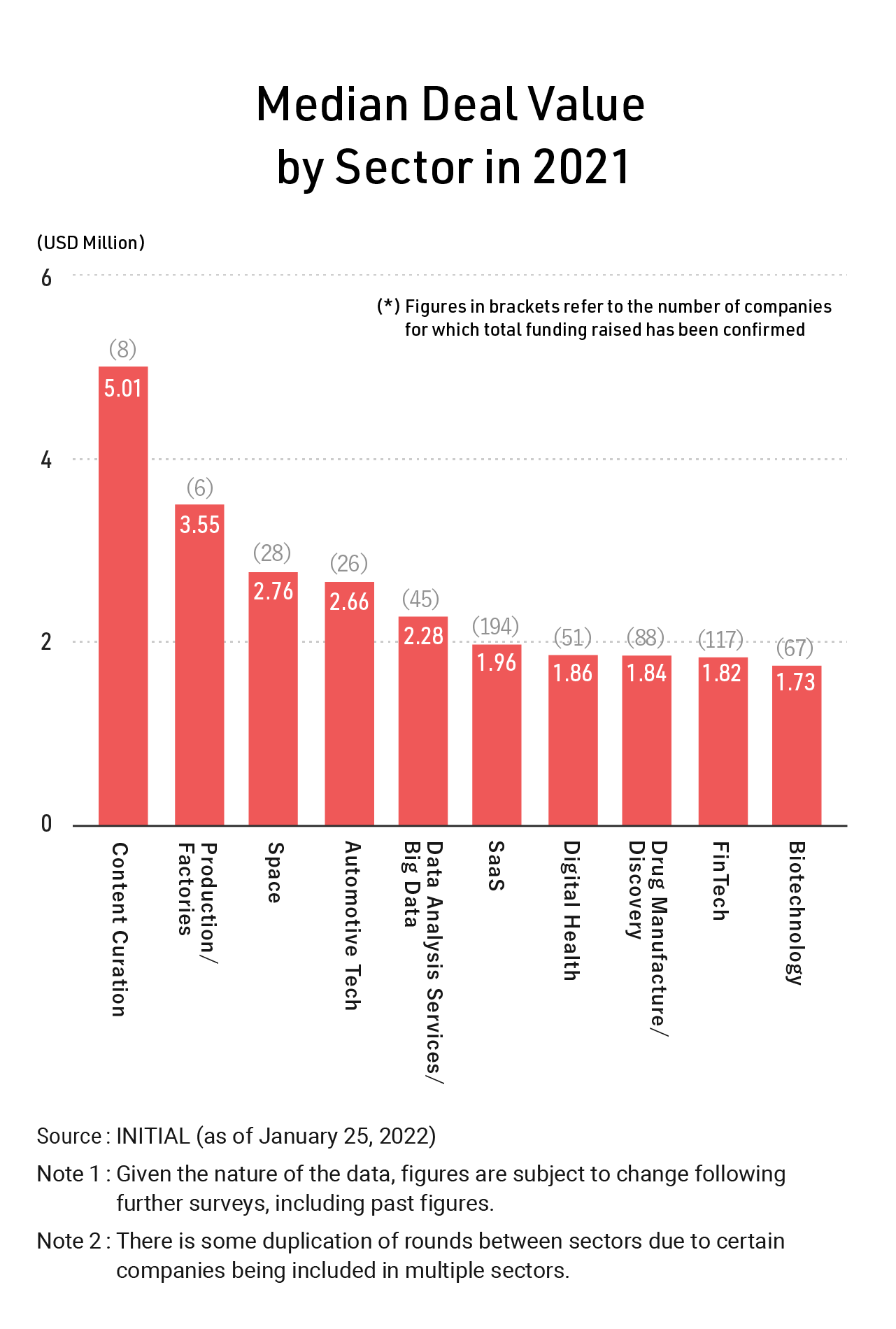

The median deal value for SaaS stood at JPY 215 million (USD 1.96 million) in 2021, while FinTech was also above JPY 200 million (USD 1.82 million), indicating the relatively large size of individual deals in both sectors.

Investors have poured significant capital into the SaaS and FinTech sectors for several years now, and both have matured into domains in which a constant stream of new startups are being established, offering a wide range of services. Numerous Japanese SaaS and FinTech startups have also gone public in recent years.

But which sectors exhibited the highest YoY growth in 2021?

Funding raised in the content curation sector surged to JPY 33 billion (USD 300.64 million) in 2021, more than 17 times the total raised in 2020. This upswing was fuelled by a series of large funding rounds that took place in 2021, in contrast to the mostly early-stage rounds seen in 2020. In addition to SmartNews mentioned earlier, other notable startups in the content curation sector include JX Press at JPY 1.6 billion (USD 14.57 million), Housmart at JPY 700 million (USD 6.38 million), and Showroom at JPY 400 million (USD 3.57 million).

In the space sector, the large amounts raised by ispace and Astroscale Holdings contributed significantly to the overall total. Large funding rounds such as these have a particular impact on the Space and Logistics sectors, given the still relatively small numbers of startups in these domains.

