As startups around the world felt the chill of venture capital pullbacks with the arrival of VC winter in 2022, startups in Japan, meanwhile, attracted more funding than ever before.

While this is certainly good news, it remains much too early to assume that Japan alone has somehow been spared the fate of other markets. In fact, a closer look at the year’s deals and the current state of IPOs in the country reveals a number of causes for concern.

“Japan Startup Funding” is a report detailing investment trends involving Japanese startups that is independently researched and published twice a year by INITIAL, a leading platform for startup information in Japan. This is an English version of the preliminary report prepared as a summary of INITIAL’s full “Japan Startup Funding” report for 2022 (available in Japanese only).

CONTENTS

- Trillion-Yen Milestone in Sight

- Tough Climate for Later-Stage Startups

- Early-Stage Deals Heating Up

- Foreign Funding Freeze Impacting Late-Stage Investments

- Series A Startups Attract Major Funding

- VC Winter Puts IPOs on Ice

- M&As Continue to Play Minor Role

- Feast-or-Famine Division Emerging Among Funds

- As Market Turns Bearish, Investors Search for "Real Deal" Startups

- 2022: Another Record Year for Startup Funding in Japan

Trillion-Yen Milestone in Sight

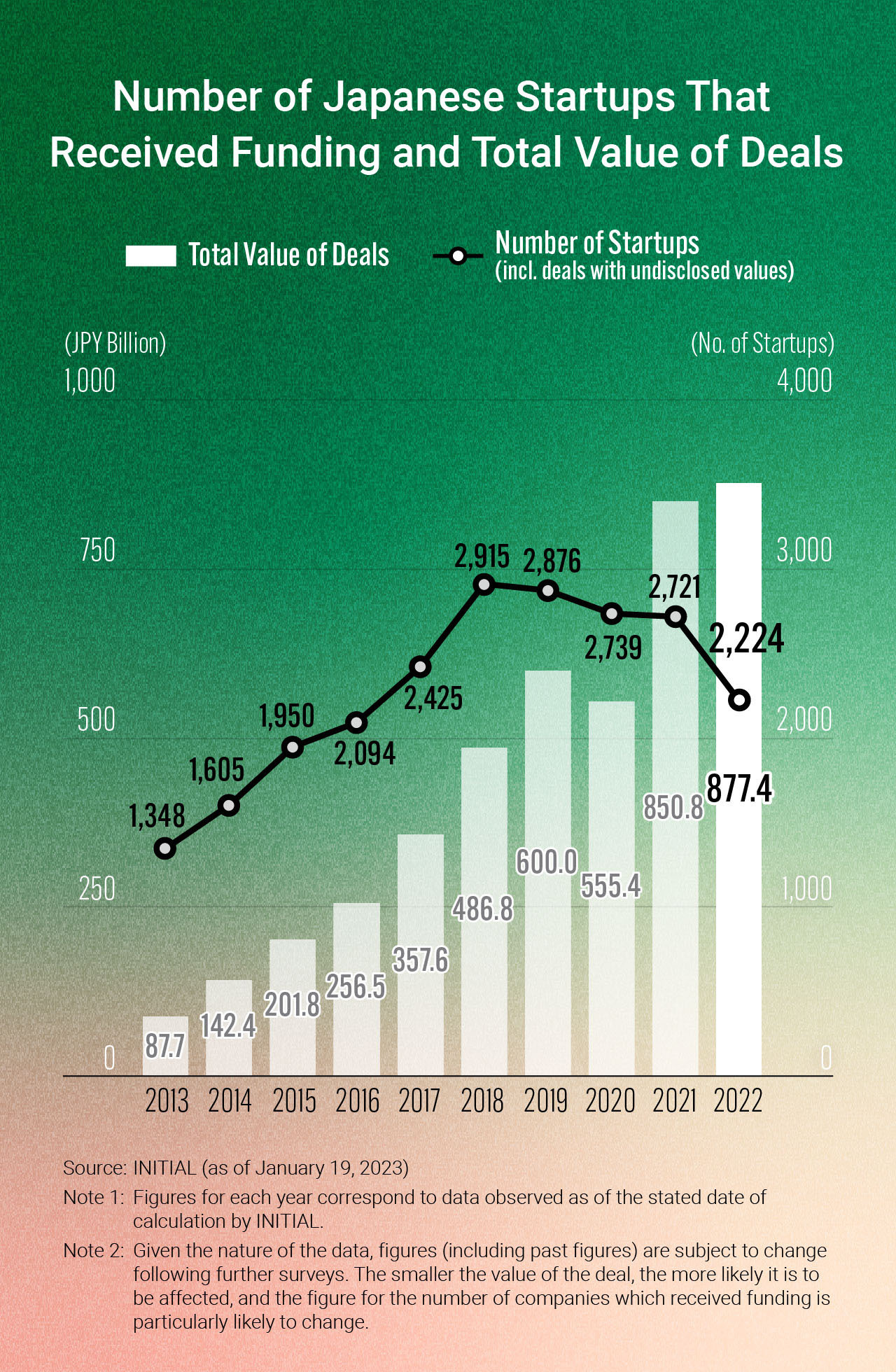

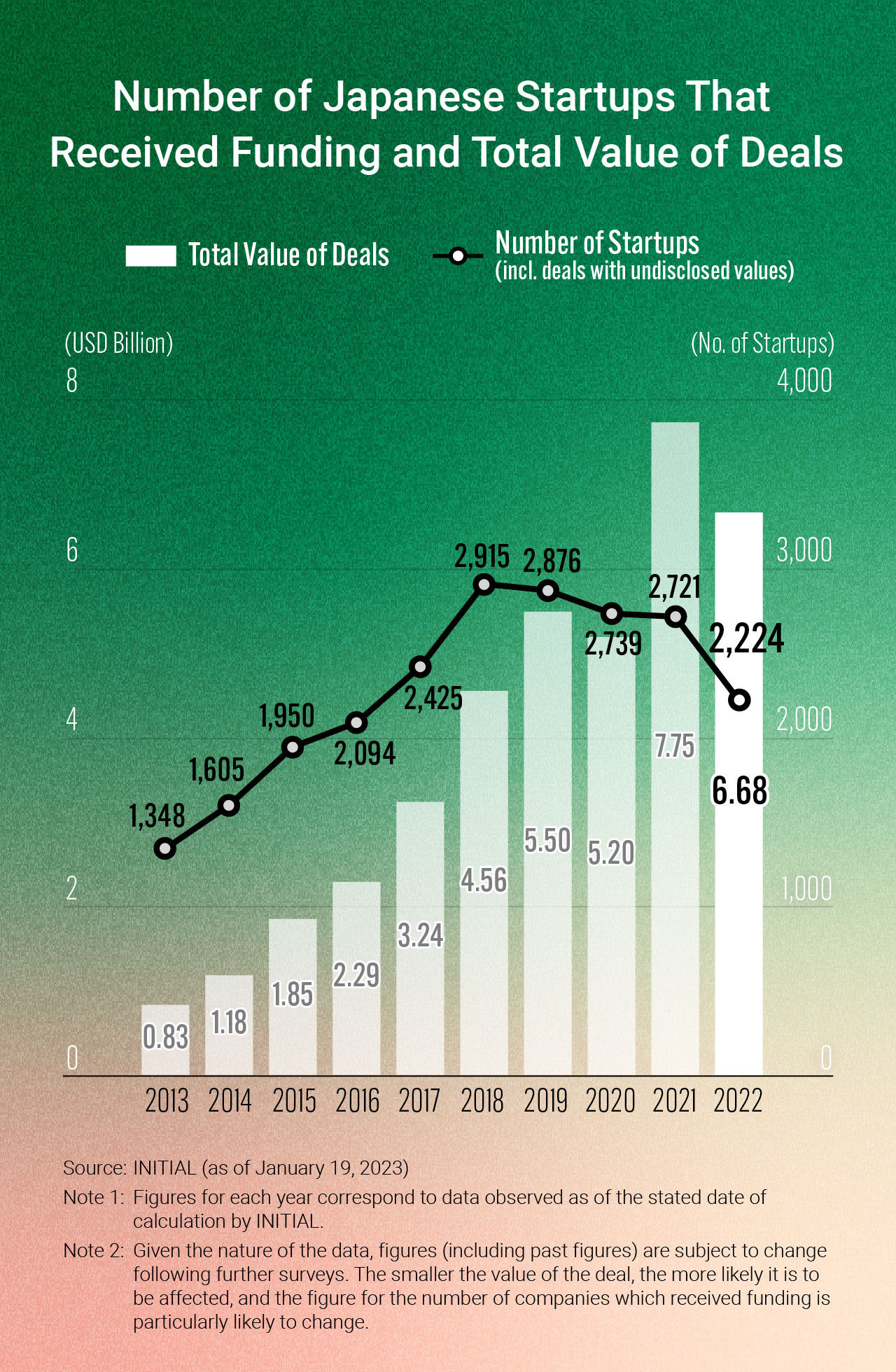

Startups in Japan raised a record JPY 877.4 billion in 2022, surpassing the previous record of JPY 850.8 billion set in 2021 and bringing the industry that much closer to reaching the trillion-yen milestone.

The performance of the Japanese startup ecosystem in 2022 is even more striking, however, considering that the amount of funding raised by startups in the US and Europe declined over the same period, with startups in each market reporting just USD 238.3 billion (-30% YoY) and EUR 91.6 billion (-16% YoY), respectively, in terms of investments received.

Editor’s Note: While overall investment increased YoY on a JPY basis, converting amounts to USD actually results in a YoY decline in total value due to the significantly devalued yen. For reference, see the appendix at the end of this report for a chart illustrating this trend in USD.

Tough Climate for Later-Stage Startups

Of course, by no means does this imply that all startups in Japan enjoyed the same degree of success.