FoodTech, meanwhile, is home to many early-stage startups. While it continues to be centred around food delivery and support services for restaurants, other areas such as plant-based meat have been gaining momentum in recent years, and mid- and later-stage FoodTech startups have begun to attract large amounts of capital in excess of JPY 1 billion. Examples include menu, Mellow, Toreta, TechMagic, DAIZ, and NextMeats.

Biotechnology is another sector that has seen significant growth. Around half of the biotech startups that raised funding in 2021 also did so in 2020. While in some cases the same round stretched across both years, many biotech startups have also boosted their valuations and successfully managed to attract capital in separate rounds two years in a row. Leading startups in this sector include Spiber, TBM, Noile-Immune Biotech, and Heartseed.

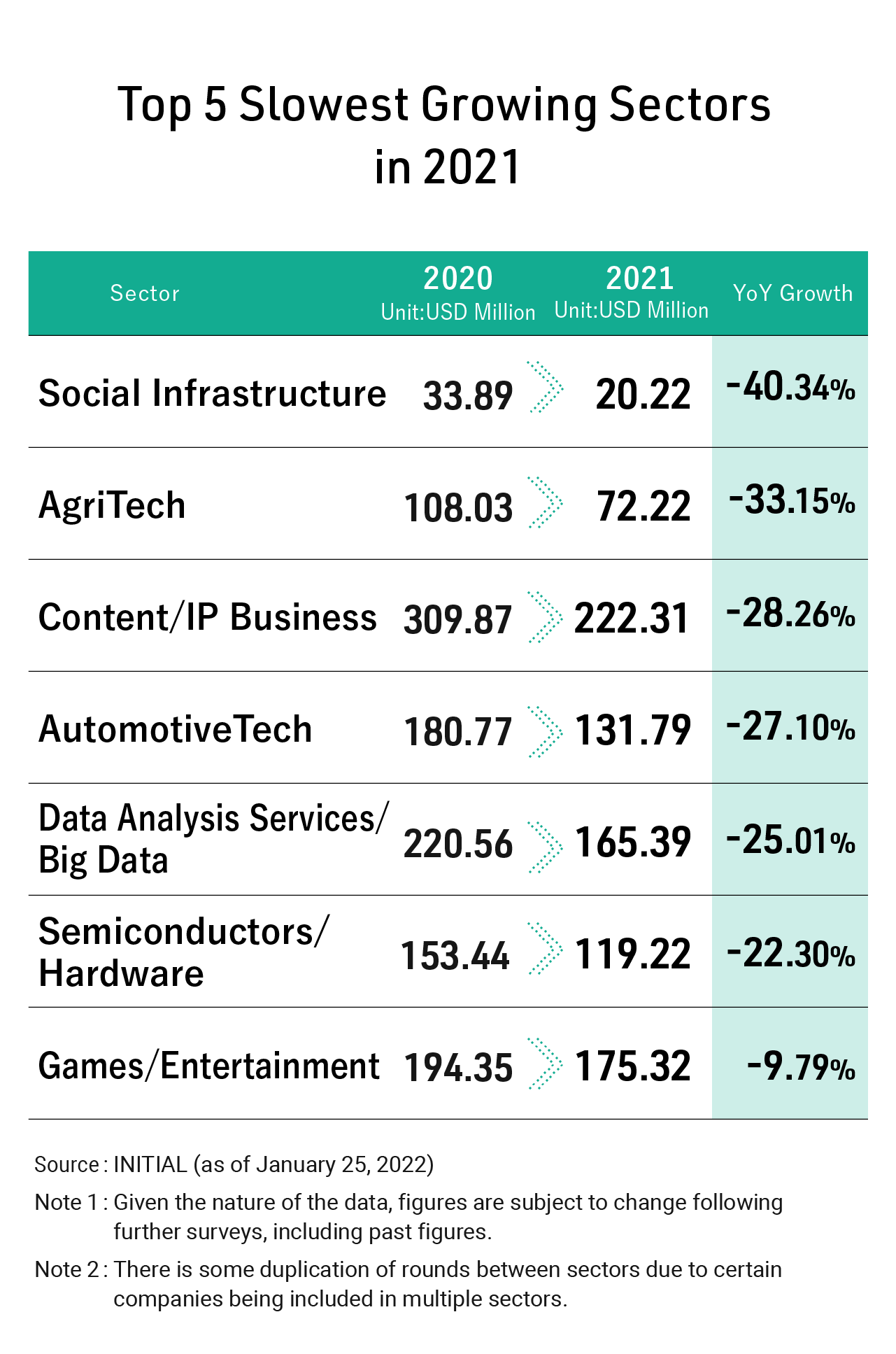

Now let’s take a look at the sectors that saw the slowest YoY growth.

In sectors where there are still only a few startups, such as Social Infrastructure and AutomotiveTech, the amount of funding raised in 2021 was sluggish.

The AgriTech sector is primarily home to early-stage startups and has the potential for significant growth going forward. The Content/Copyright Business sector, meanwhile, is seeing an increasing amount of seed and early-stage investment related to the creator economy, but there were no major rounds in 2021 and overall funding in the sector was weak. The Information Analysis Services/Big Data sector also saw sluggish funding in 2021 for the same reason.

The Exits

A large number of Japanese startups exited during 2021.

There were a total of 66 startup IPOs, 16 more than in 2020 and the highest number recorded over the last decade. M&As exits also broke records at 136, up from 82 in 2020.

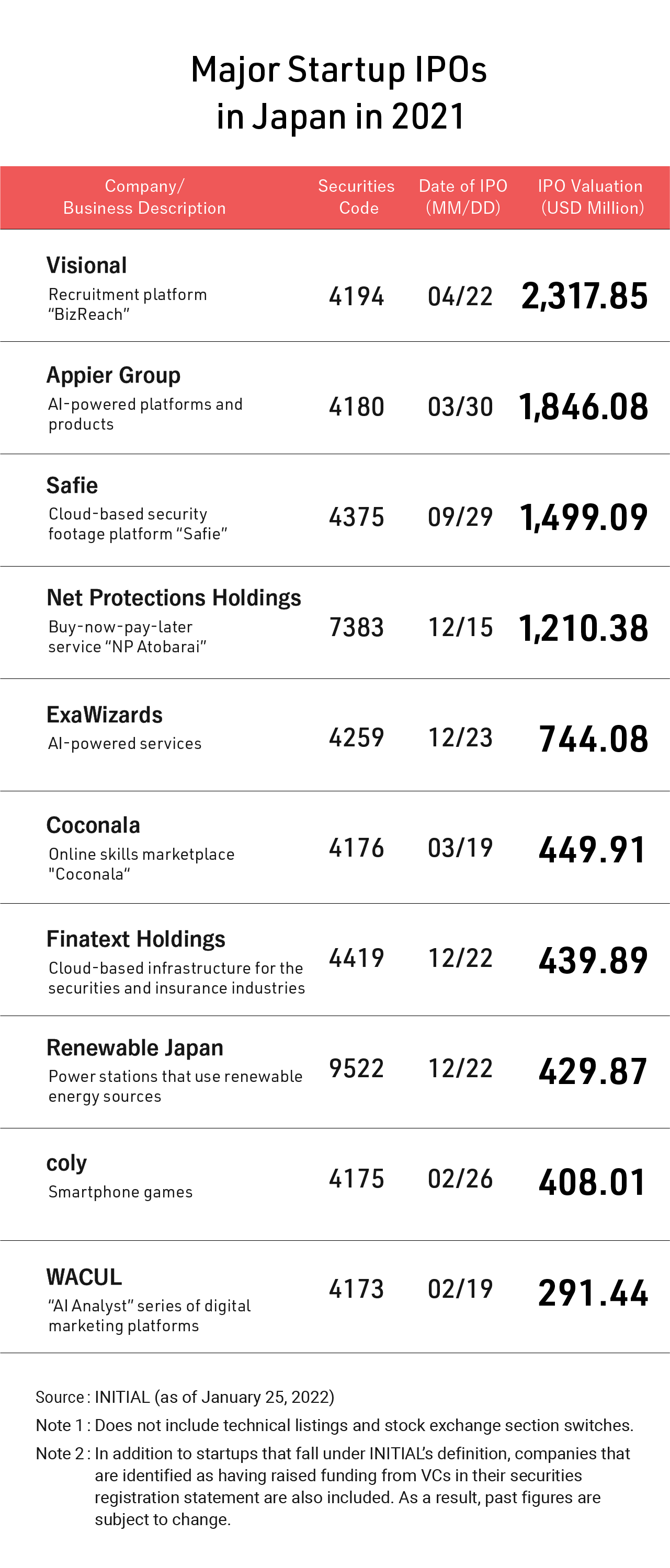

There were a number of large-scale startup IPOs in 2021, four of which resulted in post-IPO valuations of more than JPY 100 billion (USD 0.89 billion), with those of Visional and Appier Group both exceeding JPY 200 billion (USD 1.78 billion). A notable number of startups also made global offerings at the time of their IPOs.

There were also a large number of smaller IPOs, however, and the median post-IPO valuation fell by around 30% YoY to JPY 12.46 billion (USD 111.06 million). More than 30 companies (including non-startups) rushed to IPO in December 2021 as growth stocks faced strong headwinds, which led to a scattering of investments. As a result, a number of freshly-listed companies saw their initial post-IPO stock prices drop below their offering prices.