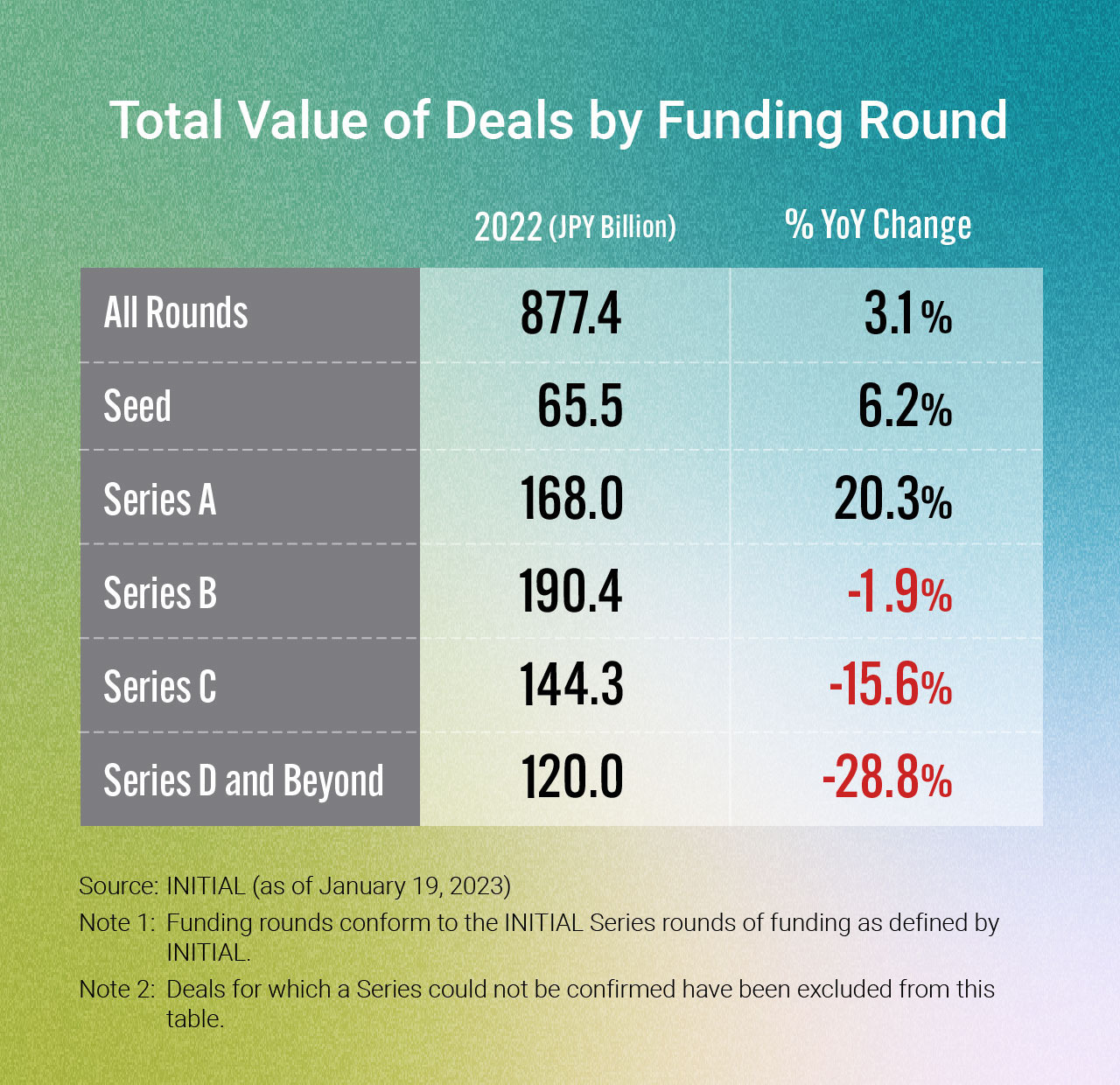

The largest beneficiaries of the industry’s performance in 2022 were early-stage startups, particularly those seeking to raise capital in seed-stage and Series A funding rounds.

SpaceData, a Japanese startup developing AI capable of generating an exact replica of the Earth in a virtual space (i.e., a “digital twin”) using satellite data and 3D-CGI technology, secured JPY 1.4 billion in funding—the company’s first injection of external capital since its founding six years ago.

Meanwhile, developer of fully autonomous electric vehicles Turing was quick to attract investment of JPY 1 billion, less than one year after its founding in August 2021.

At the same time, the climate in Japan has been tough for later-stage startups (i.e., more mature companies that are closer to preparing for an IPO). Companies seeking funding in Series D rounds and beyond had an especially hard time, with the total value of such deals falling by nearly 30% YoY in 2022.

Early-Stage Deals Heating Up

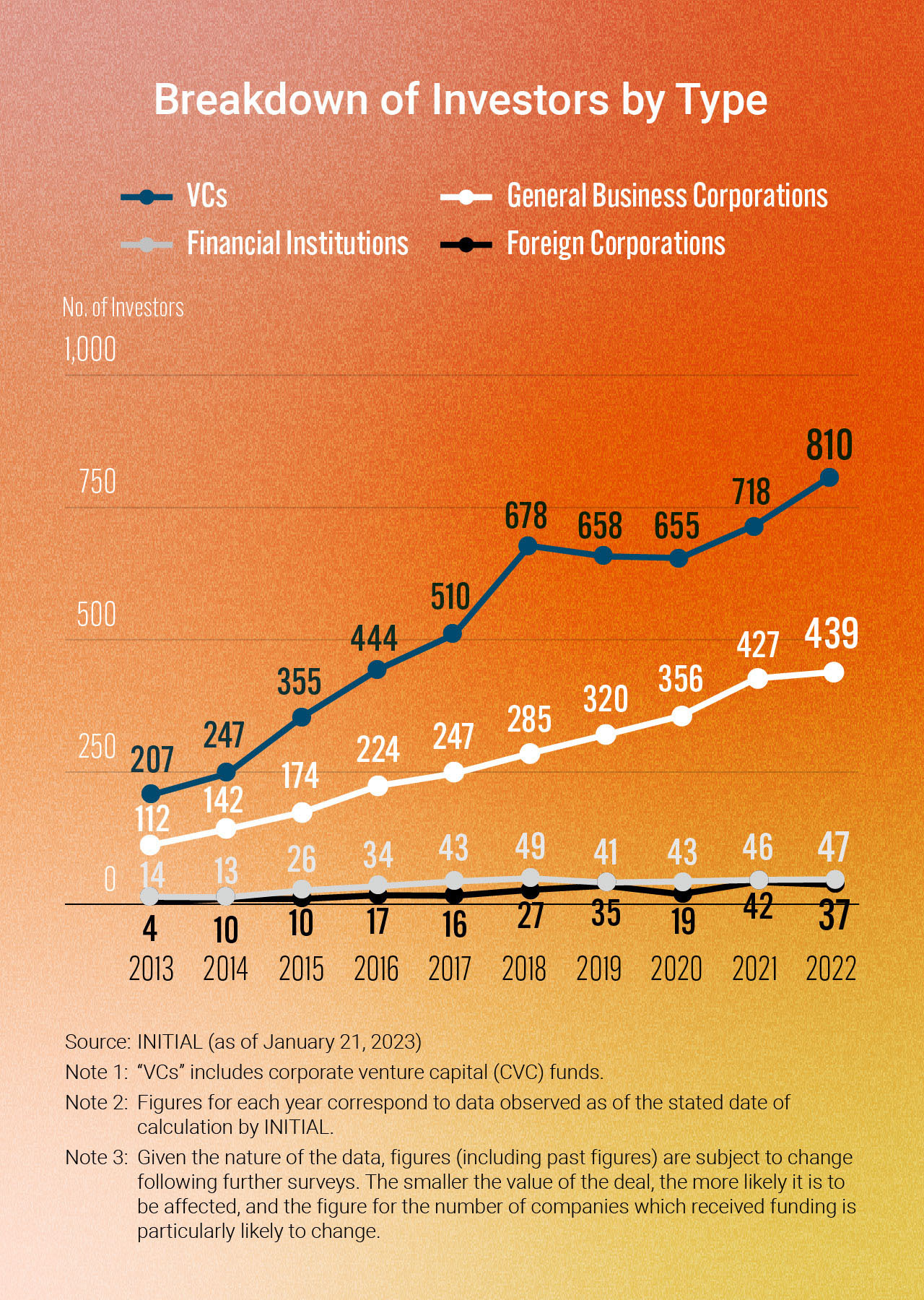

Early-stage startups in Japan have also benefited from the influx of newly-formed domestic VC funds in recent years.

In fact, the number of VC funds investing in Japanese startups has grown by nearly 40% over the last three years. Given that they are generally smaller in scale, these emerging funds tend to focus their investments on startups in the early stages of development.