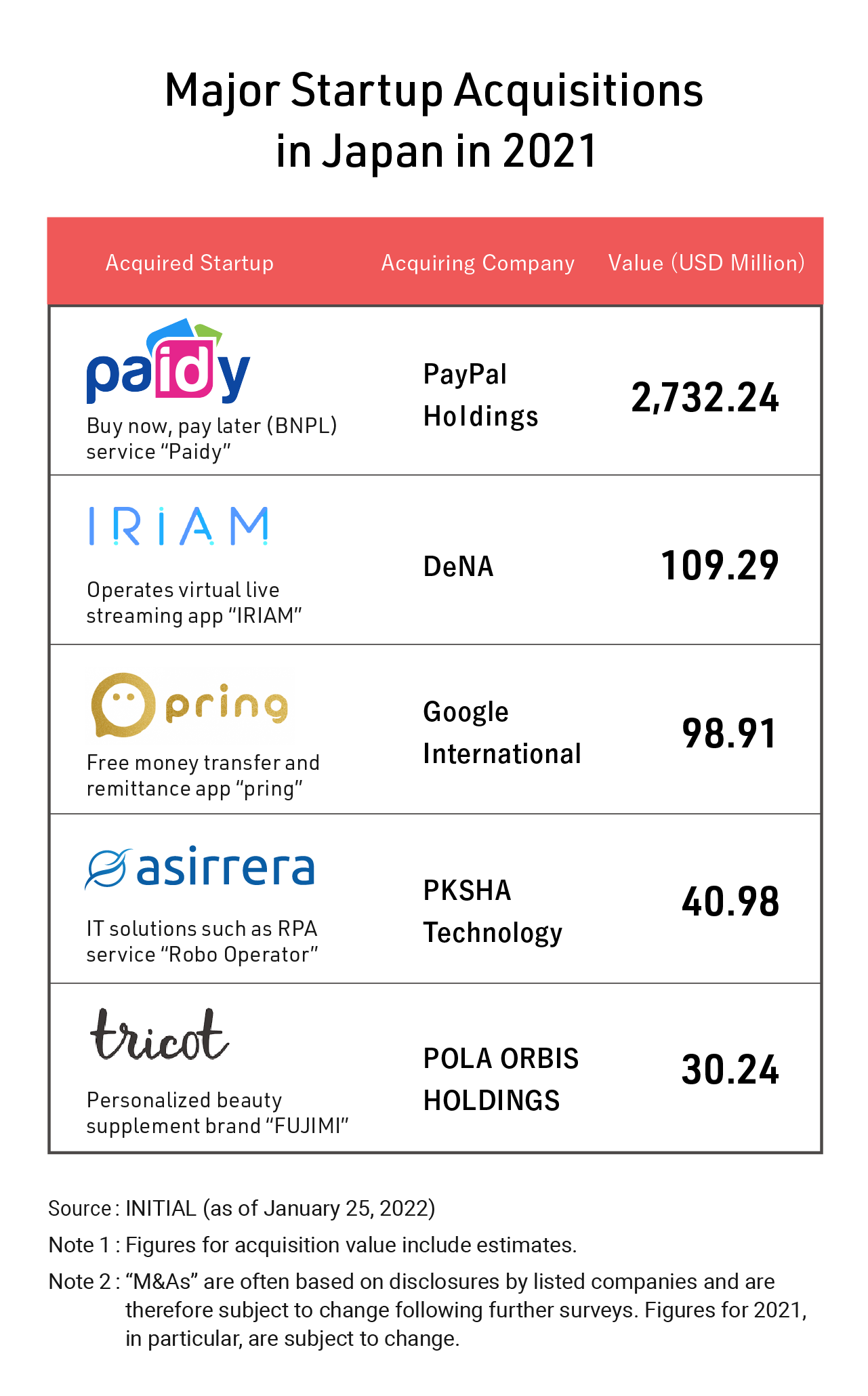

2021 was also a record year for startup acquisitions, with PayPal Holdings acquiring Paidy for an unprecedented JPY 300 billion (USD 2.73 billion). In addition, there were two other acquisitions valued at more than JPY 10 billion (USD 89.13 million).

While the median value of M&A deals in 2021 was JPY 680 million (USD 6.06 million) and IPOs remain the primary method used for startup exits, there are signs that the status quo is beginning to change as the presence of foreign capital in the Japanese market grows and more startups are acquired by large companies.

The Investors

So who is the driving force behind this upswing in startup investments? As in previous years, VCs continued to be the biggest investors in Japanese startups in 2021. VC funding jumped by around 80% YoY and accounted for 46% of total funding. Investments from general business corporations (non-financial sector) dropped YoY, although if equity transfers and M&As are included, the amount of funding here actually increased.

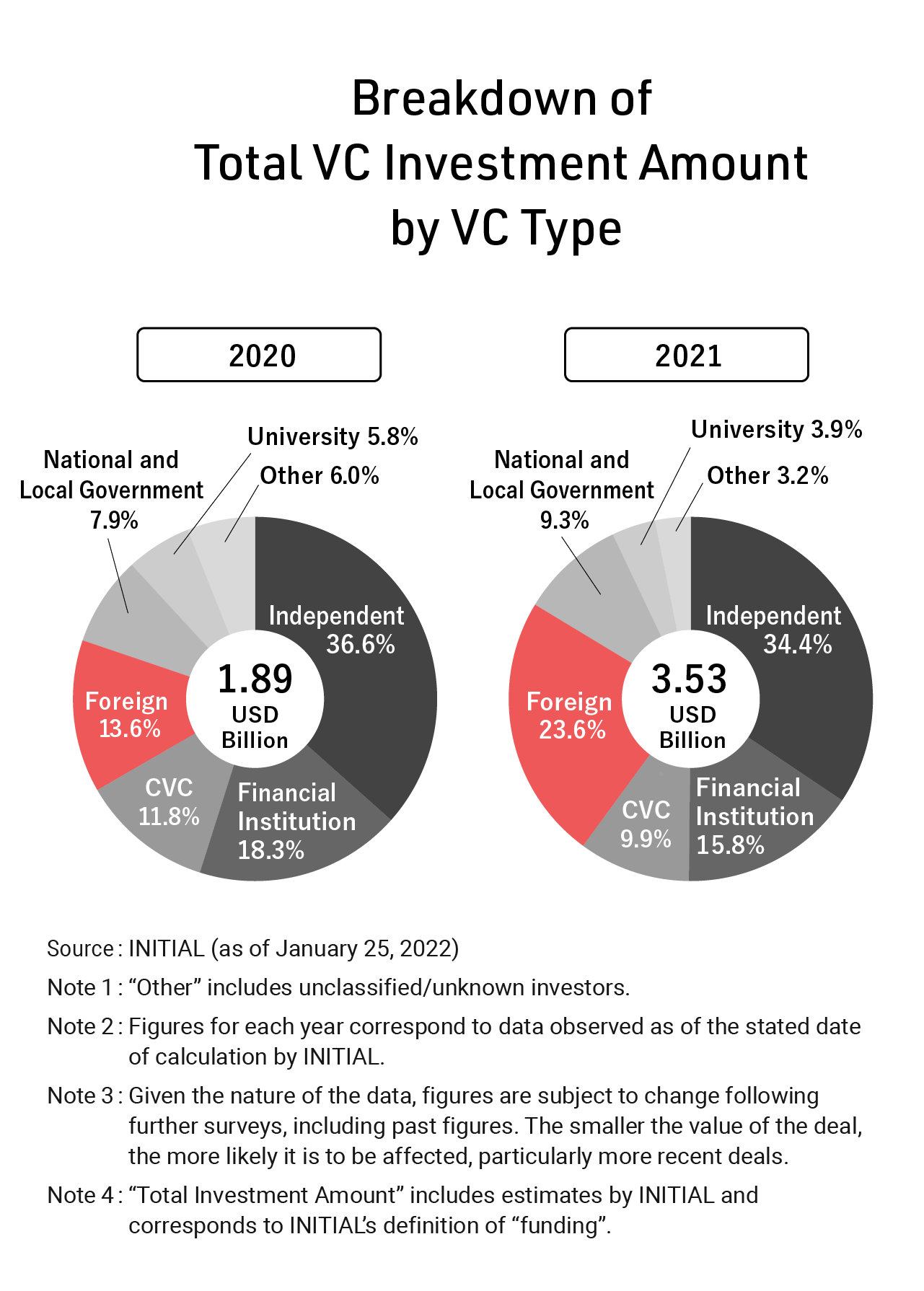

The below pie chart breaks down total VC funding in Japanese startups by VC type. A particularly notable trend here is the significant YoY growth of foreign VC (including PE) investment (red section) over 2020–21. Foreign VCs invested JPY 85.3 billion (USD 760.32 million) in 2021, 3.1 times more than in 2020, and accounted for 23.6% of all VC funding.

In fact, 70% of the top 20 Japanese startups in terms of funding received in 2021 have attracted foreign investors.

More and more foreign investors are also venturing into the Japanese startup market for the first time. In 2021, these included Princeville Capital (SmartNews) and Whale Rock Capital Management (SmartHR). Atonarp, CADDi, and Astroscale Holdings have also received funding from first-time foreign investors. Monetary easing policies in the US, combined with the efforts of Japanese startups, are both contributing to this rising foreign interest in Japan.