Another factor at play is the inflow of investment to early-stage startups from investors that typically target companies in the later stages of development, given the challenges faced by such companies in 2022.

All of this has created a situation where VCs are likely to continue reaching beyond their usual targets in search of better returns. Early-stage investor DNX Ventures is a prime example of this: according to its Managing Partner and Head of Japan, Akira Kurabayashi, the fund took note of the declining interest of investors in mid-to-later stage startups and is now open to the idea of investing in them as well, provided that it can acquire a sufficient equity stake.

Foreign Funding Freeze Impacting Late-Stage Investments

While early-stage startups have enjoyed the backing of these newly formed domestic VCs, it is later-stage startups in Japan that have borne the brunt of the freeze on funding from foreign investors.

In fact, the total number of Japanese startups receiving investment from foreign VCs declined by 10% in 2022, while the total amount of funding similarly fell by JPY 81.6 billion, a decrease of 13% YoY.

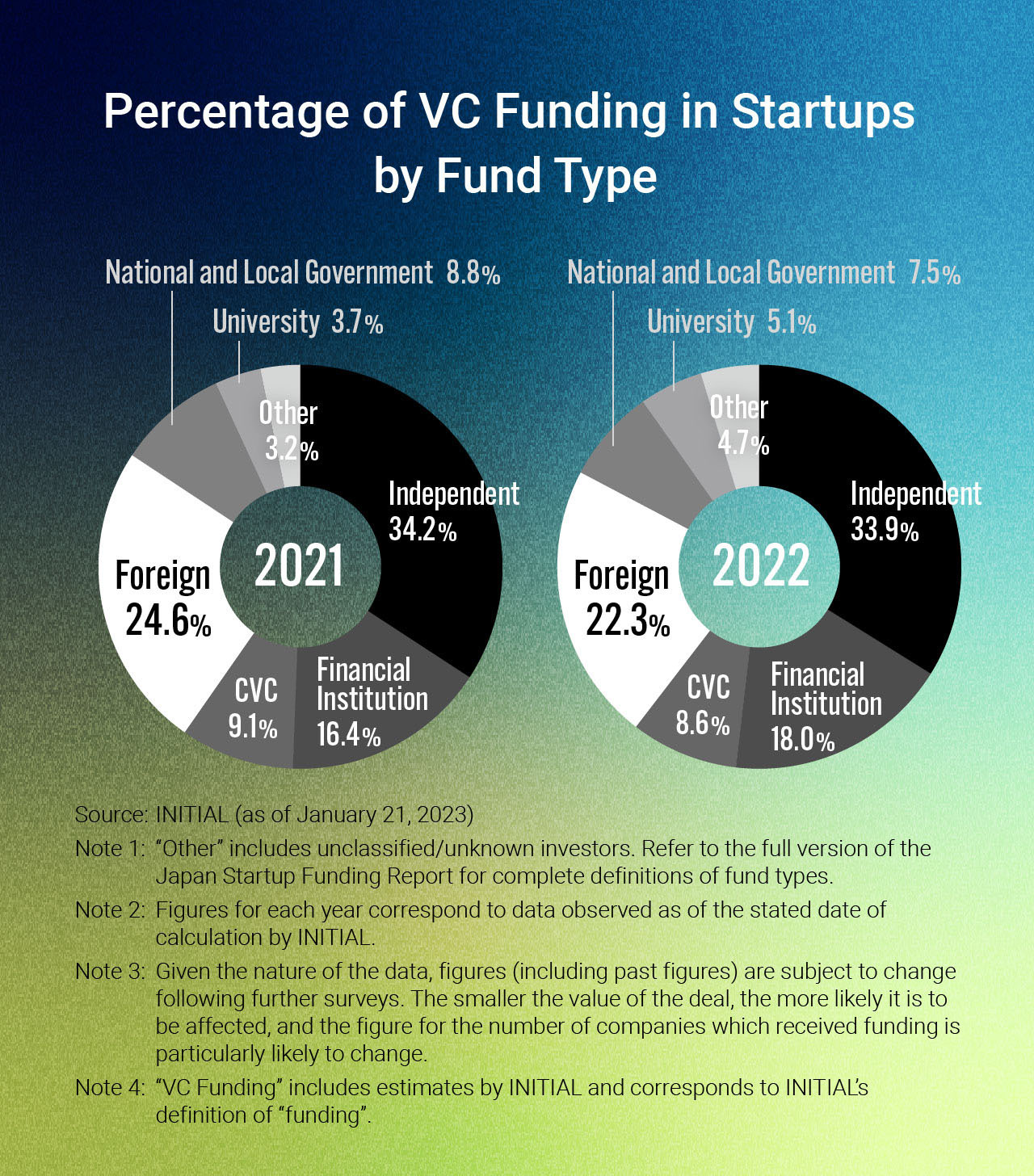

A breakdown of total VC investment by fund type in 2022 reveals that the share of funding from foreign VCs dipped by 2.3 percentage points YoY to 22.3%.

What’s symbolic here is the sentiment among crossover investors—those who invest in both startups that are about to go public as well as those that already have. Despite driving large funding rounds for the likes of SmartHR and SmartNews in 2021, these investors remained largely dormant in 2022. This likely stems from the comparative lack of incentives for taking gambles on high-risk startups as the price of publicly traded stocks declined.

Series A Startups Attract Major Funding

Unlike 2021 when the top spots on the ranking of most-funded startups were occupied by later-stage startups including SmartNews (Series F), 2022 managed to break their dominance as startups in Series A funding rounds also rose to the top, as exemplified by Web3 trailblazer Animoca Brands.

In general, startups in the middle-to-later stages of development have been struggling to attract funding in Japan as of late—with the exception of those that can clearly demonstrate significant growth potential to investors. One such successful example was Kakehashi, a developer of software and support systems for pharmacies, which impressed investors by consistently expanding its user base by 107 pharmacies per month while also maintaining a retention rate of over 99%.

According to JAFCO Group Principal Tatsuya Nagaoka, “Before 2022, all a mid-to-later stage startup needed to land a big round of funding was to have at least three KPIs or any other numbers demonstrating clear growth. In 2022, though, it felt like companies needed twice that.”

Given these circumstances, it appears the startup industry is in for even more selectivity from investors going forward.

While not included in the totals for the above rankings, the increased prevalence of debt financing was another unique feature of the Japanese startup ecosystem in 2022.

Examples of this kind of deal include Timee, a developer of an on-demand staffing platform for matching seekers of short-term work with employers seeking immediate help, and UPSIDER, a provider of corporate credit cards and other payment solutions to startups, which announced successful funding rounds of JPY 18.3 billion and JPY 57 billion, respectively.

“More and more startups in Japan are coming to the realization that it’s sometimes better to take on debt to secure capital rather than surrender a percentage of ownership under unfavorable conditions,” remarked Minoru Imano (Managing Partner at Globis Capital Partners) on this phenomenon.

VC Winter Puts IPOs on Ice

At the end of the day, the unfavorable conditions surrounding IPOs are to blame for the abrupt cooldown in funding for later-stage startups seen in 2022.

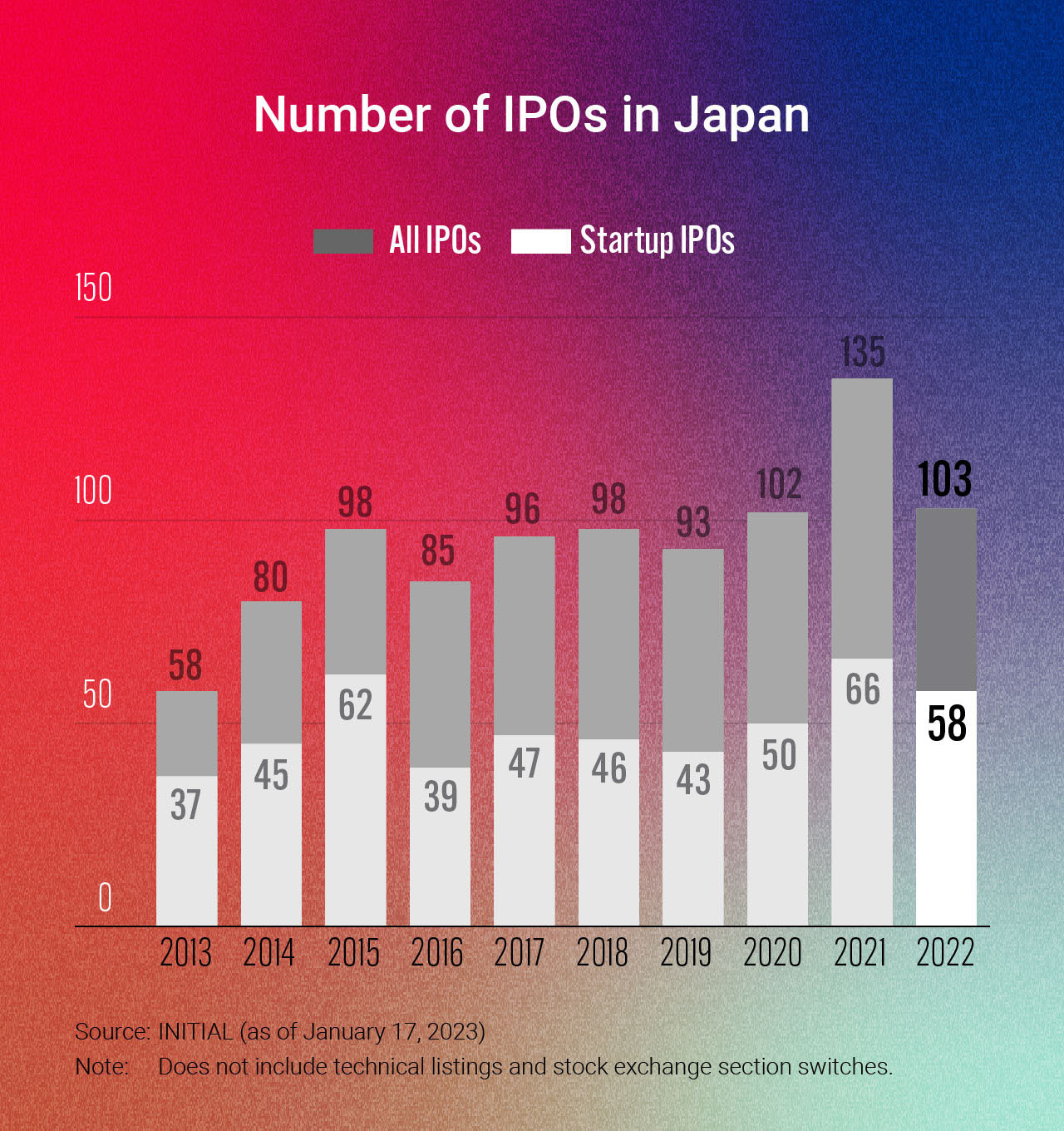

While the total number of IPOs in Japan dropped 12% YoY to 58 in 2022, this can be explained by the fact that 2021 simply saw an irregular abundance of IPOs. Taken in context, the 2022 figure is actually not that low compared to an average year.

What’s more alarming is the dramatic degree to which IPO conditions have worsened.

The median market capitalization at the time of IPO in 2022 stood at JPY 8.5 billion, falling below the JPY 10 billion line for the first time in six years. This has led to lower liquidity as institutional investors tend to avoid companies with an initial market cap of less than JPY 10 billion. This trend is likely to present a challenge for VCs and other investors that target pre-IPO startups as they look to secure returns on the open market after an investee goes public.

Late in the year, the industry also saw a string of down-round IPOs—public offerings of a company’s shares at a valuation lower than in its previous round of funding. Two startups that ultimately went public at a steeply discounted valuation were ELEMENTS, a Backend-as-a-Service (BaaS) provider of online identity verification services, and social publishing platform Note, both of which saw a price differential of more than 80%.

With IPO valuations falling this low, it is no surprise that more investors are having second thoughts when it comes to funding late-stage startups nearing public offerings.