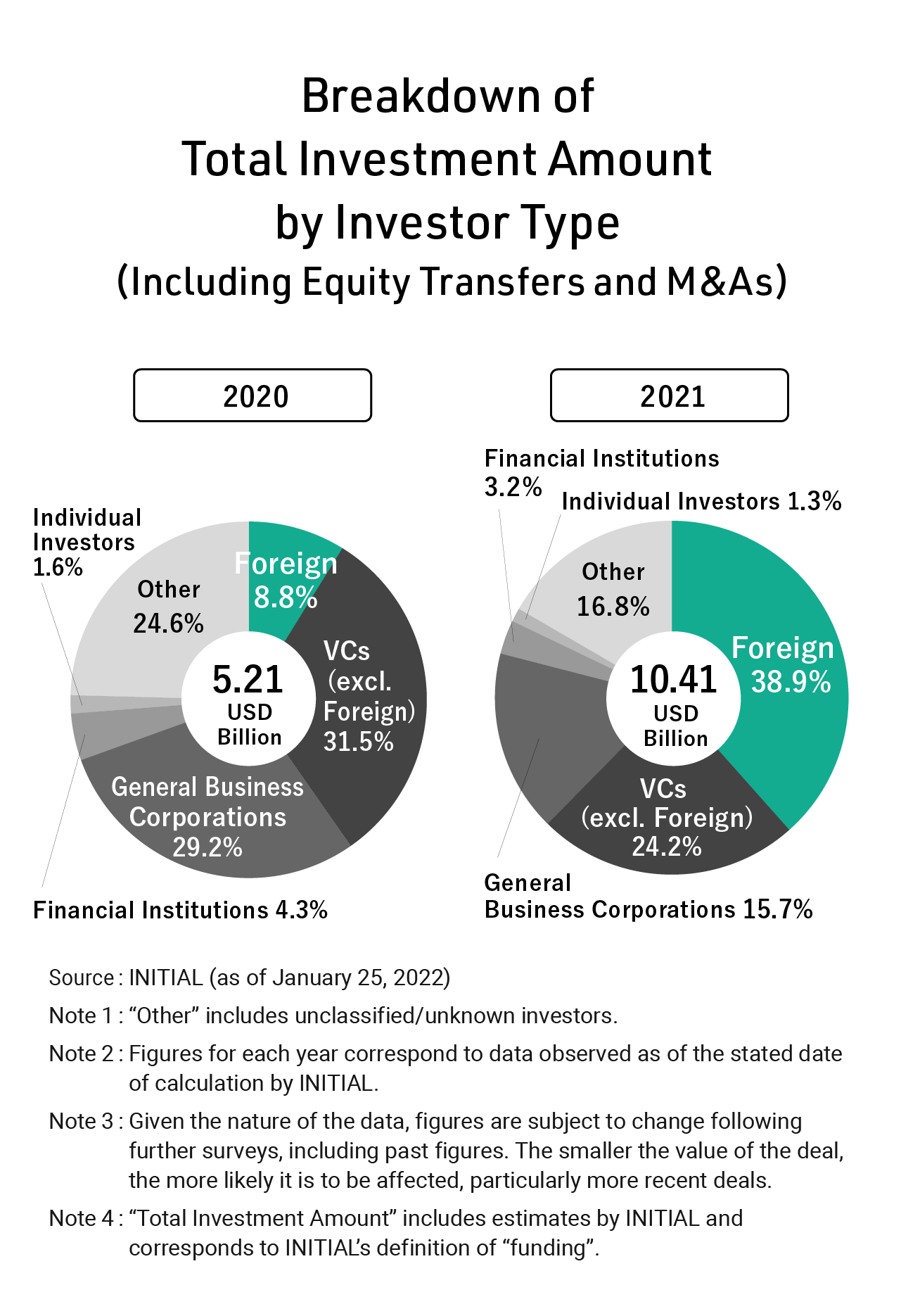

Total investment in Japanese startups, which includes not only investment from foreign VCs, but also equity transfers and M&As, broke through the JPY 1 trillion (USD 9.11 billion) mark in 2021 to stand at JPY 1.2 trillion (USD 10.70 billion). Given that the value of M&A deals is often undisclosed, it should be noted that the actual figure is almost certainly higher.

While PayPal’s enormous acquisition of Paidy definitely helped boost the total share, we estimate that 40% of capital flowing into Japanese startups in 2021 was from outside Japan.

In Conclusion

2021 ended with a roar, and records were once again shattered in Japan’s startup funding scene. Many promising startups raised a significant amount of capital, and there was strong support from foreign investors.

Japanese startups had to learn how to do a lot of things, including proper communication with foreign investors—this was seen in 2020. The robust funding attracted by companies in 2021 will likely drive the continued expansion of Japan’s startup ecosystem going forward.

Meanwhile, in the global market, British online payments provider Checkout.com raised USD 1 billion in January 2022, raising its market cap to around USD 40 billion. Going forward, funding will likely continue to be concentrated around top-tier startups.

Nevertheless, the US Federal Reserve tightened its monetary policy in early 2022, putting the brakes on the country’s long-running bull market, with the same effect being seen in the Japanese stock market.

It should thus be understood that these unfavourable conditions in public markets could push investors to adopt a more cautious approach to startup investment, given that IPOs remain the main method of exit. Investors could become more selective in the startups they choose to fund, and the gap between the top-funded companies and the rest may widen as a result.

This should not, however, deflect attention from the many exciting developments taking place in Japan’s startup scene. For example, there has been a relative uptick in the number of R&D startups raising funding, and they are continuing to exhibit steady growth. This is on the back of the rising numbers of both university funds, as well as funds that are actively investing in R&D such as the Real Tech Fund and Mirai Creation Fund.

The success of these R&D startups could lead to the formation of a virtuous circle and drive further investment into Japanese R&D startups in future.

This Report’s Scope

This report is a summary of INITIAL’s full "Japan Startup Funding 2021", a more comprehensive report on Japanese startup funding information (currently available in Japanese only).

INITIAL’s Definition of “Startups”

- Private companies in Japan (including domestic companies started by foreigners and overseas companies started by Japanese nationals).

- Companies that possess unique technologies, products/services, or business models, and are investing in the growth and expansion of their own business.

- Companies that are challenging the existing way of life in an attempt to bring about a new change, be it in terms of general lifestyle, society, economic models, or technology.

- Other companies that INITIAL determined to be eligible.

Full Report Content (Japanese Only)

Author: Atsuko Mori

Editor: Takenori Osake

Design: Eri Ishimaru, Jun Shimada

Research: Takeshi Fukui, Kana Akashi

English Version: Luke O’Donovan, Victor Makhnutin

---

In Conversation with the JVCA

2022 a Critical Juncture Following Investment Boom in 2021

As part of this year’s Japan Startup Funding Report, INITIAL sat down with Tohru Akaura and Shinzo Nakano, co-chairmen of the Japan Venture Capital Association (JVCA), to discuss startup funding trends in Japan in 2021, as well as their thoughts on what lies ahead. Two of the leading names in Japan’s VC domain for many years now, Tohru and Shinzo provide us with their assessment of the current startup landscape.

Interview & Text by Atsuko Mori Edited by Kaori Nakamura Design by Harumi Asano

Tohru Akaura: JVCA Chairman

Tohru founded Incubate Capital Partners, a VC firm specialising in seed-stage investments, in 1999, and the Incubate Fund, which he continues to operate today, in 2010. Throughout his career, he has established funds worth a total of more than JPY 80 billion and has consistently engaged in seed-stage focused investment and incubation. A councilor for the Information-Technology Promotion Agency, Japan from 2003 to 2008, he was appointed as a Director of the JVCA in July 2013, Managing Director in July 2015, and Vice-Chairman in July 2017. He assumed his current position of Chairman in 2019. Tohru has been involved in the IPOs of 17 companies, including Cybozu, S-Pool, Carta Holdings, Media Do, Ceres, Aiming, Double Standard, Sansan, and Toyokumo. He has also worked as an external reviewer as part of the Ministry of Economy, Trade, and Industry’s project for supporting the utilization of research results in business, as a member of the Advisory Board for the Cabinet Secretariat’s “Venture Challenge 2020”, and as a Recommender for the Ministry of Economy, Trade and Industry’s J-Startup, an initiative that concentrates both public and private resources to support startups with the highest potential.

Shinzo Nakano:JVCA Chairman

After joining ITOCHU Corporation in 1989, Shinzo became involved in startup investment at ITOCHU Technology (Silicon Valley) in the early 1990s. He established close relationships with leading Silicon Valley VCs, laying the foundations for the ITOCHU Group's startup investment business, ITOCHU Technology Ventures, which was founded in 2000. As a partner, he invests in and provides hands-on support to startups. In 2012, he was appointed General Manager of the Information & Communication Technology (ICT) Division of ITOCHU Corporation. In 2015, he became the President and CEO of ITOCHU Technology Ventures, as well as being appointed as a board member of the JVCA. He was subsequently appointed as Vice-Chairman in 2017 and assumed his current position of Chairman in 2019.

A Record-Breaking 2021

The amount of funding raised by Japanese startups in 2021 significantly increased YoY. How do you look back on the year?

Akaura: Well, 2021 was certainly a very good year for startup funding in Japan. We saw a record amount of funding raised, higher than even before the global financial crisis in 2008. This can be explained by the large number of foreign crossover investors entering the Japanese market. The amount raised per deal also increased, showing how strong Japanese startups continue to attract more and more investment.

Now, PayPal’s acquisition of Paidy was something entirely unexpected. A massive USD 2.7 billion non-IPO exit like that had quite a big impact on the market overall.

Nakano: For me, it was great to see big IPOs of companies that have spent a long time growing in the private market. This kind of growth trend bodes well for the future as the scale of an exit is obviously important. The more examples we see of this, the more startups will be established, and they will begin to attract better and better talent to work for them.

From a historical perspective, how has 2021 differed from previous years?

Nakano: Japan’s startup scene today is worlds apart from what it was like 20 years ago as the quality of Japanese startups has improved considerably. I think a key turning point was Mercari’s IPO in 2018. The fact that a Japanese startup went public for over JPY 100 billion—I think this was a watershed moment that helped raise the market as a whole to another level.

While the quality of a startup must, of course, be very high to achieve an exit of over JPY 100 billion, the influx of new, innovation-hungry talent and capital flowing into the private market rather than listed stocks are also important. We are now beginning to see salaries at startups exceeding those at large companies, which is driving more and more young people to join such startups.

Japan Still Behind the Rest of the World

Nakano: Despite this though, I think it’s important to remember that investment in startups also continues to accelerate globally.

Akaura: I agree. 2021 may have seen a boom in a Japanese market context, but if you pan out and take a look from a global perspective, the country is actually falling further behind. Startup investment in the US, for example, rose from USD 166.6 billion in 2020 to USD 329.6 billion in 2021 (as per Q4 2021 PitchBook-NVCA Venture Monitor). That’s an increase of around JPY 19 trillion in just one year.