M&As Continue to Play Minor Role

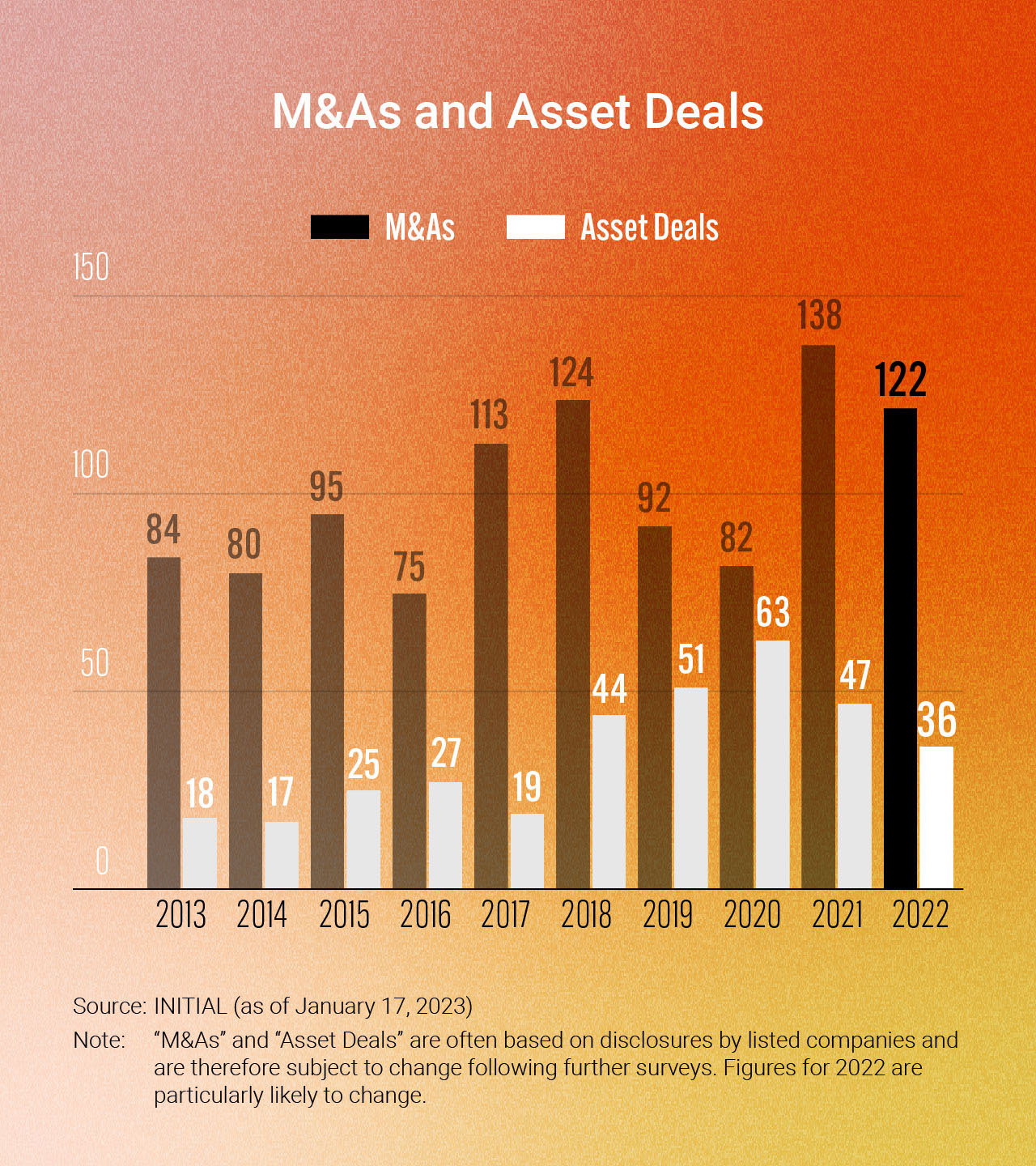

The number of mergers and acquisitions (M&As)—another common exit strategy for startup investors—once again remained low in 2022.

DeNA’s JPY 24.7 billion acquisition of Allm, a cloud-based communication platform for medical professionals, was the largest M&A deal of the year, trailing only the acquisitions of Paidy (2021), Treasure Data (2018), and gloops (2012) as the largest M&A deal with a confirmed value in Japanese startup history.

The total number of M&A deals in 2022, meanwhile, declined by just over 10% YoY to 122. Of all the startups involved in these deals, Allm was the only one to be acquired for more than JPY 10 billion.