Japan’s funding rose by just JPY 250 billion over the same year. For a market looking to create the next generation of industries, we’re talking about completely different scales here. Keep in mind that startup investment also saw a big jump in Europe and in other Asian countries in 2021.

Nakano: Globally, capital moves between geographical regions and sectors, but it’s the growth markets that attract investors. And Japan is not a growth market within Asia. We have to compete against China and India, who are actual growth markets. All of this means that we have to go an extra mile to reach out and attract investors to the country ourselves.

Akaura: I agree. The key here is global competitiveness. Yes, Japan has produced leading global players in areas like automobiles, wafers, capacitors, and motors—and yet, there are no leading Japanese IT companies on the world stage today. Not exactly the type of situation where we should just be happy with the current level of funding, I would say.

Deep Tech an Opportunity to Attract Global Attention

What business domains do you think global Japanese startups will emerge in?

Akaura: I think Japanese companies need to focus on creating industries that tap into paradigm shifts in the world over the next 30 years. Over the last 30 years, Japan has been hugely successful in automobiles and electronics. The next 30 years, though, will be the age of IT—and yet, the country has sadly not been able to keep up with the information revolution. I don’t think SaaS can be counted as a win in this context, because the country has so far not produced any globally competitive SaaS services.

Some of the major challenges facing the modern world include climate change and decarbonization, and new business opportunities are emerging in these areas. Looking at decarbonization, I think hydrogen technology, nuclear fusion, and non-silicon, high-efficiency semiconductors are areas where Japanese companies can find success. There is a company in Japan, for example, that holds around 70% of the patents for next-generation semiconductors. There are also innovative technologies originating in Japan, such as perovskite solar cells. These areas represent huge business opportunities, and I think that IP and patent strategies will hold the key to unlocking them.

Nakano: I believe that Deep Tech, including advanced materials, is an area in which Japan can go global. It’s about seriously investing in projects originating from research institutes and academia. So far, Japanese SaaS companies have been able to attract foreign funding because there are quantifiable metrics, and it is easier for investors abroad to make side-by-side comparisons and understand the services they offer. However, there are doubts about how serious many of these investors are about global expansion strategies for Japanese SaaS.

That said, while they may not be able to compete globally, the slow progress of digitalization in Japan means that demand for Japanese IT software solutions does remain strong in the domestic market.

What can take Japan to that next level?

Akaura: In the Deep Tech domain, US company SpaceX, which is still private but said to be valued at over JPY 10 trillion, has already confirmed orders from government-run NASA, helping it to generate key initial sales.

VC funds are rapidly growing in scale, but when it comes to decarbonization, funds worth JPY 10 billion or even JPY 1 trillion may not be enough. That is why I think collaboration and business with government bodies will be very important for growth.

Japan’s new Prime Minister Fumio Kishida has positioned 2022 as “the first year for actively fostering the founding of startups”. He’s set on strengthening public-private partnerships for Deep Tech and, in turn, boosting the amount of funding being raised in this area.

Normalization of Growth Curve in 2022

Do you have a positive or negative outlook for Japan’s startup funding environment in 2022?

Akaura: Positive. At least, I want to be positive. I’m aware that many people predict a slowdown at some point this year in the face of the US Federal Reserve’s continued tightening of their monetary policy. But concerns in Japan over the supply of risk capital are seeing institutional investors increasingly turn to VC, including public-private funds.

Japan’s Government Pension Investment Fund (GPIF) has also selected a new investment advisory firm, as well as a gatekeeper, for its alternative investments and looks set to finally begin investing in the VC asset class.

I think that this year will see a range of measures implemented, and that these will be successful and help the market overcome any headwinds. I hope to see cooperation on policy in particular. Not just subsidies for Deep Tech startups, but also concrete measures to boost actual topline growth. These will serve as examples of winning strategies that will further accelerate market momentum.

Nakano: The impact of such monetary tightening on startup markets in the US and China is fundamentally different to the market in Japan. They have already gone through a bubble and matured as markets. Japan, meanwhile, has never really seen strong VC funding, and its startup scene has always lagged behind as a result.

Part of the overall growth in funding is driven by investments from corporations, and Japan is now finally starting to see capital flow from foreign corporations. The startup industry as a whole has developed to the point where institutional investors are gradually starting to recognize the value of investing in startups. I think Japan is only now on the verge of real growth.

Having said that, the extent to which monetary tightening in the US will affect Japan's startups remains to be seen. But, even if it does have an impact, the market is unlikely to flounder as a result. I think US Federal Reserve policy could result in a normalization of the base growth curve, removing any outliers. Actually, that curve could actually show even quicker growth on the back of government and domestic institutional funding.

JVCA

The Japan Venture Capital Association (JVCA) is an organization dedicated to supporting the establishment, growth, and further development of promising startup companies in Japan. Since its launch in November 2002, the JVCA has worked towards its objective of strengthening mutual cooperation among VCs and cultivating a VC ecosystem. The Association, which is made up of VCs and CVCs, has 214 members. This figure increases to 284 if supporting members from other industries are also included.