Feast-or-Famine Division Emerging Among Funds

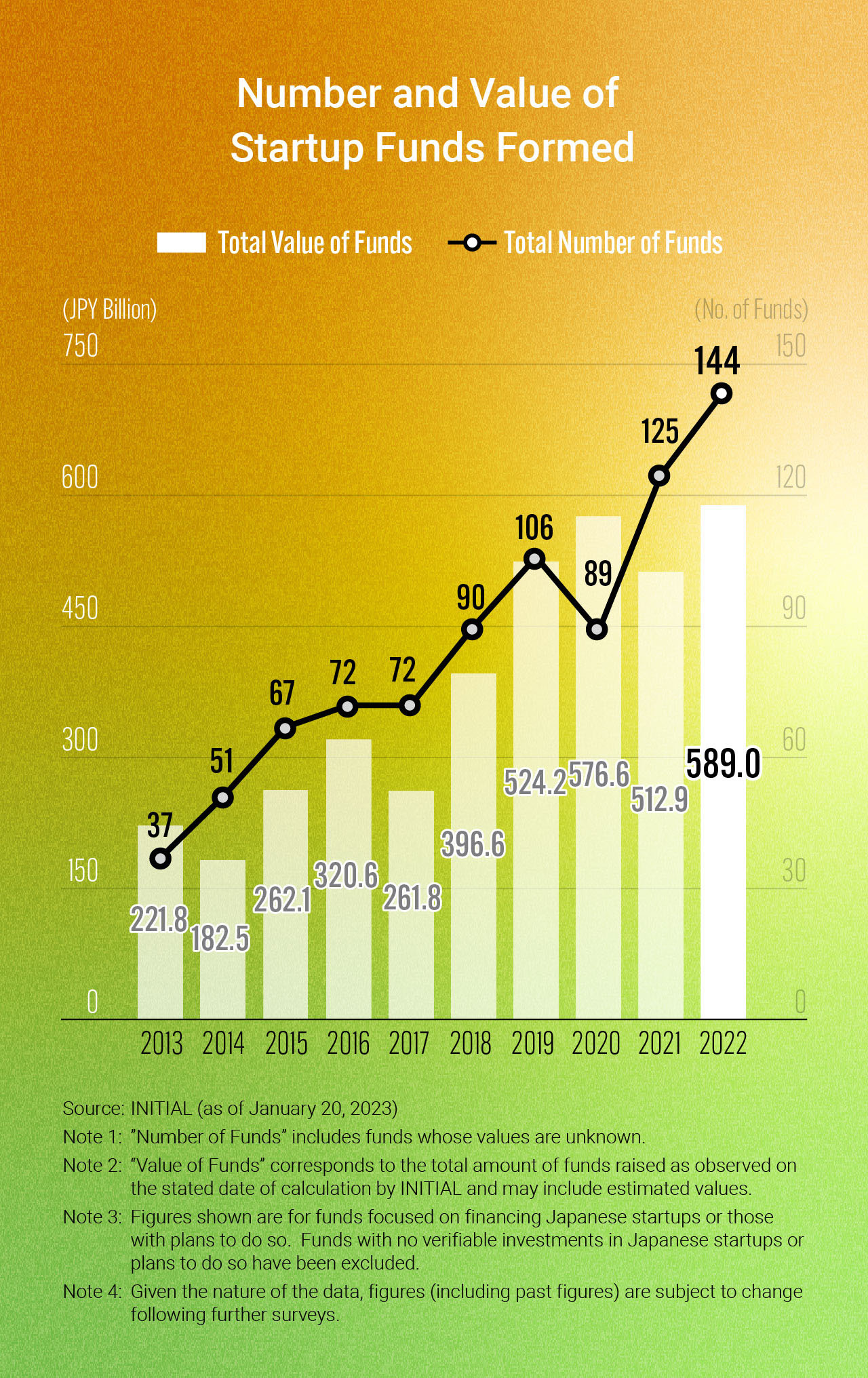

Given that 2022 surpassed 2021 in terms of both the combined value and the total number of new funds formed, it is safe to say that investors have a fair amount of dry powder on hand, and the investment climate is unlikely to feel any sudden chills.

At the same time, while the median value of a startup fund remained flat at JPY 3 billion the average value jumped by 45% YoY to JPY 8.66 billion in 2022, indicating that most new funds in Japan are being formed at opposite ends of the spectrum with either a very high value or a relatively low one.

The Japanese startup ecosystem saw the formation of 16 new startup funds with over JPY 10 billion in capital in 2022, the largest of which was the JIC Venture Growth Fund No. 2—a Japanese government-backed fund comprising JIC Venture Growth Investments (the venture capital arm of Japan Investment Corporation [JIC]) and the Development Bank of Japan.

Several prominent VCs such as Globis, JAFCO, and Eight Roads also launched major funds in 2022.

With stock prices remaining sluggish on the Growth Market of the Tokyo Stock Exchange, early 2023 has continued to present a challenging environment for startups looking to raise capital in Japan.

Help may be on the way, however, in the form of increased government support, with the current administration led by Prime Minister Fumio Kishida declaring 2022 to be the dawn of a new era for startup creation in Japan and establishing a new ministerial post overseeing the promotion of startups in the country.

In terms of more concrete actions, the government has announced a five-year plan and secured an unprecedented budget of JPY 1 trillion for fostering startups in 2022. Over the duration of this plan, the government aims to ratchet up the amount of investment in Japanese startups tenfold to JPY 10 trillion by FY2027, while simultaneously setting a target of overseeing the creation of 100 “unicorns” with a valuation of at least USD 1 billion in Japan.

The success of this plan is likely going to hinge on whether the startup industry in Japan can make the most of this opportunity at hand.

Interviews: Atsuko Mori, Shoko Hamada

Main Text: Atsuko Mori

Editing: Shoko Hamada

Design: Yurie Iwashiro, Takashi Yamaura

Research: Takeshi Fukui, Kana Akashi, Hiroshi Moro, Tomohiro Shindo, Misato Murakami

English Version: Cody Branscum, Viktor Makhnutin

APPENDIX

Editor’s Note: As mentioned earlier in the report, while overall investment increased YoY on a JPY basis, converting amounts to USD actually results in a YoY decline in total value due to the significantly devalued yen. For reference, see the below graph illustrating this trend in USD.

In Conversation with the JVCA

As Market Turns Bearish, Investors Search for "Real Deal" Startups

As part of this year’s Japan Startup Funding Report, INITIAL sat down with Tohru Akaura and Shinzo Nakano, co-chairmen of the Japan Venture Capital Association (JVCA), to discuss startup funding trends in Japan in 2022, as well as their thoughts on what lies ahead. As two of the leading names in Japan’s VC domain, Akaura and Nakano provide us with their assessment of the current startup landscape.

Shinzo Nakano: JVCA Co-Chairman

After joining ITOCHU Corporation in 1989, Nakano became involved in startup investment at ITOCHU Technology (Silicon Valley) in the early 1990s. He established close relationships with leading Silicon Valley VCs, laying the foundations for the ITOCHU Group's startup investment business, ITOCHU Technology Ventures, which was founded in 2000. As a partner, he invests in and provides hands-on support to startups. In 2012, he was appointed General Manager of the Information & Communication Technology (ICT) Division of ITOCHU Corporation. In 2015, he became the President and CEO of ITOCHU Technology Ventures, as well as being appointed as a board member of the JVCA. He was subsequently appointed as Vice-Chairman in 2017 and assumed his current position of Chairman in 2019.

Tohru Akaura: JVCA Co-Chairman

After founding Incubate Capital Partners, a VC firm specializing in seed-stage investments, in 1999, Akaura went on to form Incubate Fund in 2010, which he continues to lead today. Throughout his career, he has established funds with a total AUM (assets under management) of nearly JPY 110 billion and has consistently engaged in seed-stage-focused investment and incubation. A councillor for Japan’s Information-Technology Promotion Agency from 2003 to 2008, he was appointed Director of the JVCA in July 2013, Managing Director in July 2015, and Vice-Chairman in July 2017. He assumed his current position as Chairman in 2019.

2022: Another Record Year for Startup Funding in Japan

As you know, total funding for Japanese startups once again reached new heights in 2022. However, companies looking to raise capital in Series D rounds and beyond have struggled—raising almost 30% less than in 2021. Is this focus on early-stage startups by investors transitory, or something we can expect to continue, barring a recovery in the stock market?

Akaura: Federal Reserve interest rate hikes, the situation in Ukraine, and other global factors delivered a blow to investor sentiment which has made it harder for them to go in on bullish valuations. These investors are now trying to find startups with reasonable valuations which I think has led them to shift their focus to seed- and early-stage startups.

That said, some later-stage startups decided to postpone IPOs at the last minute and sought another injection of capital in the private market.

Nakano: Because the startups that postponed their IPOs are generally larger in size, the big rounds they raised may be due to their increased working capital needs. Either way, I think late-stage investors are likely to maintain a “wait-and-see” stance in 2023.

Do you expect to see more down round IPOs?

Nakano: Companies that are profitable and capable of financing their own operations—or those that are not yet profitable, but can raise funding at a fair valuation—can afford to delay their IPO. Some companies, however, are forced to pull the trigger on a down round IPO as a matter of survival.

Other times, something as simple as fatigue on the part of management and staff who have been long preparing for an IPO end up driving a startup to settle for this kind of discounted IPO.

We’re seeing a lot of new funds emerge but how is the sentiment among the LPs that back them?

Nakano: We’re beginning to see a polarization in the market. There are some funds with proven track records that can raise capital in short order, while there are also those that do not have that—and they are struggling. I expect we’ll see this trend continuing at least until the market begins to thaw.

In Japan, a lot of funds are backed by corporations. Given that they tend to cut back on investment when the economy takes a turn, these corporations are highly susceptible to market trends at any given time. Institutional investors, on the other hand, are less affected and more likely to maintain their current investment stance, I think.

Akaura: As someone directly involved in fundraising myself, I’ve gotten the sense that we’re seeing more institutional investors from outside Japan.

At the JVCA, we sent a delegation to Singapore in November to meet with several institutional investors there, which ended up being a very fruitful trip. We plan to arrange similar delegations to other countries later this year, and the impression that I’m getting is that institutional investors abroad are increasingly keen to invest in Japanese VC funds.

Are we still seeing investments from largely the same players?

Akaura: I think we’re seeing less from those foreign investors that featured so prominently in 2021 with direct investments in Japanese startups.

In the domestic market, it seems that more and more capitalists are leaving CVCs in favor of independent VC funds. We’re also seeing more capitalists leave independent VCs to launch their own funds. At my VC firm, we offer support for these capitalists via a fund that invests in them as an LP.

Nakano: Foreign investors with an established track record and presence in Japan remain active in the industry. However, the types of investors we’re seeing are a bit different than the wave led by the crossover investors and hedge funds that were prominent globally in 2021 and that came to Japan simply “because they had the money”.

What do you think the future holds for Japanese startups?

Nakano: I think the market is bound to grow. The bubble that started growing in the US around 2017 reached its peak in 2021, and valuations are now normalizing.

At the same time, circumstances are a bit different in Japan where the scale of startup funding remains comparatively small. While it’s possible we could see the level of investment dip temporarily in reaction to interest rate hikes and other factors, by and large, we expect that the overall amount of capital raised by startups in Japan will continue to increase.

Akaura: I agree. Ultimately, I think it will hinge on what happens with the situation in Ukraine and the interest rate policy of the US Federal Reserve.

Of course, while there’s always a chance that a new risk could emerge and aggravate the situation, in my opinion, this decline in fundamentals is most likely temporary. For the most part, I think we’ll see things improve.

What are your thoughts on the government’s five-year plan for fostering startups?

Akaura: We were very grateful for such positive developments, including on matters of taxation. The JVCA had long been lobbying the government for these changes, so, of course, we’re thrilled to see them reflected.

There is still much work to be done, though, and we intend to continue delivering results through our support of startups while maintaining communication with all stakeholders involved.

What do you make of trends regarding deep tech startups?

Akaura: I believe we’re seeing more investment in startups developing proprietary technologies and deep tech startups. As one such investor myself, I’m excited about the possibilities. At the same time, though, it’s important to remember that it’s a lot easier said than done when it comes to making such big dreams a reality.

Nakano: These startups have the potential to hit significantly high valuations, so we do dream big when we invest in them. Still, compared to other areas like software, funding a deep tech startup can be more difficult and involve more risk factors.

Another key factor for their success is whether there is a good match between the university researchers and those who can turn their work into a successful business operation. In my mind, there has been a longstanding issue with a lack of those in academia who have the right mindset to commercialize the fruits of their research or otherwise see them fully realized within society. Of course, this may also have been due in part to fundraising difficulties.

I feel that we’re starting to see an increase in the number of deep tech startups and other startups geared toward R&D in recent years, as sentiment among investors has shifted, and university researchers now have the option to launch their own businesses.

These changes have recently led to a growing enthusiasm for entrepreneurship among universities in Japan. In fact, in his address to new students at the school’s entrance ceremony last year, the president of the University of Tokyo actually touched on the importance of addressing social issues through entrepreneurship and the need to support such ventures.

What would you say was the turning point behind this shift in sentiment?

Nakano: For investors, the actions of university VCs—university-affiliated funds that mainly invest in startups originating from academic research facilities—were a big factor. For startups, seeing the likes of Euglena secure steady funding and go public makes a difference. These examples serve to inspire others to take their own risks.

Akaura: I also think we’re seeing more people driven by the desire to make up for the opportunities missed during Japan’s so-called “lost decades”—myself included. I believe a growing number of entrepreneurs and investors alike are wanting to contribute to the emergence of tech-based innovations in Japan.

Interview & Text by Atsuko Mori

Editing by Misato Murakami

Design by Yusuke Mori

English Version by Cody Branscum, Viktor Makhnutin

About the JVCA

The Japan Venture Capital Association (JVCA) is an organization focused on the venture capital (VC) industry that provides support and other services to assist in the founding, growth, and development of promising startups not yet listed on any stock exchanges. Since its founding in November 2002, it has worked to promote deeper cooperation within Japan’s VC industry and solidify its own role in fostering successful startup companies. Its regular membership—which includes VC and CVC firms—currently comprises 252 members, with total membership climbing to 329 members when also accounting for supporting members.